Three tips for winning a bidding war

Three Ways to Win in a Bidding War

With so few houses for sale today and low mortgage rates driving buyer activity, bidding wars are becoming more common. Multiple-offer scenarios are heating up, so it’s important to get pre-approved before you start your search. This way, you can put your best foot forward – quickly and efficiently – if you’re planning to buy a home this season.

Javier Vivas, Director of Economic Research at realtor.com, explains:

“COVID-19 has accelerated earlier trends, bringing even more buyers than the market can handle. In many markets, fierce competition, bidding wars, and multiple offer scenarios may be the common theme in the weeks to come.”

Here are three things you can do to make your offer a competitive one when you’re ready to make your move.

1. Be Ready

A recent survey shows that only 52% of active homebuyers obtained a pre-approval letter before they began their home search. That means about half of active buyers missed out on this key part of the process.

Buyers who are pre-approved are definitely a step ahead when it’s time to make an offer. Having a pre-approval letter indicating you’re a qualified buyer shows sellers you’re serious. It’s often a deciding factor that can tip the scale in your direction if there’s more than one offer on a home. It’s best to contact a mortgage professional to start your pre-approval process early, so you’re in the best position right from the start of your home search.

2. Present Your Best Offer

In a highly competitive market, it’s common for sellers to pick a date and time to review all offers on a house at one time. If this is the case, you may not have an opportunity to negotiate back and forth with the sellers. As a matter of fact, the National Association of Realtors (NAR) notes:

“Not only are properties selling quickly, but they are also getting more offers. On average, REALTORS® reported nearly three offers per sold property in July 2020.”

Make sure the offer you’re presenting is the best one the sellers receive. A real estate professional can help you make sure your offer is a fair and highly competitive one.

3. Act Fast

With existing homes going like hotcakes, there’s no time to waste in the process. NAR reports how the speed of home sales is ramping up:

“Properties typically remained on the market for 22 days in July, seasonally down from 24 days in June and from 29 days in July 2019. Sixty-eight percent of homes sold in July 2020 were on the market for less than a month.”

In addition, NAR notes:

“Total existing-home sales…jumped 24.7% from June to a seasonally adjusted annual rate of 5.86 million in July. The previous record monthly increase in sales was 20.7% in June of this year. Sales as a whole rose year-over-year, up 8.7% from a year ago (5.39 million in July 2019).”

As you can see, the market is gaining steam. For two consecutive months houses have sold very quickly. Essentially, you may not have time to sleep on it or shop around when you find a home you love. Chances are, someone else loves it too. If you take your time, it may not be available when you’re ready to commit.

Bottom Line

The housing market is very strong right now in R.I. and buyers are scooping up available homes faster than they’re coming to market. If you’re planning to purchase a home this year in RI, let’s connect to discuss the trends in our current area, so you’re ready to compete – and win.

Sellers are returning!!!

Sellers Are Returning to the Housing Market

In today’s housing market, it can be a big challenge for buyers to find homes to purchase, as the number of houses for sale is far below the current demand. Now, however, we’re seeing sellers slowly starting to come back into the market, a bright spark for potential buyers. Javier Vivas, Director of Economic Research at realtor.com, explains:

“Seller confidence has been improving gradually after reaching its bottom in mid-April, and now it appears to have reached an important recovery milestone…After five long months, sellers are back in the housing market; while encouraging, the improvement to new listings is only the first step in the long road to solving low inventory issues keeping many buyers at bay.”

Even with the number of homes coming into the market, the available inventory is well below where it needs to be to satisfy buyer interest. The National Association of Realtors (NAR) reports:

“Total housing inventory at the end of June totaled 1.57 million units, up 1.3% from May, but still down 18.2% from one year ago (1.92 million). Unsold inventory sits at a 4.0-month supply at the current sales pace, down from both 4.8 months in May and from the 4.3-month figure recorded in June 2019.”

Houses today are selling faster than they’re coming to market. That’s why we only have inventory for 4 months at the current sales pace when in reality we need inventory for 6 months to keep up. But, as mentioned above, sellers are starting to return to the game. Realtor.com explains:

“The ‘housing supply’ component – which tracks growth of new listings – reached 101.7, up 4.9 points over the prior week, finally reaching the January growth baseline. The big milestone in new listings growth comes as seller sentiment continues to build momentum…After constant gradual improvements since mid-April, seller confidence appears to be reaching an important milestone. The temporary boost in new listings comes as the summer season replaces the typical spring homebuying season. More homes are entering the market than typical for this time of the year.”

