The latest unemployment market report is in

The Latest Unemployment Report: Slow and Steady Improvement

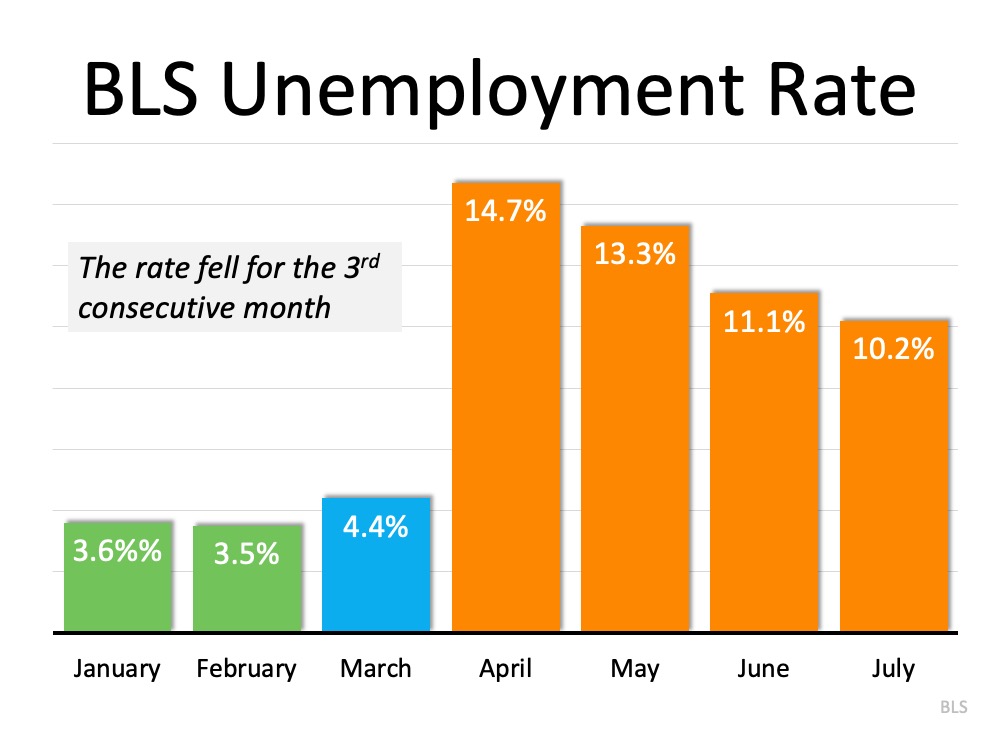

Last Friday, the Bureau of Labor Statistics (BLS) released its latest Employment Situation Summary. Going into the release, the expert consensus was for 1.58 million jobs to be added in July, and for the unemployment rate to fall to 10.5%.

When the official report came out, it revealed that 1.8 million jobs were added, and the unemployment rate fell to 10.2%(from 11.1% last month). Once again, this is excellent news as this was the third consecutive month the unemployment rate decreased. There is, however, still a long way to go before the job market fully recovers. The Wall Street Journal (WSJ) put a potential date on that recovery:

There is, however, still a long way to go before the job market fully recovers. The Wall Street Journal (WSJ) put a potential date on that recovery:

“July’s payroll growth, at 1.8 million, still leaves total payrolls 12.9 million lower than in February. And yet if job gains continued at July’s pace, that deficit will be erased by March 2021. If payrolls reclaim their last peak in 13 months, that would be remarkably fast. It took more than six years after the last recession.”

Permanent vs. Temporary Unemployment

During a pandemic, it’s important to differentiate those who have lost their jobs on a temporary basis from those who have lost them on a permanent basis. Morgan Stanley economists noted in the same WSJ article:

“The rate of churn in the labor market remains incredibly high, but a notable positive detail in this month’s report was the downtick in the rate of new permanent layoffs.”

