What the experts are saying about home prices

What Are Experts Saying about Home Prices?

Last week, a very well-respected real estate analytics firm surprised many with their home price projection for the next twelve months. CoreLogic, in their latest Home Price Index said:

“The economic downturn that started in March 2020 is predicted to cause a 6.6% drop in the HPI by May 2021, which would be the first decrease in annual home prices in over 9 years.”

The forecast was surprising as it was strikingly different than any other projection by major analysts. Six of the other eight forecasts call for appreciation, and the two who project depreciation indicate it will be one percent or less.

Here is a graph showing all of the projections:There’s a simple formula to determine the future price of any item: calculate the supply of that item in ratio to the demand for that item. In housing right now, demand far exceeds supply. Last week mortgage applications to buy a home were 33% higher than they were at the same time last year. The available inventory of homes for sale is 31% lower than it was last year. Normally, these numbers should call for homes to continue to appreciate.

Bottom Line

Because of the uncertainty with the pandemic, any economic prediction is extremely difficult. However, looking at the limited supply of homes for sale and the tremendous demand for housing, it is difficult to disagree with the majority of analysts who are calling for price appreciation. I’ve been nothing short of amazed by the strength and robustness of our local RI market. Homes listed precisely are going quickly and lucratively. Let me know if I can be of any help during this bullish time in RI real estate!

Bidding war madness

Buyers: Are You Ready for a Bidding War?

With businesses reopening throughout the country and some experts indicating early signs of a much-anticipated economic recovery, more homebuyers are actively entering the housing market this summer. Today, housing is truly driving the U.S. economy forward. With so many buyers looking for homes to purchase and so few houses for sale right now, there’s a disconnect between supply and demand. This imbalance is pushing home prices upward while driving more bidding wars and multiple-offer scenarios. Danielle Hale, Chief Economist at realtor.com explains:

“People are surprised that prices are rising, not falling, because in the last recession home prices fell, the difference this time is the severe shortage of homes for sale…We are seeing bigger price increases with [a limited] number of homes…That is likely to lead to more competition and potentially multiple offers and bidding wars.”

According to the recent Realtors Confidence Index (RCI) survey conducted by the National Association of Realtors (NAR), this trend is growing:

“On average, there were about three offers on a home that closed in May, up from just about two in April 2020 and in May 2019 (2.3 offers).”

HousingWire also indicates:

“42% of homeowners who made a purchase during the January to May time period ended up in a bidding war, demonstrating the strong demand for homes amid low inventory.”

With more people returning to work we’ll continue to see the number of interested buyers increase. So, if you’re among the many people looking for a home to buy this summer, it’s important to ensure you have the right guidance from the start. This way, you make sure your offer stands out from the crowd when it really counts. Here are two tips to follow.

1. Hire a Trusted Local Expert

A trusted local real estate professional matters more than ever right now, as noted in a recent survey shared by NAR. In fact, according to respondents, 54% of buyers and 62% of sellers indicated that “Particularly during the pandemic, a real estate agent’s guidance is especially valued.”

We’re not in a normal market. We are in one of the greatest health crises our nation has ever seen. The pandemic has had a dramatic impact on the journey consumers must take to purchase a home. To successfully navigate the landscape today, you need a true expert on your side.

2. Get Pre-Approved for a Mortgage

When there are more buyers than sellers on the market, the process to find a home becomes much more challenging. One way to show you’re serious about buying a home is to work with a lender to get pre-approved for a mortgage before starting your search. With a pre-approval letter, sellers will see your true desire to buy this year, potentially helping your offer rise to the top.

Bottom Line

If this is the year you’re ready to buy, let’s connect to get the process started so you can make sure your offer is a strong one when the competition heats up.

There are definite ways to make an offer more competitive and now more than ever you need to tap into them. The former athlete in my thrives on competition and the teacher in me drills down on a very thorough and exhaustive method of offer preparation! Reach out to me if you’d like to search for that special home to call your own in RI~

Weekly market news

Weekly housing trends – Total inventory was down 31% as more and more buyers continue to take advantage of low mortgage rates and put a dent in inventory. Median listing prices continue growing at 6.2% over last year, faster than the pr-COVID pace. Time on market is 3 days slower than last year with the limited number of homes for sale forcing buyers to make faster decisions than they did pre-COVID. I’m seeing this all over RI as I engage in representing both sellers and buyers. The market continues to pick up speed due to the surge in buyers fueled by a lack of inventory state wide. Now is a great time to sell in RI!

