The Top 2 Things Rhode Island Homeowners Need To Know Before Selling

By Sarah Huard, REALTOR® | Mott & Chace Sotheby’s International Realty

If you’re thinking about selling your home in Rhode Island—or in nearby Southeastern Massachusetts—here’s something important to know:

The sellers who win in today’s market aren’t the ones waiting on the sidelines. They’re the ones who adapt from the start.

This year, a number of homeowners didn’t get the outcomes they hoped for. But it wasn’t because the market was “off.”

It’s because their expectations were.

Nationwide, Realtor.com reports 57% more homes were pulled off the market compared to last year—meaning they listed but didn’t sell. I see the same patterns here in Rhode Island, especially among sellers who weren’t guided with clarity or strategy from day one.

As someone who has already closed 30 transactions this year, representing over $23 million in sales volume, I have my hands—and my heart—deep in the market every single day. That level of activity provides a real-time pulse on buyer behavior, pricing shifts, neighborhood trends, and what truly drives offers in today’s landscape.

And the truth is simple: the listings that stalled this year almost always came down to price and timing.

Both are entirely fixable—with the right strategy.

Here’s what you need to know so you don’t fall into the traps that derailed so many other sellers.

1. Price It Right from Day One

Pricing is the single biggest driver of a successful sale.

Today, 8 in 10 sellers expect to get their asking price or more, yet only 1 in 4 actually do (Redfin). Why?

Because many are still anchored to 2021 expectations.

What’s happening in Rhode Island right now?

Across Barrington, Bristol, Warren, Providence, East Providence, Cumberland, Tiverton, and more, buyers are:

-

More selective

-

More informed

-

Less willing to pursue an overpriced home

Inventory has increased just enough to give buyers choices—meaning the “list high and wait” strategy simply doesn’t work anymore.

HousingWire notes the average price reduction nationally is just 4%.

But many RI sellers listed even higher, panicked when demand didn’t materialize immediately, and took their homes off the market instead of making that small, strategic adjustment.

Had they priced correctly from day one—or adjusted early—they likely would have sold.

What my volume means for your sale

With over $23M in closed volume this year, I’m in living rooms, at inspections, analyzing comps, and negotiating offers across the state weekly.

I know exactly how buyers are responding at each price point because I’m in the field every day—not watching from afar.

Smart, data-backed pricing isn’t about going lower.

It’s about positioning your home to command strong attention and protect your equity.

2. Don’t Rush the Process

The second major misconception:

Expecting your home to sell instantly.

Many sellers still remember the lightning-fast pace of 2020–2021. But that was an anomaly.

Today, a normalized RI market looks like:

-

30–60 days from list to accepted offer

-

Steady, intentional buyer activity

-

Thoughtful decision-making, not frenzy

It feels slower only because we’re comparing it to a once-in-a-lifetime market.

Think of it as shifting from 70 mph to 35 mph—you’re moving at the right speed for the conditions, even if it feels different.

Where the Huard Hustle makes the difference

If you want your home to sell efficiently and competitively, strategy matters more than ever:

-

Comprehensive pre-listing prep (a cornerstone of my service)

-

Staging and styling that meets today’s buyer expectations

-

Magazine-quality photography + video

-

Precision pricing grounded in hyperlocal data

-

Hands-on, proactive guidance from an agent deeply active across all RI price points

With 30 successful closings so far this year, I’ve seen firsthand:

The homes that sold quickly weren’t just beautiful—they were positioned right.

Bottom Line

The listings that didn’t sell this year weren’t doomed.

They simply started with the wrong expectations and strategy.

In today’s Rhode Island and Southeastern MA markets, success comes from:

-

Strategic, data-backed pricing

-

Patience and understanding of today’s timeline

-

Partnering with a local agent with depth, experience, and relentless advocacy

With 30 transactions and over $23 million in volume this year, I bring unmatched market insight—and the Huard Hustle—to ensure your home is positioned to win from day one.

You can succeed in this market.

You just need the right plan—and the right partner.

Thinking about selling?

Let’s talk value, timing, and strategy. I’d be honored to guide you.

Why Some Homes Sell Quickly- and Others Don’t Sell at All

Why Some Homes Sell Quickly – and Others Don’t Sell at All

Why are some homes selling while others sit—especially now that more listings are hitting the market?

The difference isn’t luck. It’s strategy.

With more inventory and discerning buyers, the homes that stand out are those priced precisely, prepped intentionally, and marketed strategically from day one.