To address this, the core unemployment rate becomes increasingly important. It identifies the number of people who have permanently lost their jobs. This measure subtracts temporary layoffs and adds unemployed who did not search for a job recently. Jed Kolko, Chief Economist at Indeed and the founder of the index reported:

“Core unemployment fell in July for the first time in the pandemic. That’s the good news I was hoping for.”

What about the housing market?

The housing market has continued to show tremendous resilience during the pandemic. Commenting on the labor report, Robert Dietz, Chief Economist for the National Association of Home Builders (NAHB), tweeted:

“Housing continues to rebound in another positive labor market report. Home builder and remodeler job gains of 24K for July. Residential construction employment down just 56.4K compared to a year ago. Total residential construction employment at 2.85 million.”

Bottom Line

We should remain cautious in our optimism, as the recovery is ultimately tied to our future success in mitigating the ongoing health crisis. However, as Mike Fratantoni, Chief Economist for the Mortgage Bankers Association, reminds us: “The pace of job growth slowed in July, but the gains over the past three months represent an impressive rebound during the ongoing economic challenges brought forth by the pandemic.”

Seeking the suburbs…..

Will We See a Surge of Homebuyers Moving to the Suburbs?

Surban living……Seeking the amenities/perks of urban living yet in a suburban setting. It’s a big movement right now and I am seeing it daily in RI. Five new buyer clients last week alone looking to leave the city and hit the ‘burbs. It’s a nationwide trend. fueled by the pandemic and one we are seeing locally here in RI.

As remote work continues on for many businesses and Americans weigh the risks of being in densely populated areas, will more people start to move out of bigger cities? Spending extra time at home and dreaming of more indoor and outdoor space is certainly sparking some interest among homebuyers. Early data shows an initial trend in this direction of moving from urban to suburban communities, but the question is: will the trend continue?

