Mott & Chace Sotheby International Realty’s December Market Report is featured below. I hope you find the reports informative and please reach out to me if I can be of any assistance with purchasing or listing pursuits this spring! I truly love what I do and find representing and advocating for my clients to be the most rewarding and most prized part of being a Realtor!

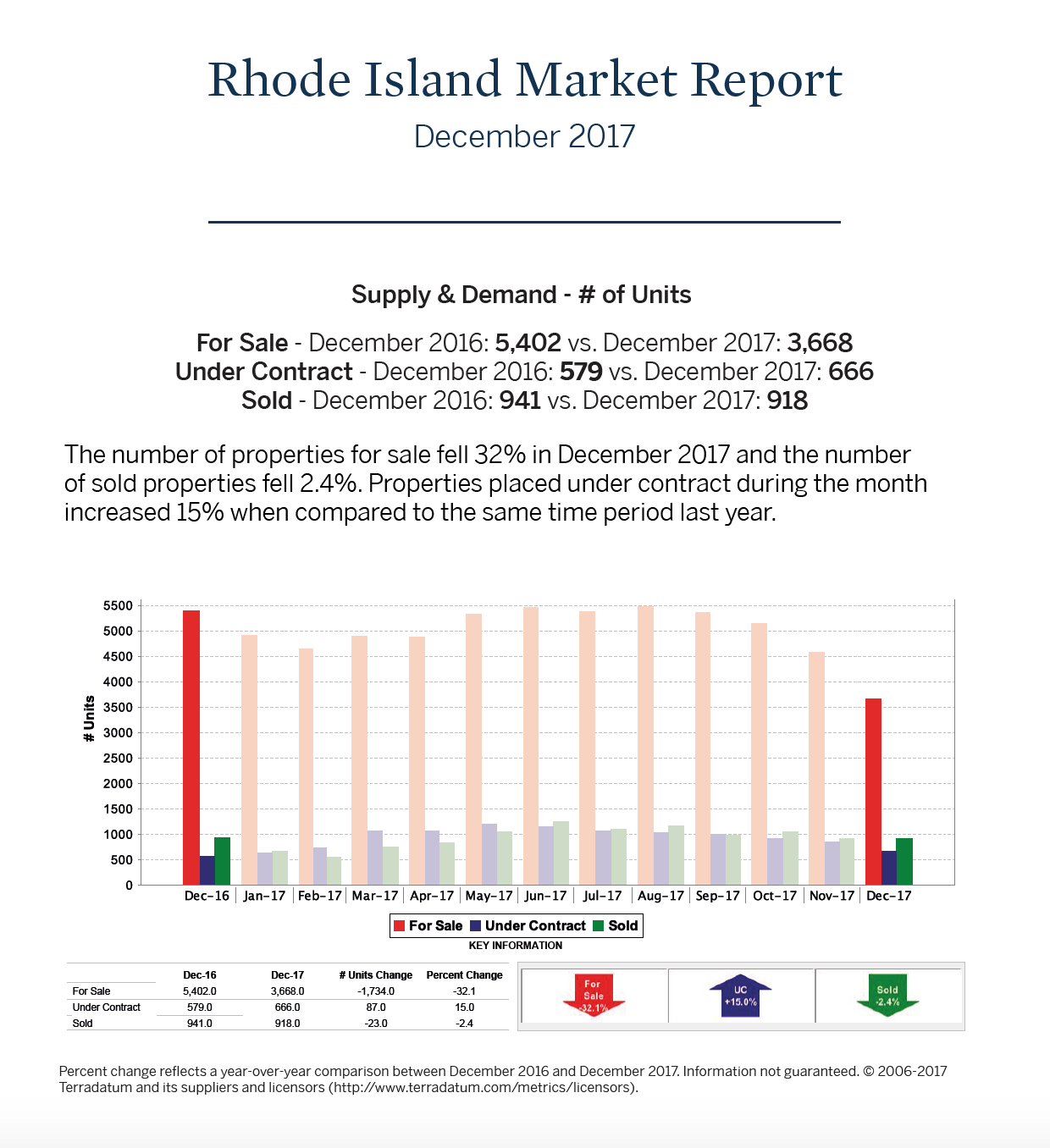

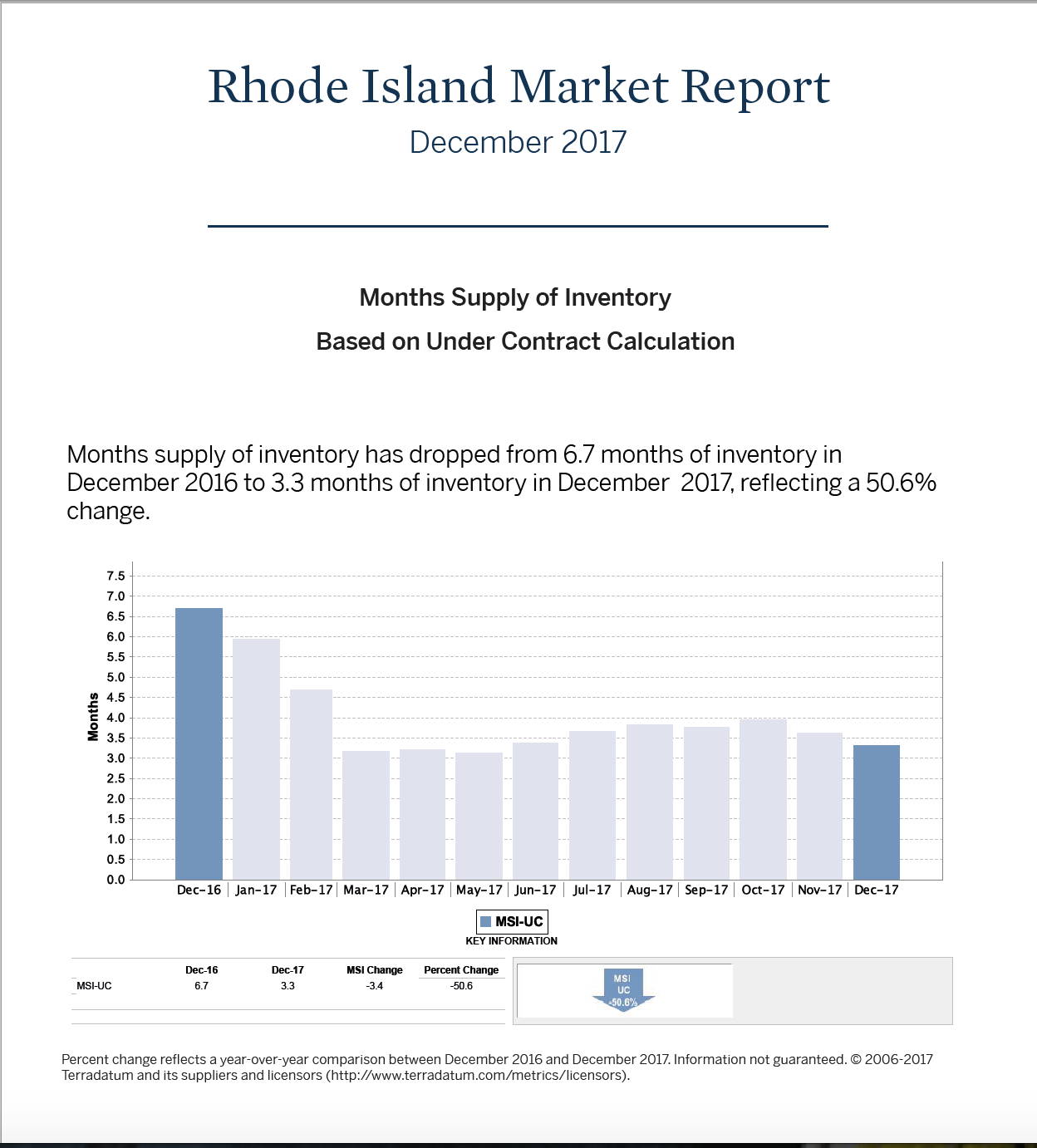

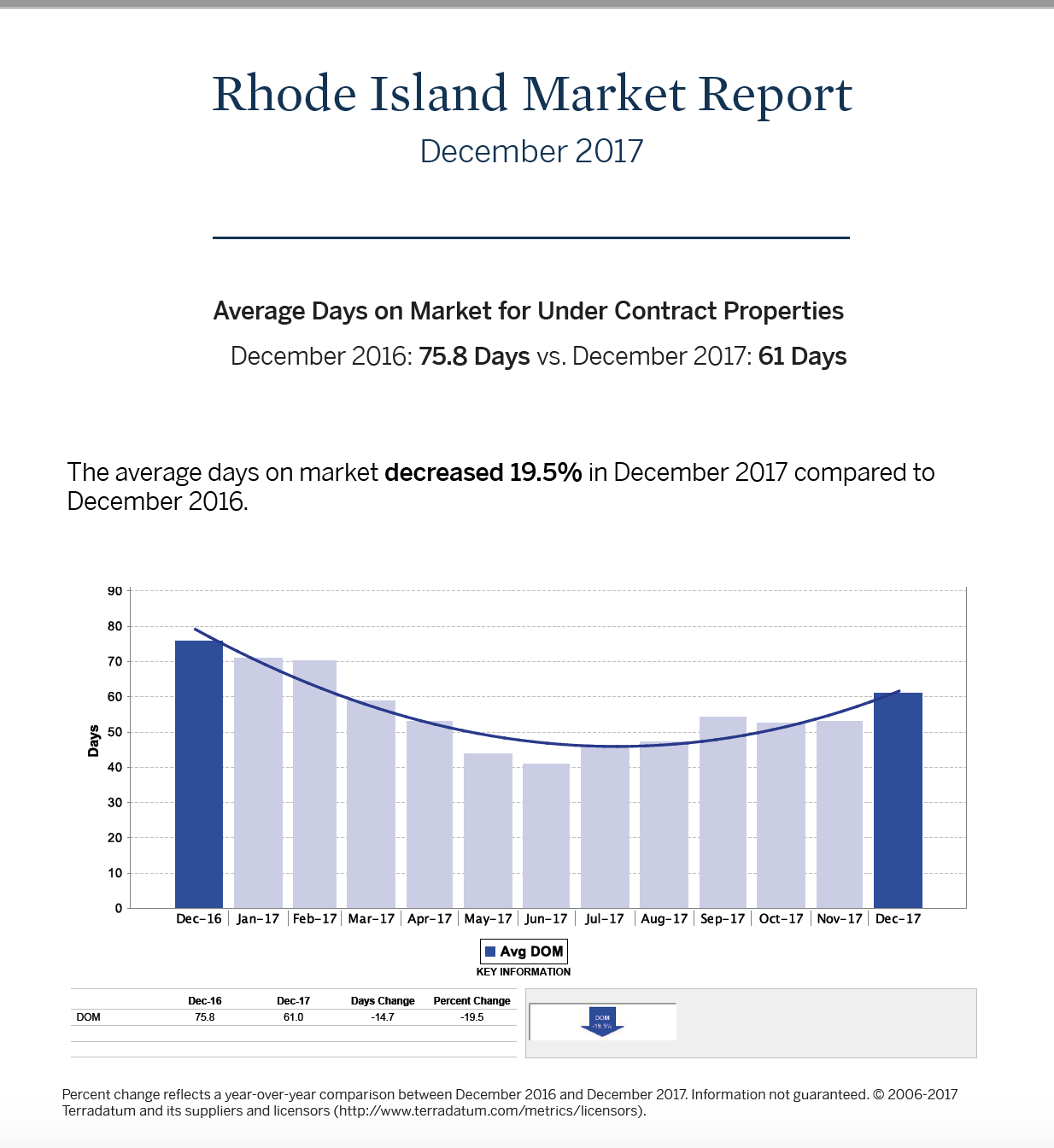

Mott & Chace Sotheby’s International Realty is pleased to release the Rhode Island real estate single family home statistics for December 2017 which continues to show an increasing demand for well-priced homes in the marketplace. The median home price for new listings increased 13.5%, while the supply of inventory decreased from 6.7 months to 3.3 months when compared to the same time period last year. Additionally, the average days on market decreased 19.5% in December 2017 when compared to last year. The economic indicators for real estate (low mortgage rates, low unemployment rates, inventory shortage and rising costs of rent) suggest gains will continue at least in the short term. The 13.5% increase in median home price for new listings coupled with a 3.3 months supply of inventory add credence to this trend. The economic signs that affect real