That’s exactly what my Huard Hustle approach is all about—bringing grit, heart, and relentless preparation to help my clients launch with luster and sell with success.

If a move is on your horizon, now’s the time to start planning your strategy. Let’s connect and put the Huard Hustle to work for you—no pressure, just trusted guidance rooted in results. Check out the information below on home movement or lack thereof , on a national level.

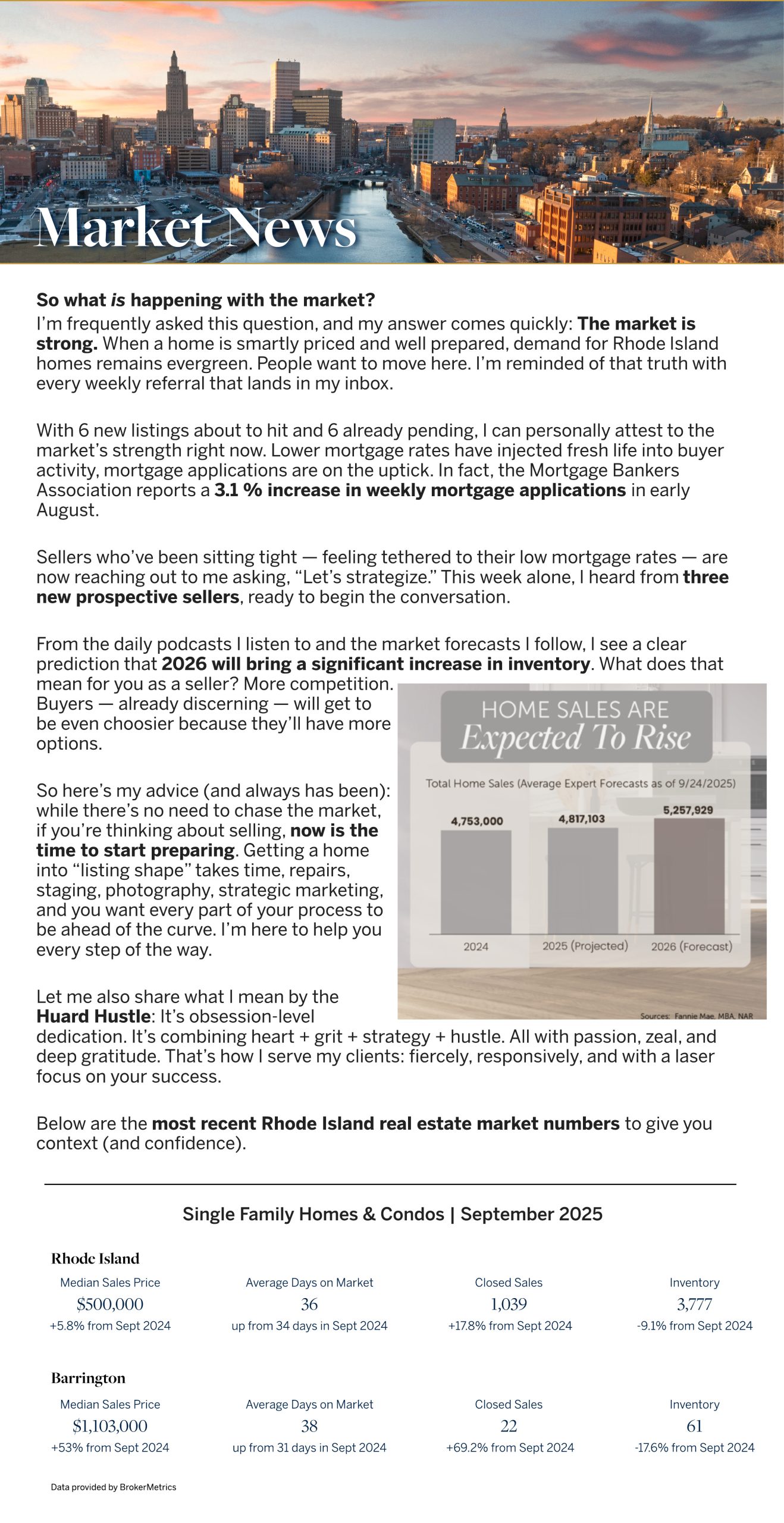

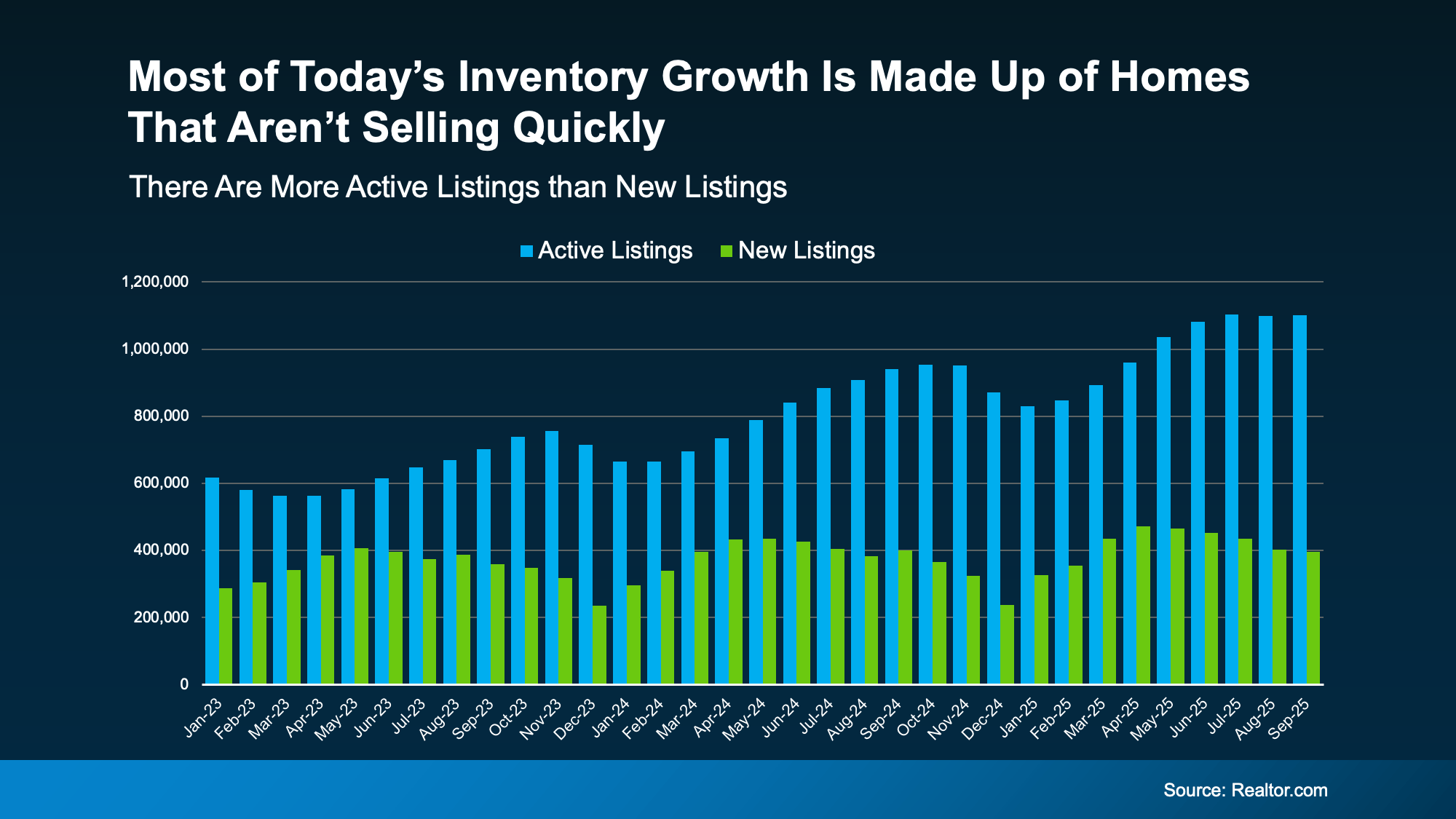

A few years ago, inventory hit a record low. Just about anything sold – and fast. But now, there are far more homes on the market. Listings are up almost 20% from this time last year. And in some areas, supply is even back to levels we last saw in 2017–2019. For sellers, that means one thing:

Your house needs to stand out and grab attention from day one.

That’s especially true when you consider why the number of homes for sale is up. Here’s how it works. Available inventory is a mix of:

- Active Listings: homes that have been sitting on the market, but haven’t sold yet

- New Listings: homes that were just put on the market

Data from Realtor.com shows most of the inventory growth lately is actually from active listings that are staying on the market and taking longer to sell (see the graph below).