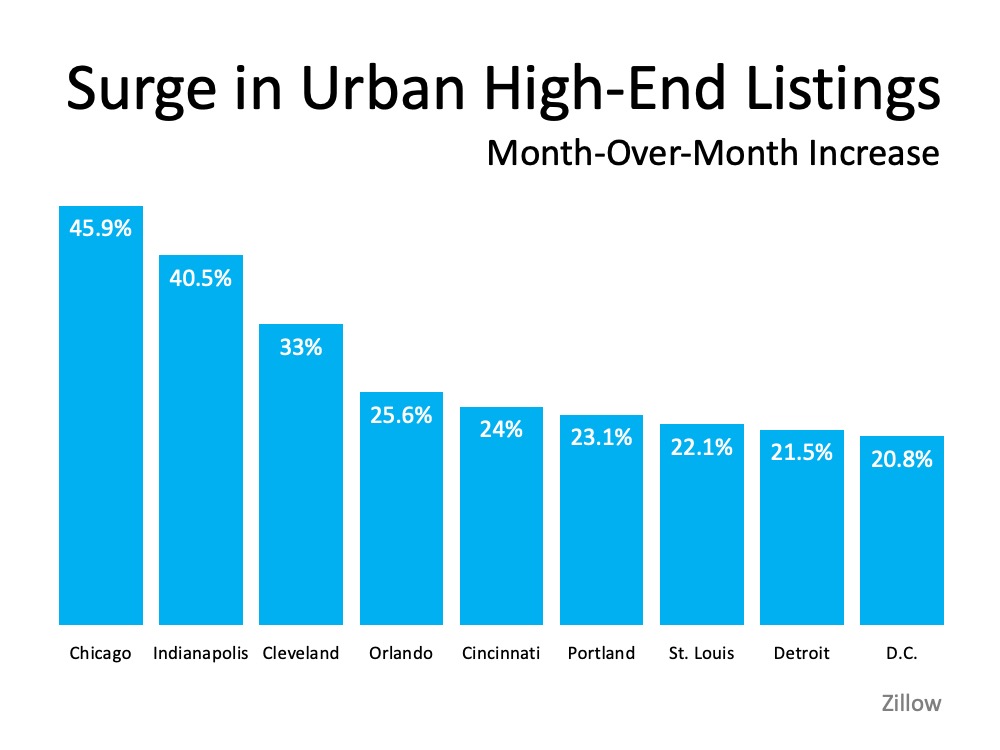

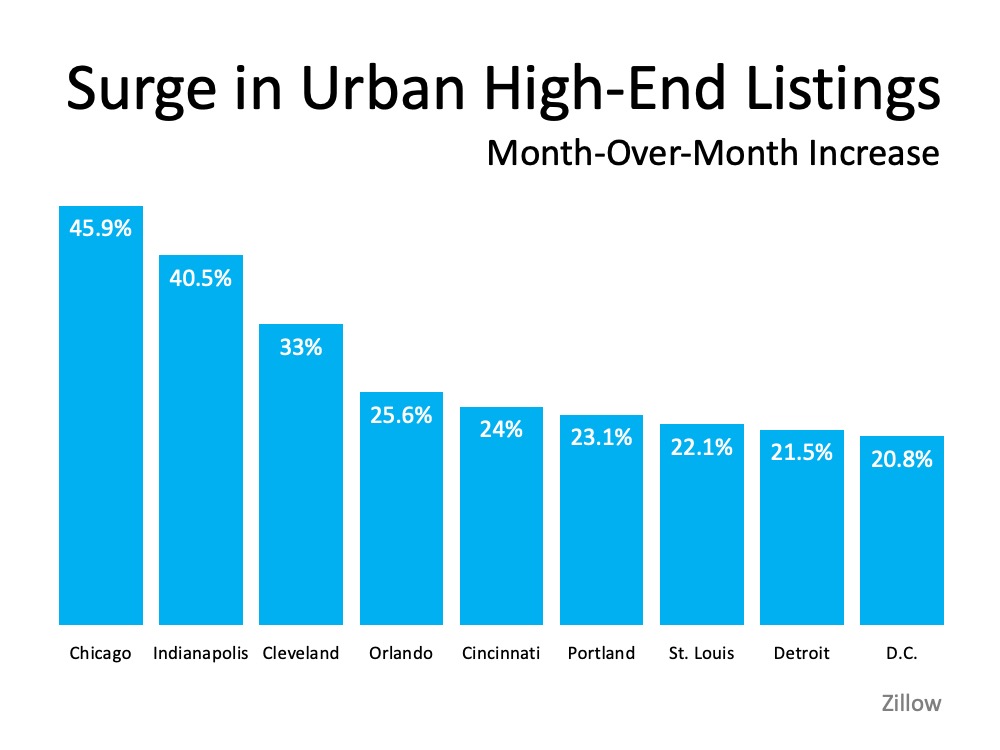

According to recent data from Zillow, there is a current surge in urban high-end listings in some larger metro areas. The month-over-month increase in these homes going on the market indicates more urban homeowners may be ready to make a move out of the city, particularly at the upper end of the market (See graph below):

Why are people starting to move out of larger cities?

With the ongoing health crisis, it’s no surprise that many people are starting to consider this shift. A July survey from HomeLight notes the top reasons people are actually moving today:

- More interior space

- Desire to own

- Move from city to suburbs

- More outdoor space

More space, proximity to fewer people, and a desire to own at a more affordable price point are highly desirable features in this new era, so the list makes sense.

John Burns Consulting notes:

“The trend is accelerating faster than anyone could have predicted. The need for more space is driving suburban migration.”

In addition, Sheryl Palmer, CEO of Taylor Morrison, a home building company, indicates:

“Most recently, we’re really seeing a pickup in folks saying they want more rural or suburban locations. Initially, there was a lot of talk about that, but it’s really coming through our buyers today.”

The National Association of Home Builders (NAHB) also shares:

“New home demand is improving in lower density markets, including small metro areas, rural markets and large metro exurbs, as people seek out larger homes and anticipate more flexibility for telework in the years ahead. Flight to the suburbs is real.”