Why is this good for sellers?

A good time to enter the housing market is when the competition in your area is low, meaning there are fewer sellers than interested buyers. You don’t want to wait for all of the other homeowners to list their houses before you do, providing more options for buyers to choose from. With sellers starting to get back into the market after five months of waiting, if you want to sell your house for the best possible price, now is a great time to do so.

Why is this good for buyers?

It can be challenging to find a home in today’s low-inventory environment. If more sellers are starting to put their houses up for sale, there will be more homes for you to choose from, providing a better opportunity to find the home of your dreams while taking advantage of the affordability that comes with historically low mortgage rates.

Bottom Line

While we still have a long way to go to catch up with the current demand, inventory is slowly starting to return to the market. Every day I am receiving requests to come do a property analysis of homeowners thinking of making the move and listing here in RI. If you’re thinking of moving this year, let’s connect today so you’re ready to make your move when the home of your dreams comes up for sale.

Recovery on the Horizon

The Beginning of an Economic Recovery

The news these days seems to have a mix of highs and lows. We may hear that an economic recovery is starting, but we’ve also seen some of the worst economic data in the history of our country. The challenge today is to understand exactly what’s going on and what it means relative to the road ahead. We’ve talked before about what experts expect in the second half of this year, and today that progress largely hinges upon the continued course of the virus.

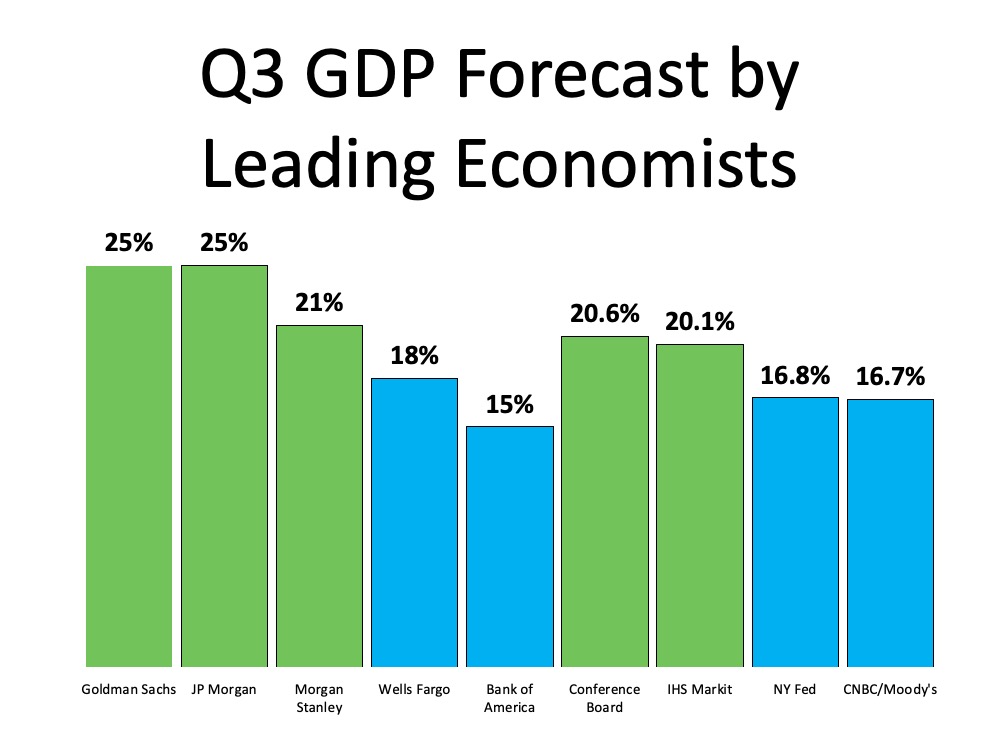

A recent Wall Street Journal survey of economists noted, “A strong economic recovery depends on effective and sustained containment of Covid-19.” Given the uncertainty around the virus, we can also see what economists are forecasting for GDP in the third quarter of this year (see graph below): Overwhelmingly, economists are projecting GDP growth in the third quarter of 2020, with 5 of the 9 experts indicating over 20% growth.