Not all Agents are created equal…..

Not All Agents Are Created Equal

In today’s fast-paced world where answers are just a Google search away, there are some who may question the benefits of hiring a real estate professional when selling a house. The reality is, the addition of more information can lead to more confusion. A real estate agent can be your essential guide, but truth be told, not all agents are created equal. Finding the right agent for you and your family should be your top priority when you’re ready to sell your house.

The right agent is the person who can truly walk you through the whole process, look out for your best interest, and seamlessly lead you through all the steps along the way. In today’s complex market, the way we execute real estate transactions is changing constantly, especially as more elements can be done virtually. Making sure you have the best advice on your side is more important than ever.

So, how do you choose the perfect agent?

It starts with trust. You must trust the advice this person is going to give you, and you’ll want to begin by making sure you’re connected to a true professional. An agent can’t give you perfect advice because it’s impossible to know exactly what’s going to happen at every turn – especially in this unique market. A true professional agent can, however, give you the best advice possible based on the information and situation at hand, helping you make the necessary adjustments and best decisions along the way. The right agent – the professional – will get you the best offer available. That’s exactly what you want and deserve.

What do you need to trust your agent to do?

1. Navigate the Process

There are over 230 possible steps that take place during a successful real estate transaction. Don’t you want someone who has been there before, someone who knows what these actions are, to ensure you have a positive selling experience?

2. Negotiate on Your Behalf

Today, hiring a trusted and talented negotiator could save you thousands, perhaps tens of thousands of dollars. Each step – from the buyer submitting an original offer, to the possible renegotiation of that offer after a home inspection, to the potential cancelation of the deal based on a troubled appraisal – you need someone who can keep the deal together until it closes.

3. Price Your House Competitively

There’s so much information in the news and on the Internet about home sales, prices, and mortgage rates. How do you know what’s going on in our local area? Who do you turn to in order to competitively and correctly price your home at the beginning of the selling process?

Dave Ramsey, known as the financial guru, advises:

“When getting help with money, whether it’s insurance, real estate or investments, you should always look for someone with the heart of a teacher, not the heart of a salesman.”

Hiring a trusted professional who has a finger on the pulse of the market and is eager to help you learn will make your experience an informed and educated one. You need someone who’s going to tell you the truth, not just what they think you want to hear.

Bottom Line

Today’s real estate market is highly competitive. Having a trusted professional who’s been there before to guide you through the process is a simple step that will give you a huge advantage when you’re ready to sell your house. Let’s make it happen together.I pride myself on my work ethic, my hustle and my competitive drive that is devoted 100% on and toward my clients. Whether I am listing a home or purchasing a home I dive in on day one and apply pure grit and a thorough and exhaustive approach to every element of a transaction. Advocating for my clients is truly my “why I’m here.” Looking for real estate guidance? I am here to help!

Latest Unemployment Report….Good news for the most part!

Latest Unemployment Report: Great News…for the Most Part

The Bureau of Labor Statistics (BLS) released their latest Employment Situation Summary last Thursday, and it again beat analysts’ expectations in a big way. The consensus was for 3,074,000 jobs to be added in June. The report revealed that 4,800,000 jobs were added. The unemployment rate fell to 11.1% from 13.3% last month. Again, excellent news as the unemployment rate fell for the second consecutive month. However, there’s still a long way to go before the economy fully recovers as 17.8 million Americans remain unemployed.

Here are two interesting insights on the report:

What about a supposed misclassification?

The BLS addressed this at length in a blog post last week, and concluded by saying:

“Regardless of the assumptions we might make about misclassification, the trend in the unemployment rate over the period in question is the same; the rate increased in March & April and eased in May.”