Will the shift pick up speed and continue on?

The question remains, will this interest in suburban and rural living continue? Some, like Lawrence Yun, Chief Economist at the National Association of Realtors (NAR) think the possibility is there, but it is still quite early to tell for sure. Yun notes:

“Homebuyers considering a move to the suburbs is a growing possibility after a decade of urban downtown revival…Greater work-from-home options and flexibility will likely remain beyond the virus and any forthcoming vaccine.”

While much of the energy behind this trend has largely been accelerated by the current health crisis, monitoring the momentum over time is critically important. Businesses are discovering new and innovative ways to function in remote environments, so the shift has the potential to stick. Much like the economic recovery, however, the long-term impact may hinge largely on the health situation throughout this country.

Bottom Line

Early data is showing a shift from urban to suburban markets, but keeping an eye on this trend will help us understand how it will ultimately play out.

Will We See a Surge of Homebuyers Moving to the Suburbs?

As remote work continues on for many businesses and Americans weigh the risks of being in densely populated areas, will more people start to move out of bigger cities? Spending extra time at home and dreaming of more indoor and outdoor space is certainly sparking some interest among homebuyers. Early data shows an initial trend in this direction of moving from urban to suburban communities, but the question is: will the trend continue?

According to recent data from Zillow, there is a current surge in urban high-end listings in some larger metro areas. The month-over-month increase in these homes going on the market indicates more urban homeowners may be ready to make a move out of the city, particularly at the upper end of the market (See graph below):

Why are people starting to move out of larger cities?

With the ongoing health crisis, it’s no surprise that many people are starting to consider this shift. A July survey from HomeLight notes the top reasons people are actually moving today:

- More interior space

- Desire to own

- Move from city to suburbs

- More outdoor space

More space, proximity to fewer people, and a desire to own at a more affordable price point are highly desirable features in this new era, so the list makes sense.

John Burns Consulting notes:

“The trend is accelerating faster than anyone could have predicted. The need for more space is driving suburban migration.”

In addition, Sheryl Palmer, CEO of Taylor Morrison, a home building company, indicates:

“Most recently, we’re really seeing a pickup in folks saying they want more rural or suburban locations. Initially, there was a lot of talk about that, but it’s really coming through our buyers today.”

The National Association of Home Builders (NAHB) also shares:

“New home demand is improving in lower density markets, including small metro areas, rural markets and large metro exurbs, as people seek out larger homes and anticipate more flexibility for telework in the years ahead. Flight to the suburbs is real.”

Will the shift pick up speed and continue on?

The question remains, will this interest in suburban and rural living continue? Some, like Lawrence Yun, Chief Economist at the National Association of Realtors (NAR) think the possibility is there, but it is still quite early to tell for sure. Yun notes:

“Homebuyers considering a move to the suburbs is a growing possibility after a decade of urban downtown revival…Greater work-from-home options and flexibility will likely remain beyond the virus and any forthcoming vaccine.”

While much of the energy behind this trend has largely been accelerated by the current health crisis, monitoring the momentum over time is critically important. Businesses are discovering new and innovative ways to function in remote environments, so the shift has the potential to stick. Much like the economic recovery, however, the long-term impact may hinge largely on the health situation throughout this country.

Bottom Line

Early data is showing a shift from urban to suburban markets, but keeping an eye on this trend will help us understand how it will ultimately play out. It may just be a temporary swing in a new direction until Americans once again feel a sense of comfort in the cities they’ve grown to love .

Thinking of selling your home ? Now may be the right time!

Thinking of Selling Your House? Now May be the Right Time

Inventory is arguably the biggest challenge for buyers in today’s housing market. There are simply more buyers actively looking for homes to purchase than there are sellers selling them, so the scale is tipped in favor of the sellers.

According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), total housing inventory is down 18.8% from one year ago. Inventory is well below what was available last year, and the houses that do come to the market are selling very quickly.