Overwhelmingly, economists are projecting GDP growth in the third quarter of 2020, with 5 of the 9 experts indicating over 20% growth.

Lisa Shalett, Chief Investment Officer for Morgan Stanley puts it this way:

“Indeed, the ‘worst ever’ GDP reading could be followed by the ‘best ever’ growth in the third quarter.”

As we look forward, we can expect consumer spending to improve as well. According to Opportunity Insights, as of August 1, consumer spending was down just 7.8% as compared to January 1 of this year.

Bottom Line

An economic recovery is beginning to happen throughout the country. While there are still questions that need to be answered about the road ahead, we can expect to see improvement this quarter.

Inventory is slowly opening up!

Sellers Are Returning to the Housing Market

In today’s housing market, it can be a big challenge for buyers to find homes to purchase, as the number of houses for sale is far below the current demand. Now, however, we’re seeing sellers slowly starting to come back into the market, a bright spark for potential buyers. Javier Vivas, Director of Economic Research at realtor.com, explains:

“Seller confidence has been improving gradually after reaching its bottom in mid-April, and now it appears to have reached an important recovery milestone…After five long months, sellers are back in the housing market; while encouraging, the improvement to new listings is only the first step in the long road to solving low inventory issues keeping many buyers at bay.”

Even with the number of homes coming into the market, the available inventory is well below where it needs to be to satisfy buyer interest. The National Association of Realtors (NAR) reports:

“Total housing inventory at the end of June totaled 1.57 million units, up 1.3% from May, but still down 18.2% from one year ago (1.92 million). Unsold inventory sits at a 4.0-month supply at the current sales pace, down from both 4.8 months in May and from the 4.3-month figure recorded in June 2019.”

Houses today are selling faster than they’re coming to market. That’s why we only have inventory for 4 months at the current sales pace when in reality we need inventory for 6 months to keep up. But, as mentioned above, sellers are starting to return to the game. Realtor.com explains:

“The ‘housing supply’ component – which tracks growth of new listings – reached 101.7, up 4.9 points over the prior week, finally reaching the January growth baseline. The big milestone in new listings growth comes as seller sentiment continues to build momentum…After constant gradual improvements since mid-April, seller confidence appears to be reaching an important milestone. The temporary boost in new listings comes as the summer season replaces the typical spring homebuying season. More homes are entering the market than typical for this time of the year.”

Why is this good for sellers?

A good time to enter the housing market is when the competition in your area is low, meaning there are fewer sellers than interested buyers. You don’t want to wait for all of the other homeowners to list their houses before you do, providing more options for buyers to choose from. With sellers starting to get back into the market after five months of waiting, if you want to sell your house for the best possible price, now is a great time to do so.

Why is this good for buyers?

It can be challenging to find a home in today’s low-inventory environment. If more sellers are starting to put their houses up for sale, there will be more homes for you to choose from, providing a better opportunity to find the home of your dreams while taking advantage of the affordability that comes with historically low mortgage rates.

Bottom Line

While we still have a long way to go to catch up with the current demand, inventory is slowly starting to return to the market. While we currently sit at only 1 month’s worth of inventory,I continue to meet with sellers every day who are preparing to hit the market throughout RI. If you’re thinking of moving this year, let’s connect today so you’re ready to make your move when the home of your dreams comes up for sale.

Homes are more affordable now than they have been in years

Homes Are More Affordable Right Now Than They Have Been in Years

Today, home prices are appreciating. When we hear prices are going up, it’s normal to think a home will cost more as the trend continues. The way the housing market is positioned today, however, low mortgage rates are actually making homes more affordable, even as prices rise. Here’s why.

According to the Mortgage Monitor Report from Black Knight:

“While home prices have risen for 97 consecutive months, July’s record-low mortgage rates have made purchasing the average-priced home the most affordable it’s been since 2016.”

How is that possible?

Black Knight continues to explain:

“As of mid-July, it required 19.8% of the median monthly income to make the mortgage payment on the average-priced home purchase, assuming a 20% down payment and a 30-year mortgage. That was more than 5% below the average of 25% from 1995-2003.