estate continue to be positive. The financial markets had another record breaking year. Jobless claims are the lowest since 1973; consumer confidence rose to a 17-year high and the world economy had its best year since the financial crisis of 2008.

Major tax legislation passed in late December benefits corporations and is forecasted to help fuel the bull market yet another year. For homeowners, tax reform reduces the amount of property tax that can be deducted, increasing the after-tax cost of homeownership in higher price points. Buyers’ purchasing power is reduced as well, with the impact greatest in the luxury market. We anticipate that declining purchasing power will exert pressure on luxury inventory to offset the new math of tax reform.

We are monitoring the markets closely since the legislation passed and so far, buyer behavior appears unchanged. Properties are going under contract, transactions are going to closing and showings, a leading indicator of future pended sales, are remaining steady. The surging equity markets and growing portfolios have created an unprecedented wealth effect. However, post-recession buyers are disciplined, cautious and informed. They want a fair price that can be justified.

We wil continue to monitor market activity through the first quarter. In the interim, our job remains the same – to give buyers and sellers the tools to make an informed real estate decision. Tax changes are nuanced and tax planning is different for everyone. There is no “one size fits all” and your tax advisor can provide comprehensive guidance.

Mott & Chace Sotheby’s International Realty is pleased to release the Rhode Island real estate single family home statistics for December 2017 which continues to show an increasing demand for well-priced homes in the marketplace. The median home price for new listings increased 13.5%, while the supply of inventory decreased from 6.7 months to 3.3 months when compared to the same time period last year. Additionally, the average days on market decreased 19.5% in December 2017 when compared to last year. The economic indicators for real estate (low mortgage rates, low unemployment rates, inventory shortage and rising costs of rent) suggest gains will continue at least in the short term. The 13.5% increase in median home price for new listings coupled with a 3.3 months supply of inventory add credence to this trend. The economic signs that affect real estate continue to be positive. The financial markets had another record breaking year. Jobless claims are the lowest since 1973; consumer confidence rose to a 17-year high and the world economy had its best year since the financial crisis of 2008.

Major tax legislation passed in late December benefits corporations and is forecasted to help fuel the bull market yet another year. For homeowners, tax reform reduces the amount of property tax that can be deducted, increasing the after-tax cost of homeownership in higher price points. Buyers’ purchasing power is reduced as well, with the impact greatest in the luxury market. We anticipate that declining purchasing power will exert pressure on luxury inventory to offset the new math of tax reform.

We are monitoring the markets closely since the legislation passed and so far, buyer behavior appears unchanged. Properties are going under contract, transactions are going to closing and showings, a leading indicator of future pended sales, are remaining steady. The surging equity markets and growing portfolios have created an unprecedented wealth effect. However, post-recession buyers are disciplined, cautious and informed. They want a fair price that can be justified.

We wil continue to monitor market activity through the first quarter. In the interim, our job remains the same – to give buyers and sellers the tools to make an informed real estate decision. Tax changes are nuanced and tax planning is different for everyone. There is no “one size fits all” and your tax advisor can provide comprehensive guidance.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link