Sam Khater, Chief Economist at Freddie Mac notes:

“Simply put, new housing supply is not keeping up with rising demand. We estimate that the housing market is undersupplied by 3.3 million units, and the shortage is rising by about 300,000 units a year. More than half of all states have a housing shortage.”

Why is inventory so low?

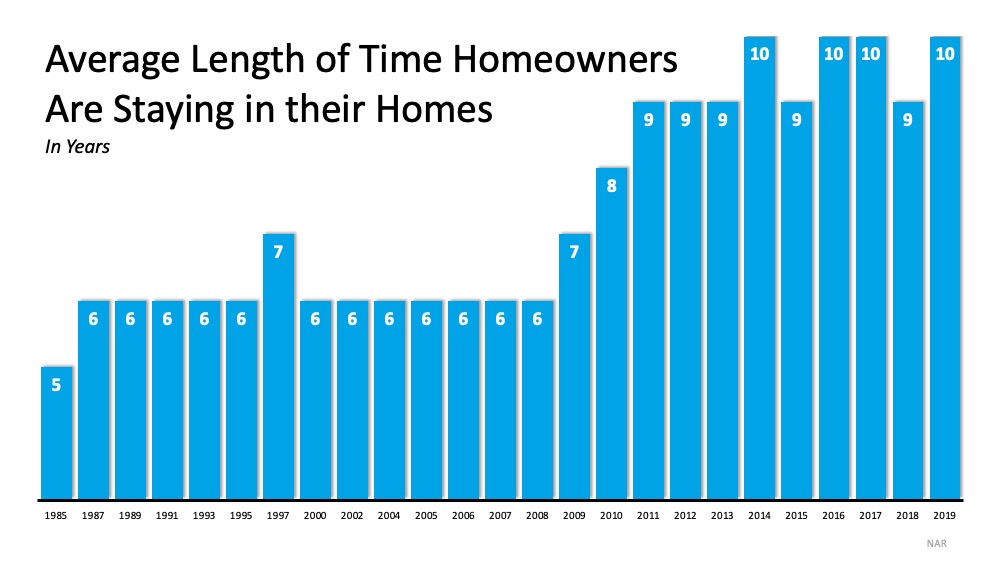

There are many reasons why it’s hard to find a home to buy today, stemming from an undersupply of newly constructed homes to sellers pressing pause on their moving plans due to the current health pandemic. One of the key factors making it even more challenging, however, is the amount of time current homeowners are staying in their homes. There has truly been a fundamental shift in the market that started about 10 years ago: people are staying put longer, and it’s contributing to the shortage of houses for sale.

In the 2019 Profile of Home Buyers and Sellers, NAR explained:

“In 2019, the median tenure for sellers was 10 years…After 2008, the median tenure in the home began to increase by one year each year. By 2011, the median tenure reached nine years, where it remained for three consecutive years, and jumped up again in 2014 to 10 years.”

As shown in the graph below, historical data indicates that staying in a home for 5-7 years used to be the norm, until the housing bubble burst. Since 2010, that length of time has trended upward, toward 9-10 years, largely due to homeowners aiming to recoup their equity: Thankfully, with the strength the market has gained over the last 10 years, today’s homeowners are in a much better equity position. Now is a fantastic time for homeowners who are ready to make a move to break the 10-year trend and sell their houses, especially while buyer demand is so high and inventory is so low. It’s a prime time to sell.

Thankfully, with the strength the market has gained over the last 10 years, today’s homeowners are in a much better equity position. Now is a fantastic time for homeowners who are ready to make a move to break the 10-year trend and sell their houses, especially while buyer demand is so high and inventory is so low. It’s a prime time to sell.

In addition, with today’s historically low interest rates, there’s an opportunity for sellers to maintain a low monthly payment while getting more house for their money. Think: move-up opportunity, more square footage, or finding the features they’re really looking for rather than doing costly renovations. With more new homes poised to enter the market this year, homeowners ready to make a move may have a golden opportunity to do so right now.