This means it currently requires a $1,071 monthly payment to purchase the average-priced home, which is down 6% from the same time last year, despite the average home increasing in value by more than $12,000 during that same time period.

In fact, buying power is now up 10% year-over-year, meaning the average home buyer can afford nearly $32,000 more home than they could at the same time last year, while keeping their monthly payment the same.”

This is great news for the many buyers who were unable to purchase last year, or earlier in the spring due to the slowdown from the pandemic. By waiting a little longer, they can now afford 10% more home than they could have a year ago while keeping their monthly mortgage payment unchanged.

With mortgage rates hitting all-time lows eight times this year, it’s now less expensive to borrow money, making homes significantly more affordable over the lifetime of your loan. Mark Fleming, Chief Economist at First American, shares what low mortgage rates mean for affordability:

“In July, house-buying power got a big boost as the 30-year, fixed mortgage rate made history by moving below three percent. That drop in the mortgage rate from 3.23 percent in May to 2.98 percent in July increased house-buying power by nearly $15,000.”

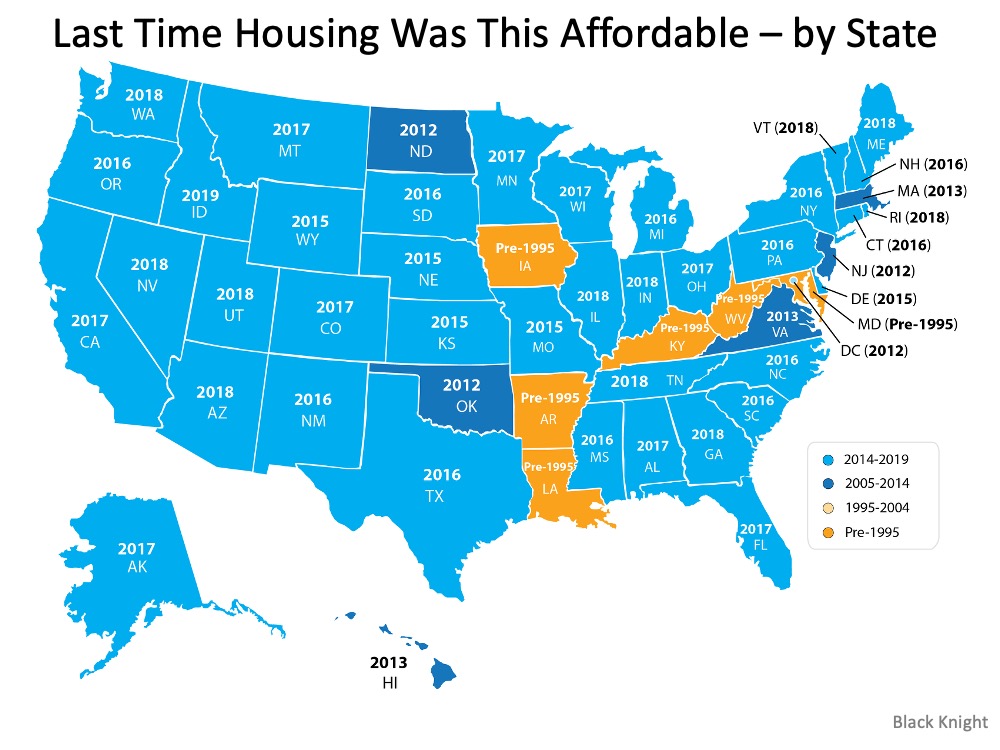

The map below shows the last time homes were this affordable by state: In six states – Arkansas, Iowa, Kentucky, Louisiana, Maryland, and West Virginia – homes have not been this affordable in more than 25 years.

In six states – Arkansas, Iowa, Kentucky, Louisiana, Maryland, and West Virginia – homes have not been this affordable in more than 25 years.

Bottom Line

If you’re thinking of making a move in RI , now is a great time to take advantage of the affordability that comes with such low mortgage rates. For sellers in RI , it truly is an ideal time to take advantage of the increase in home prices here in RI . Whether you’re thinking of purchasing your first home or moving into a new one and securing a significantly lower mortgage rate than you may have on your current house, let’s connect today to determine your next steps in the process. I am here to help.