They specifically noted the issue in the latest report by explaining that if they adjusted the rate for the potential miscalculation, it would increase from 11.1% to 12.1% (which is lower than the adjusted rate of 16.4% last month). They went on to say:

“However, this represents the upper bound of our estimate of misclassification and probably overstates the size of the misclassification error.”

Does the shutdown of parts of the economy skew the unemployment numbers?

Because the uniqueness of 2020 impacts the employment situation in so many ways, each jobs report is now examined with a microscope to make sure the headlines generated by the report accurately convey what’s happening in the job market.

One such analysis is done by Jed Kolko, Chief Economist at Indeed. He believes the extraordinary number of people in the “temporary” unemployed category confuses the broader issue of how many people have permanently lost their job. He adjusts for this when calculating his “core unemployment rate” (which subtracts temporary layoffs and adds unemployed who didn’t search for a job recently).

The bad news is that his analysis reveals that the number of permanently unemployed is still rising (from 4.6% in April to 5.9% last month). The good news, however, is when you use his methodology to look back at the Great Recession, today’s “core unemployment rate” is significantly lower (5.9% versus 10.5% in April 2010).

Bottom Line

Last week’s jobs report was much better than most expected. However, we should remain cautious in our optimism. As the Wall Street Journalexplained in their analysis of the jobs report:

“U.S. job growth surged last month, underscoring the economy’s capacity for a quick rebound if businesses continue to reopen and consumers regain confidence. A recent coronavirus spike, however, could undermine trends captured in the latest jobs report.”

What the experts are saying about the rest of 2020

What Are Experts Saying About the Rest of 2020?

One of the biggest questions on everyone’s minds these days is: What’s going to happen to the housing market in the second half of the year? Based on recent data on the economy, unemployment, real estate, and more, many economists are revising their forecasts for the remainder of 2020 – and the outlook is extremely encouraging. Here’s a look at what some experts have to say about key areas that will power the industry and the economy forward this year.

Mortgage Purchase Originations: Joel Kan, Associate Vice President of Economic and Industry Forecasting, Mortgage Bankers Association

“The recovery in housing is happening faster than expected. We anticipated a drop off in Q3. But, we don’t think that’s the case anymore. We revised our Q3 numbers higher. Before, we predicted a 2 percent decline in purchase originations in 2020, now we think there will be 2 percent growth this year.”

Home Sales: Lawrence Yun, Chief Economist, National Association of Realtors

“Sales completed in May reflect contract signings in March and April – during the strictest times of the pandemic lock down and hence the cyclical low point…Home sales will surely rise in the upcoming months with the economy reopening, and could even surpass one-year-ago figures in the second half of the year.”

Inventory: George Ratiu, Senior Economist, realtor.com

“We can project that the next few months will see a slow-yet-steady improvement in new inventory…we projected a stepped improvement for the May through August months, followed by a return to historical trend for the September through December time frame.”

Mortgage Rates: Freddie Mac

“Going forward, we forecast the 30-year fixed-rate mortgage to remain low, falling to a yearly average of 3.4% in 2020 and 3.2% in 2021.”

New Construction: Doug Duncan, Chief Economist, Fannie Mae

“The weaker-than-expected single-family starts number may be a matter of timing, as single-family permits jumped by a stronger 11.9 percent. In addition, the number of authorized single-family units not yet started rose 5.4 percent to the second-highest level since 2008. This suggests that a significant acceleration in new construction will likely occur.”

Bottom Line

The experts are optimistic about the second half of the year. If you paused your 2020 real estate plans this spring, let’s connect today to determine how you can re-engage in the process.

Three reasons why it’s a great time to sell!