Bottom Line

There are simply not enough houses for sale today. We currently have 1.1 months supply of inventory here in RI. A balanced market has SIX months of inventory. Asking prices are up 6% and Sales prices are up 3.3 %. If you’re ready to leverage your equity and sell your Rhode Island house, let’s connect today. It’s a great time to move while demand for homes to buy is extremely high.

How is the Economy Affecting the Real Estate Market?

Watch the video for July numbers and trends

A Remarkable Recovery for the Housing Market

A Remarkable Recovery for the Housing Market

For months now the vast majority of Americans have been asking the same question: When will the economy turn around? Many experts have been saying the housing market will lead the way to a recovery, and today we’re seeing signs of that coming to light. With record-low mortgage rates driving high demand from potential buyers, homes are being purchased at an accelerating pace, and it’s keeping the housing market and the economy moving.

Here’s a look at what a few of the experts have to say about today’s astonishing recovery. In more than one instance, it’s being noted as truly remarkable.

Ali Wolf, Chief Economist, Meyers Research

“The housing recovery has been nothing short of remarkable…The expectation was that housing would be crushed. It was—for about two months—and then it came roaring back.”

“Recent home purchase measures have continued to show remarkable strength, leading us to revise upward our home sales forecast, particularly over the third quarter. Similarly, we bumped up our expectations for home price growth and purchase mortgage originations.”

Javier Vivas, Director of Economic Research for realtor.com

“All-time low mortgage rates and easing job losses have boosted buyer confidence back to pre-pandemic levels.”

James Knightley, Chief International Economist, ING

“At face value this is remarkable given the scale of joblessness in the economy and the ongoing uncertainty relating to the path of Covid-19…The outlook for housing transactions, construction activity and employment in the sector is looking much better than what looked possible just a couple of months ago.”

Bottom Line

The strength of the housing market is a bright spark in the economy and leading the way to what is truly being called a remarkable recovery throughout this country. If you’re thinking of buying or selling a home in R.I. maybe this is your year to make a move after all.

What the experts are saying about home prices

What Are Experts Saying about Home Prices?

Last week, a very well-respected real estate analytics firm surprised many with their home price projection for the next twelve months. CoreLogic, in their latest Home Price Index said:

“The economic downturn that started in March 2020 is predicted to cause a 6.6% drop in the HPI by May 2021, which would be the first decrease in annual home prices in over 9 years.”

The forecast was surprising as it was strikingly different than any other projection by major analysts. Six of the other eight forecasts call for appreciation, and the two who project depreciation indicate it will be one percent or less.

Here is a graph showing all of the projections:There’s a simple formula to determine the future price of any item: calculate the supply of that item in ratio to the demand for that item. In housing right now, demand far exceeds supply. Last week mortgage applications to buy a home were 33% higher than they were at the same time last year. The available inventory of homes for sale is 31% lower than it was last year. Normally, these numbers should call for homes to continue to appreciate.

Bottom Line

Because of the uncertainty with the pandemic, any economic prediction is extremely difficult. However, looking at the limited supply of homes for sale and the tremendous demand for housing, it is difficult to disagree with the majority of analysts who are calling for price appreciation. I’ve been nothing short of amazed by the strength and robustness of our local RI market. Homes listed precisely are going quickly and lucratively. Let me know if I can be of any help during this bullish time in RI real estate!

Bidding war madness

Buyers: Are You Ready for a Bidding War?

With businesses reopening throughout the country and some experts indicating early signs of a much-anticipated economic recovery, more homebuyers are actively entering the housing market this summer. Today, housing is truly driving the U.S. economy forward. With so many buyers looking for homes to purchase and so few houses for sale right now, there’s a disconnect between supply and demand. This imbalance is pushing home prices upward while driving more bidding wars and multiple-offer scenarios. Danielle Hale, Chief Economist at realtor.com explains:

“People are surprised that prices are rising, not falling, because in the last recession home prices fell, the difference this time is the severe shortage of homes for sale…We are seeing bigger price increases with [a limited] number of homes…That is likely to lead to more competition and potentially multiple offers and bidding wars.”