The blue bars show active listings. These are the homes that are sitting month to month and not selling. The green bars are new listings, the homes that were just put on the market. And it’s clear there are fewer new listings compared to how many are staying on the market unsold.

Since you don’t want your house to be one of the ones that take a long time to sell, let’s break down where things can go sideways and how to set yourself up to sell quickly.

Since you don’t want your house to be one of the ones that take a long time to sell, let’s break down where things can go sideways and how to set yourself up to sell quickly.

Why Some Homes Sell and Others Sit

The secret to selling in today’s market is simple. Make sure your house is easy for buyers to say yes to as soon as it is listed.

Price it based on current conditions (not what your neighbor sold for 3 years ago). Make important repairs. And highlight the best things about your house. If you do that, it will sell in any market – sometimes even faster than you’d think. Because the truth is, homes that are priced right today are still selling.

It’s the homeowners who are clinging to outdated expectations that are seeing their house sit and their listing go stale. According to Redfin and HousingWire, here are some of the most common reasons sales stall out:

- Priced it too high from the start

- Skipped necessary repairs before listing

- Didn’t stage the house well

- Sellers won’t negotiate with buyers

- Limited availability for showings

- Ineffective marketing or listing pictures

Most of those things didn’t matter as much just a few years ago. When inventory was at a record low, sellers could skip the prep, name their price, and still walk away with multiple offers over their asking price.

But today’s market is different now that inventory has grown. And that means your approach needs to be different too.

You don’t want to try out old strategies and aim too high just to see what sticks. Your first few weeks on the market are everything. That’s when your listing gets the most attention – and when pricing or presentation mistakes hurt the most. Get it wrong up front and your house will sit…and sit. Get it right, and it’ll be snatched up before you know it.

The Right Agent Helps Your House Stand Out

Selling quickly isn’t about luck. It’s about knowing how to play to the market you’re in. And that’s where your agent comes in.

A great agent will analyze your local market, suggest a price based on the latest comparables sold in your neighborhood, and create a marketing plan that makes buyers pay attention from day one. They’ll also walk you through any repairs you need to make or whether you need to bring in a staging company. As the National Association of Realtors (NAR) explains:

“Home sellers without an agent are nearly twice as likely to say they didn’t accept an offer for at least three months; 53% of sellers who used an agent say they accepted an offer within a month of listing their home.”

That’s the power of getting it right (and getting expert help) from the start.

Bottom Line

There are more homes for sale today than there were even just a year ago, but that doesn’t have to work against you.

When your house is priced right, shows well, and is marketed effectively, it will sell. Let’s connect if you want to know how to make that happen in our market this fall.