Three Reasons Homebuyers Are Ready to Purchase This Year

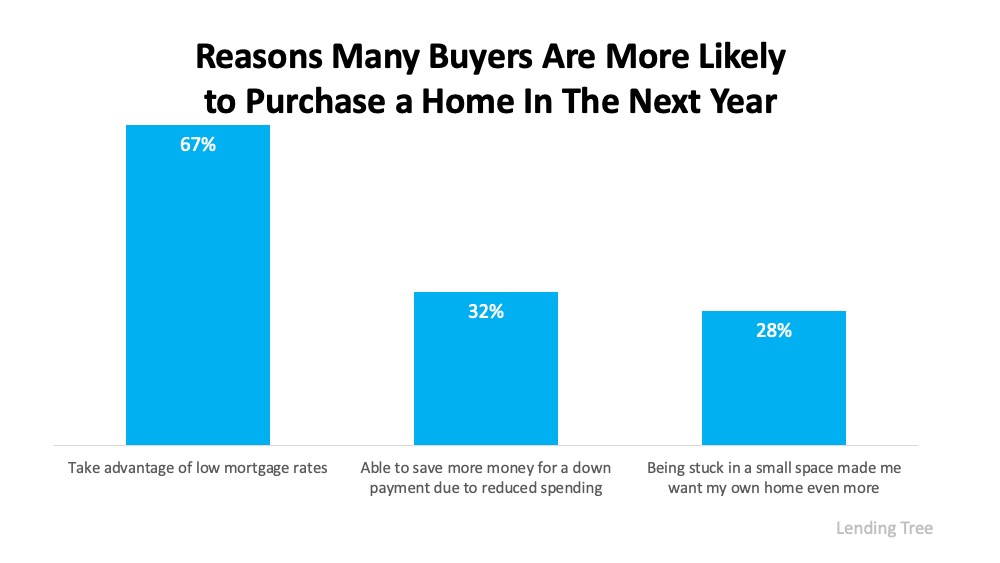

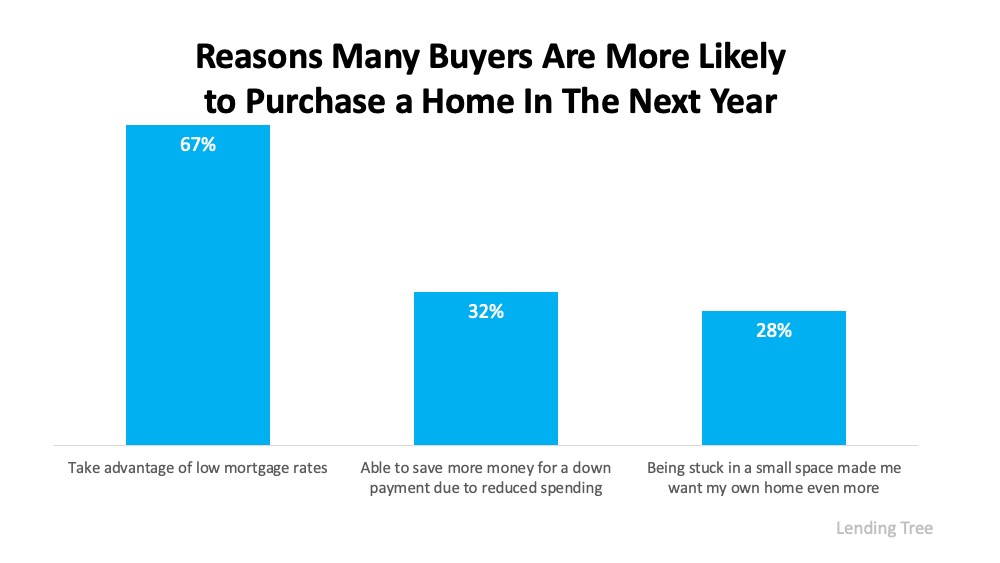

A recent survey by Lending Tree tapped into behaviors of over 1,000 prospective buyers. The results indicated 53% of all homebuyers are more likely to buy a home in the next year, even amid the current health crisis. The survey further revealed why, naming several reasons buyers are more likely to move this year (see graph below): Let’s break down why these are a few of the key factors motivating buyers to actively engage in the home search process, and the corresponding wins for sellers as well.

Let’s break down why these are a few of the key factors motivating buyers to actively engage in the home search process, and the corresponding wins for sellers as well.