According to the recent Realtors Confidence Index (RCI) survey conducted by the National Association of Realtors (NAR), this trend is growing:

“On average, there were about three offers on a home that closed in May, up from just about two in April 2020 and in May 2019 (2.3 offers).”

HousingWire also indicates:

“42% of homeowners who made a purchase during the January to May time period ended up in a bidding war, demonstrating the strong demand for homes amid low inventory.”

With more people returning to work we’ll continue to see the number of interested buyers increase. So, if you’re among the many people looking for a home to buy this summer, it’s important to ensure you have the right guidance from the start. This way, you make sure your offer stands out from the crowd when it really counts. Here are two tips to follow.

1. Hire a Trusted Local Expert

A trusted local real estate professional matters more than ever right now, as noted in a recent survey shared by NAR. In fact, according to respondents, 54% of buyers and 62% of sellers indicated that “Particularly during the pandemic, a real estate agent’s guidance is especially valued.”

We’re not in a normal market. We are in one of the greatest health crises our nation has ever seen. The pandemic has had a dramatic impact on the journey consumers must take to purchase a home. To successfully navigate the landscape today, you need a true expert on your side.

2. Get Pre-Approved for a Mortgage

When there are more buyers than sellers on the market, the process to find a home becomes much more challenging. One way to show you’re serious about buying a home is to work with a lender to get pre-approved for a mortgage before starting your search. With a pre-approval letter, sellers will see your true desire to buy this year, potentially helping your offer rise to the top.

Bottom Line

If this is the year you’re ready to buy, let’s connect to get the process started so you can make sure your offer is a strong one when the competition heats up.

There are definite ways to make an offer more competitive and now more than ever you need to tap into them. The former athlete in my thrives on competition and the teacher in me drills down on a very thorough and exhaustive method of offer preparation! Reach out to me if you’d like to search for that special home to call your own in RI~

Weekly market news

Weekly housing trends – Total inventory was down 31% as more and more buyers continue to take advantage of low mortgage rates and put a dent in inventory. Median listing prices continue growing at 6.2% over last year, faster than the pr-COVID pace. Time on market is 3 days slower than last year with the limited number of homes for sale forcing buyers to make faster decisions than they did pre-COVID. I’m seeing this all over RI as I engage in representing both sellers and buyers. The market continues to pick up speed due to the surge in buyers fueled by a lack of inventory state wide. Now is a great time to sell in RI!

Not all Agents are created equal…..

Not All Agents Are Created Equal

In today’s fast-paced world where answers are just a Google search away, there are some who may question the benefits of hiring a real estate professional when selling a house. The reality is, the addition of more information can lead to more confusion. A real estate agent can be your essential guide, but truth be told, not all agents are created equal. Finding the right agent for you and your family should be your top priority when you’re ready to sell your house.

The right agent is the person who can truly walk you through the whole process, look out for your best interest, and seamlessly lead you through all the steps along the way. In today’s complex market, the way we execute real estate transactions is changing constantly, especially as more elements can be done virtually. Making sure you have the best advice on your side is more important than ever.

So, how do you choose the perfect agent?

It starts with trust. You must trust the advice this person is going to give you, and you’ll want to begin by making sure you’re connected to a true professional. An agent can’t give you perfect advice because it’s impossible to know exactly what’s going to happen at every turn – especially in this unique market. A true professional agent can, however, give you the best advice possible based on the information and situation at hand, helping you make the necessary adjustments and best decisions along the way. The right agent – the professional – will get you the best offer available. That’s exactly what you want and deserve.

What do you need to trust your agent to do?