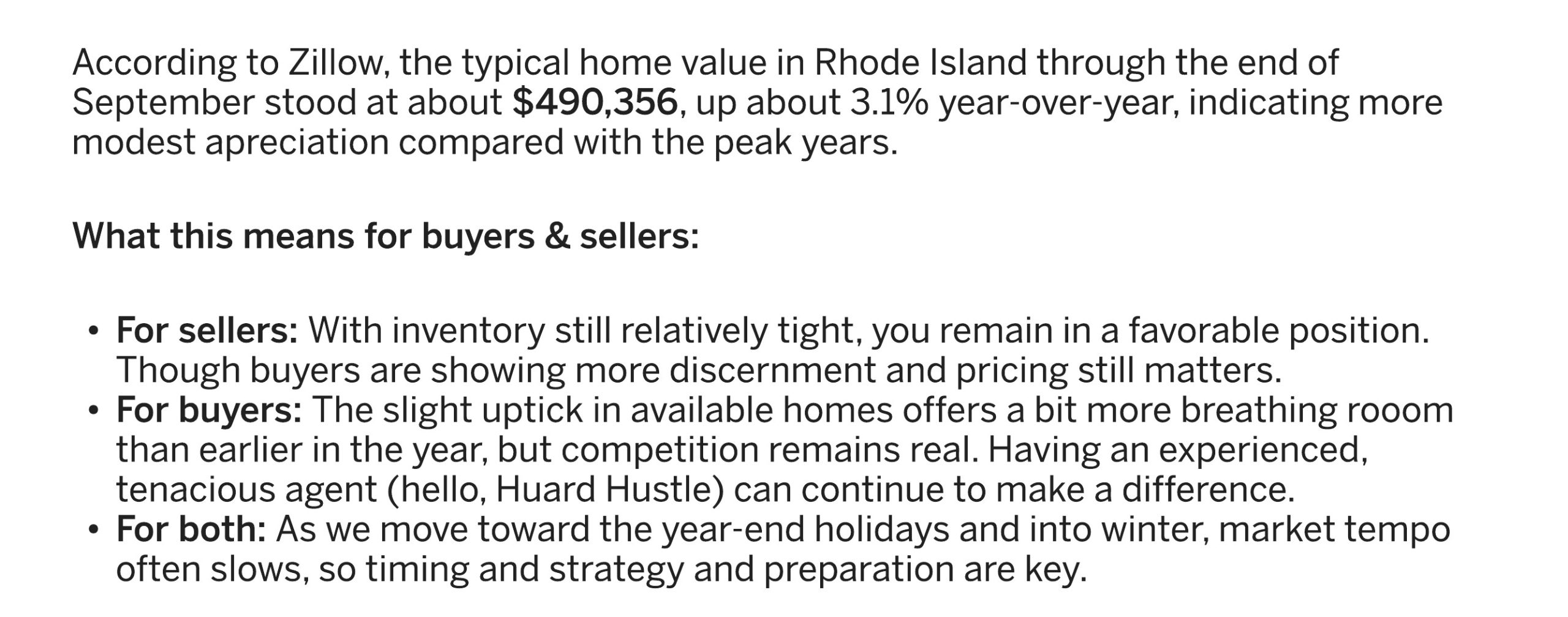

Rhode Island Real Estate: 2025 Market Insights & What’s Ahead

As we move through 2025, Rhode Island’s housing market continues to make waves with persistent price gains, strong buyer demand, and slowly increasing—but still constrained—inventory. The latest report from the Rhode Island Association of Realtors places the median single-family home price at $520,000 in June, reflecting a 5.3% year‑over‑year increase, and a remarkable 73.6% increase since 2019 rirealtors.org+1rhodeislandliving.com+1. Meanwhile, total listings remain low: with only about 2–2.5 months of supply, it’s well below the 5–6‑month threshold considered balanced rirealtors.org+1Houzeo+1.

Comparatively, Redfin reports a median sale price of $533,800 in June, up 2.3% from the previous year, with home sales increasing nearly 13% YoY and inventory up roughly 7.8% Redfin. Zillow’s data shows average home values around $495,600, up 4.3%, with homes selling in approximately 10 days on average Houzeo+2Zillow+2Architectural Digest+2.

In the first quarter (Q1) of 2025, RI saw fewer single-family transactions (‑3.2% YoY), but prices climbed to $465,000, up from $440,000—a 5.7% increase. Condominiums rose 14% to a median of $390,000, and multifamily homes posted a 12% jump to $570,000 rirealtors.org+1rhodeislandliving.com+1.

On the national stage, Zillow has named Providence among the “Top 10 hottest housing markets for 2025”, driven by strong demand, limited supply, and its appeal as relatively affordable compared to larger metros like Boston or New YorkArchitectural Digest.

🏠 What This Means for Buyers, Sellers — and Where Prices May Be Headed

-

Sellers remain in a strong position: low inventory and rising prices mean homes often sell quickly and sometimes above list price. Redfin data shows over 52% of Rhode Island homes sold above list price in June, and the average sale‑to‑list ratio hovered around 101.3% Zillow+2Redfin+2Houzeo+2.

-

Buyers face competition—but there’s cautious optimism. While some sellers engage in bidding wars, areas with price drops and higher days on market may offer negotiation chances.

-

Price Forecast: National forecasts suggest strong appreciation continues. A recent HireAHelper/Redfin analysis projects that by 2030, Rhode Island’s median home price could approach $855,000, potentially requiring average incomes near $190,000 just to remain affordable Houzeonypost.com.

Curious how these state‑level trends compare with what’s projected for the rest of 2025? Read on to dive into the forecast article below — plus what it all means for your next move in the Ocean State market.

The Market is Shifting…Price it RIGHT!!!

The market is shifting, and the sharpest homeowners I know are staying ahead of it – even if they aren’t ready to sell today. Because being informed now means being prepared later.