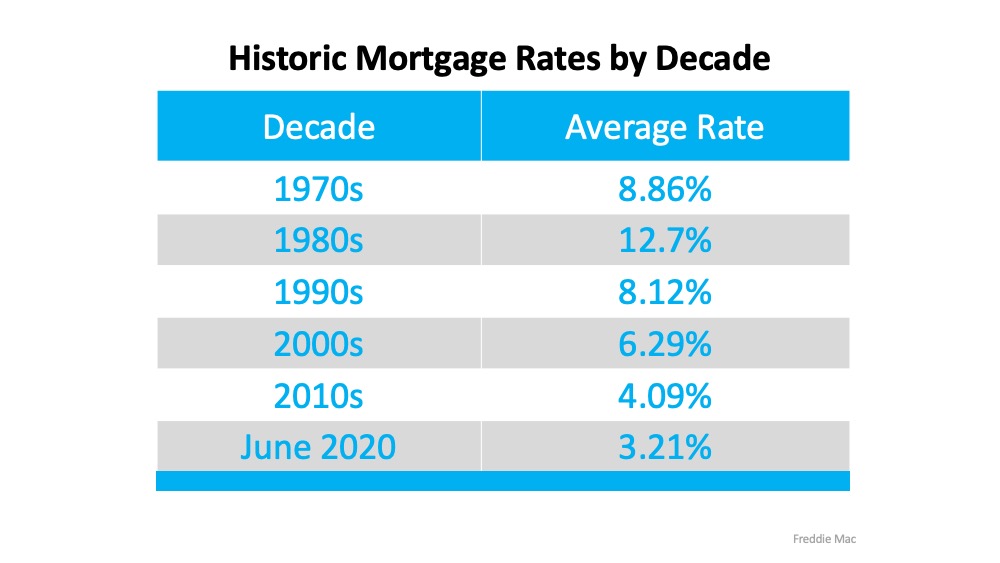

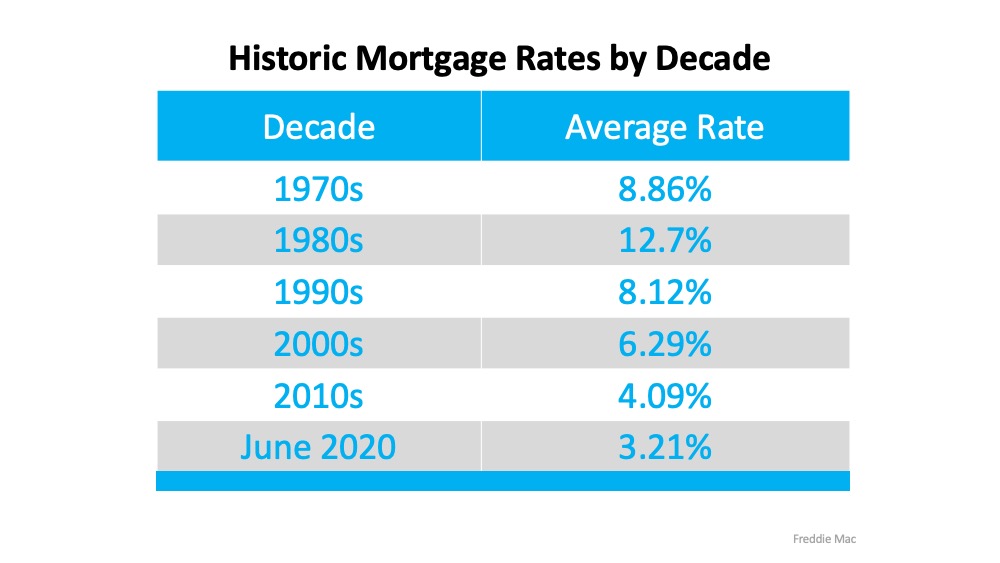

1. Low Mortgage Rates

The biggest reason potential homebuyers indicated they’re eager to purchase this year is due to current mortgage rates, which are hovering near all-time lows. Today’s low rates are making it more affordable than ever to buy a home, which is a huge incentive for purchasers. In fact, 67% of respondents in the Lending Tree survey want to take advantage of low mortgage rates. This is no surprise when comparing historic mortgage rates by decade (see below): Sam Khater, Chief Economist at Freddie Mac recently said:

Sam Khater, Chief Economist at Freddie Mac recently said:

“As the economy is slowly rebounding, all signs continue to point to a solid recovery in home sales activity heading into the summer as prospective buyers jump back into the market. Low mortgage rates are a key factor in this recovery.”