1. Navigate the Process

There are over 230 possible steps that take place during a successful real estate transaction. Don’t you want someone who has been there before, someone who knows what these actions are, to ensure you have a positive selling experience?

2. Negotiate on Your Behalf

Today, hiring a trusted and talented negotiator could save you thousands, perhaps tens of thousands of dollars. Each step – from the buyer submitting an original offer, to the possible renegotiation of that offer after a home inspection, to the potential cancelation of the deal based on a troubled appraisal – you need someone who can keep the deal together until it closes.

3. Price Your House Competitively

There’s so much information in the news and on the Internet about home sales, prices, and mortgage rates. How do you know what’s going on in our local area? Who do you turn to in order to competitively and correctly price your home at the beginning of the selling process?

Dave Ramsey, known as the financial guru, advises:

“When getting help with money, whether it’s insurance, real estate or investments, you should always look for someone with the heart of a teacher, not the heart of a salesman.”

Hiring a trusted professional who has a finger on the pulse of the market and is eager to help you learn will make your experience an informed and educated one. You need someone who’s going to tell you the truth, not just what they think you want to hear.

Bottom Line

Today’s real estate market is highly competitive. Having a trusted professional who’s been there before to guide you through the process is a simple step that will give you a huge advantage when you’re ready to sell your house. Let’s make it happen together.I pride myself on my work ethic, my hustle and my competitive drive that is devoted 100% on and toward my clients. Whether I am listing a home or purchasing a home I dive in on day one and apply pure grit and a thorough and exhaustive approach to every element of a transaction. Advocating for my clients is truly my “why I’m here.” Looking for real estate guidance? I am here to help!

Latest Unemployment Report….Good news for the most part!

Latest Unemployment Report: Great News…for the Most Part

The Bureau of Labor Statistics (BLS) released their latest Employment Situation Summary last Thursday, and it again beat analysts’ expectations in a big way. The consensus was for 3,074,000 jobs to be added in June. The report revealed that 4,800,000 jobs were added. The unemployment rate fell to 11.1% from 13.3% last month. Again, excellent news as the unemployment rate fell for the second consecutive month. However, there’s still a long way to go before the economy fully recovers as 17.8 million Americans remain unemployed.

Here are two interesting insights on the report:

What about a supposed misclassification?

The BLS addressed this at length in a blog post last week, and concluded by saying:

“Regardless of the assumptions we might make about misclassification, the trend in the unemployment rate over the period in question is the same; the rate increased in March & April and eased in May.”

They specifically noted the issue in the latest report by explaining that if they adjusted the rate for the potential miscalculation, it would increase from 11.1% to 12.1% (which is lower than the adjusted rate of 16.4% last month). They went on to say:

“However, this represents the upper bound of our estimate of misclassification and probably overstates the size of the misclassification error.”

Does the shutdown of parts of the economy skew the unemployment numbers?

Because the uniqueness of 2020 impacts the employment situation in so many ways, each jobs report is now examined with a microscope to make sure the headlines generated by the report accurately convey what’s happening in the job market.

One such analysis is done by Jed Kolko, Chief Economist at Indeed. He believes the extraordinary number of people in the “temporary” unemployed category confuses the broader issue of how many people have permanently lost their job. He adjusts for this when calculating his “core unemployment rate” (which subtracts temporary layoffs and adds unemployed who didn’t search for a job recently).

The bad news is that his analysis reveals that the number of permanently unemployed is still rising (from 4.6% in April to 5.9% last month). The good news, however, is when you use his methodology to look back at the Great Recession, today’s “core unemployment rate” is significantly lower (5.9% versus 10.5% in April 2010).

Bottom Line

Last week’s jobs report was much better than most expected. However, we should remain cautious in our optimism. As the Wall Street Journalexplained in their analysis of the jobs report:

“U.S. job growth surged last month, underscoring the economy’s capacity for a quick rebound if businesses continue to reopen and consumers regain confidence. A recent coronavirus spike, however, could undermine trends captured in the latest jobs report.”

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link