Here’s what I’m seeing that you need to know:

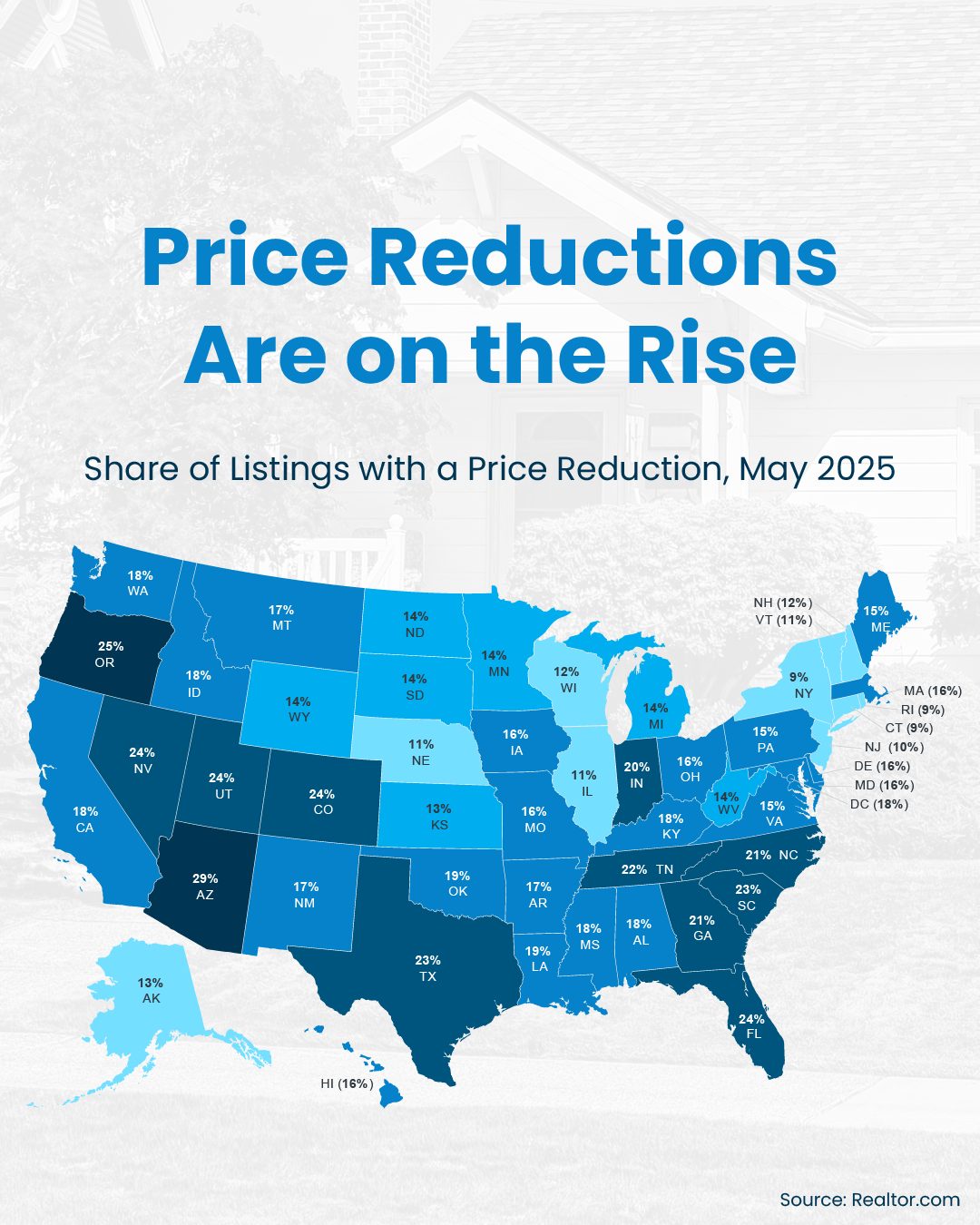

Right now, 1 in 5 homes on the market are lowering their asking price.

But the homes that are selling? They’re priced right with what today’s buyers are actually looking for, and willing to pay.

Getting that dialed in the first time takes more than guesswork. It takes strategy, timing, expertise, and a clear understanding of what’s really happening in our area. That’s the reality – and it’s where I help my clients win.

Because home values are up 55% over the last 5 years, so you have room to move and still come out ahead.

Here’s a short blog I put together for you that sums it all up:

What Every Homeowner Needs to Know in Today’s Shifting Market

Even if you’re not ready to sell, but you just want to know what’s impacting your home, let’s have a quick conversation.

I’ll share my expert opinion based upon facts and show you exactly what’s taking place in our local market. That way, you can decide what makes the most sense for you – now or later. No strings attached.

Best,

Sarah Huard

(401) 255-2578

sarah.huard@mottandchace.com

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link