2. Reduced Spending

Some people have also been able to save a little extra money over the past few months while sheltering in place. One of the upsides of staying home recently is that many have been able to work remotely and minimize extra spending on things like commuting expenses, social events, and more. For those who fall into this category, they may have a bit more saved up for down payments and closing costs, making purchasing a home more feasible today.

3. Re-Evaluating Their Space

Spending time at home has also given buyers a chance to really evaluate their living space, whether renting or as a current homeowner. With time available to craft a wish list of what they really need in their next home, from more square footage to a more spacious neighborhood, they’re ready to make it happen.

What does this mean for buyers and sellers?

With these three factors in play, the demand for housing will keep growing this year, especially over the summer as more communities continue their phased approach to reopening. Buyers can take advantage of additional savings and low mortgage rates. And if you’re thinking of selling, know that your home may be in high demand as buyer interest grows and the number of homes for sale continues to dwindle. This may be your moment to list your house and make a move into a new space as well.

Bottom Line

If you’re ready to buy or sell – or maybe both – let’s connect to put your plans in motion. With low mortgage rates leading the way, it’s a great time to take advantage of your position in today’s market.

Three reasons to sell your home now

Three Reasons Homebuyers Are Ready to Purchase This Year

A recent survey by Lending Tree tapped into behaviors of over 1,000 prospective buyers. The results indicated 53% of all homebuyers are more likely to buy a home in the next year, even amid the current health crisis. The survey further revealed why, naming several reasons buyers are more likely to move this year (see graph below): Let’s break down why these are a few of the key factors motivating buyers to actively engage in the home search process, and the corresponding wins for sellers as well.

Let’s break down why these are a few of the key factors motivating buyers to actively engage in the home search process, and the corresponding wins for sellers as well.

1. Low Mortgage Rates

The biggest reason potential homebuyers indicated they’re eager to purchase this year is due to current mortgage rates, which are hovering near all-time lows. Today’s low rates are making it more affordable than ever to buy a home, which is a huge incentive for purchasers. In fact, 67% of respondents in the Lending Tree survey want to take advantage of low mortgage rates. This is no surprise when comparing historic mortgage rates by decade (see below): Sam Khater, Chief Economist at Freddie Mac recently said:

Sam Khater, Chief Economist at Freddie Mac recently said:

“As the economy is slowly rebounding, all signs continue to point to a solid recovery in home sales activity heading into the summer as prospective buyers jump back into the market. Low mortgage rates are a key factor in this recovery.”

2. Reduced Spending

Some people have also been able to save a little extra money over the past few months while sheltering in place. One of the upsides of staying home recently is that many have been able to work remotely and minimize extra spending on things like commuting expenses, social events, and more. For those who fall into this category, they may have a bit more saved up for down payments and closing costs, making purchasing a home more feasible today.

3. Re-Evaluating Their Space

Spending time at home has also given buyers a chance to really evaluate their living space, whether renting or as a current homeowner. With time available to craft a wish list of what they really need in their next home, from more square footage to a more spacious neighborhood, they’re ready to make it happen.

What does this mean for buyers and sellers?

With these three factors in play, the demand for housing will keep growing this year, especially over the summer as more communities continue their phased approach to reopening. Buyers can take advantage of additional savings and low mortgage rates. And if you’re thinking of selling, know that your home may be in high demand as buyer interest grows and the number of homes for sale continues to dwindle. This may be your moment to list your house and make a move into a new space as well.

Bottom Line

If you’re ready to buy or sell – or maybe both – let’s connect to put your plans in motion. With low mortgage rates leading the way, it’s a great time to take advantage of your position in today’s market.

Homeownership Advantages!

The Benefits of Homeownership May Reach Further Than You Think

More than ever, our homes have become an integral part of our lives. Today they are much more than the houses we live in. They’re evolving into our workplaces, schools for our children, and safe havens that provide shelter, stability, and protection for our families through the evolving health crisis. Today, 65.3% of Americans are able to call their homes their own, a rate that has risen to its highest point in 8 years.

June is National Homeownership Month, and it’s a great time to reflect on the benefits of owning your own home. Below are some highlights and quotes recently shared by the National Association of Realtors (NAR). From non-financial to financial, and even including how owning a home benefits your local economy, these items may give you reason to think homeownership stretches well beyond a sound dollars and cents investment alone.

Non-Financial Benefits

Owning a home brings families a sense of happiness, satisfaction, and pride.

- Pride of Ownership: It feels good to have a place that’s truly your own, especially since you can customize it to your liking. “The personal satisfaction and sense of accomplishment achieved through homeownership can enhance psychological health, happiness and well-being for homeowners and those around them.”

- Property Maintenance and Improvement: Your home is your stake in the community, and a way to give back by driving value into your neighborhood.

- Civic Participation: Homeownership creates stability, a sense of community, and increases civic engagement. It’s a way to add to the strength of your local area.

Financial Benefits

Buying a home is also an investment in your family’s financial future.

- Net Worth: Homeownership builds your family’s net worth. “The median family net worth for all homeowners ($231,400) increased by nearly 15% since 2013, while net worth ($5,000) actually declined by approximately 9% since 2013 for renter families.”

- Financial Security: Equity, appreciation, and predictable monthly housing expenses are huge financial benefits of homeownership. Homeownership is truly the best way to improve your long-term net worth.

Economic Benefits

Homeownership is even a local economic driver.

- Housing-Related Spending: An economic force throughout our nation, housing-related expenses accounted for more than one-sixth of the country’s economic activity over the past three decades.

- GDP Growth: Homeownership also helps drive GDP growth as the country aims to make an economic rebound. “Every 10% increase in total housing market wealth would translate to approximately $147 billion in additional consumer spending, or 0.8% of GDP, as well as billions of dollars in new federal tax revenue.”

- Entrepreneurship: Homeownership is even a form of forced savings that provides entrepreneurial opportunities as well. “Owning a home enables new entrepreneurs to obtain access to credit to start or expand a business and generate new jobs by using their home as collateral for small business loans.”

Bottom Line

The benefits of homeownership are vast and go well beyond the surface level. Homeownership is truly a way to build financial freedom, find greater satisfaction and happiness, and make a substantial impact on your local economy. If owning a home is part of your dream, let’s connect today so you can begin the homebuying process.

Shocking news in the unemployment report

The Shocking News in the Unemployment Report

Last Friday, the U.S. Bureau of Labor Statistics released their May Employment Situation Summary. Leading up to the release, most experts predicted the unemployment rate would jump up to approximately 20% from the 14.7% rate announced last month.

The experts were shocked.

The Wall Street Journal put it this way:

“The May U.S. jobless rate fell to 13.3% and employers added 2.5 million jobs, blowing Wall Street expectations out of the water: Economists had forecast a loss of 8.3 million jobs and a 19.5% unemployment rate.”

In addition, CNBC revealed:

“The May gain was by far the biggest one-month jobs surge in U.S. history since at least 1939.”

Here are some of the job gains by sector:

- Food Service and Bartenders – 1,400,000

- Construction – 464,000

- Education and Health Services – 424,000

- Retail – 368,000

- Other Services – 272,000

- Manufacturing – 225,000

- Professional Services – 127,000

There’s still a long way to go before the economy fully recovers, as 21 million Americans remain unemployed. That number is down, however, from 23 million just last month. And, of the 21 million in the current report, 73% feel their layoff is temporary. This aligns with a recent Federal Reserve Bank report that showed employers felt 75% of the job losses are temporary layoffs and furloughs.

The Employment Situation Summary was definitely a pleasant surprise, and evidence that the country’s economic turnaround is underway. The data also offers a labor-market snapshot from mid-May, when the government conducted its monthly survey of households and businesses. Many states did not open for business until the second half of May. This bodes well for next month’s jobs report.

Bottom Line

We cannot rejoice over a report that reveals millions of American families are still without work. We can, however, feel relieved that we are headed in the right direction, and much more quickly than most anticipated.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link