The latest unemployment market report is in

The Latest Unemployment Report: Slow and Steady Improvement

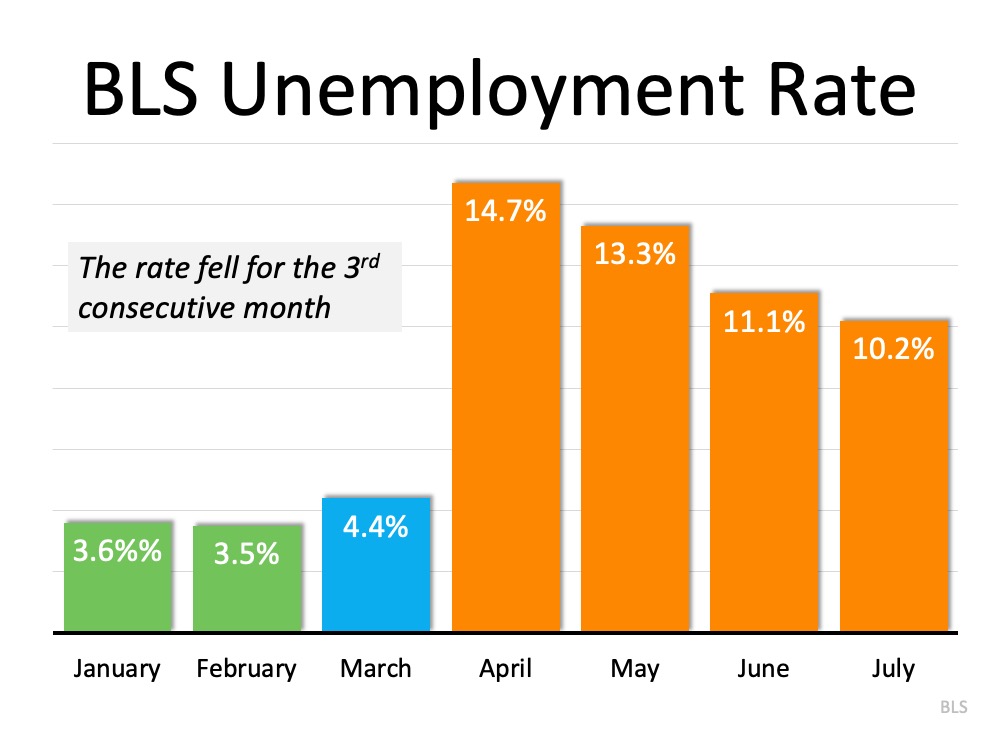

Last Friday, the Bureau of Labor Statistics (BLS) released its latest Employment Situation Summary. Going into the release, the expert consensus was for 1.58 million jobs to be added in July, and for the unemployment rate to fall to 10.5%.

When the official report came out, it revealed that 1.8 million jobs were added, and the unemployment rate fell to 10.2%(from 11.1% last month). Once again, this is excellent news as this was the third consecutive month the unemployment rate decreased. There is, however, still a long way to go before the job market fully recovers. The Wall Street Journal (WSJ) put a potential date on that recovery:

There is, however, still a long way to go before the job market fully recovers. The Wall Street Journal (WSJ) put a potential date on that recovery:

“July’s payroll growth, at 1.8 million, still leaves total payrolls 12.9 million lower than in February. And yet if job gains continued at July’s pace, that deficit will be erased by March 2021. If payrolls reclaim their last peak in 13 months, that would be remarkably fast. It took more than six years after the last recession.”

Permanent vs. Temporary Unemployment

During a pandemic, it’s important to differentiate those who have lost their jobs on a temporary basis from those who have lost them on a permanent basis. Morgan Stanley economists noted in the same WSJ article:

“The rate of churn in the labor market remains incredibly high, but a notable positive detail in this month’s report was the downtick in the rate of new permanent layoffs.”

To address this, the core unemployment rate becomes increasingly important. It identifies the number of people who have permanently lost their jobs. This measure subtracts temporary layoffs and adds unemployed who did not search for a job recently. Jed Kolko, Chief Economist at Indeed and the founder of the index reported:

“Core unemployment fell in July for the first time in the pandemic. That’s the good news I was hoping for.”

What about the housing market?

The housing market has continued to show tremendous resilience during the pandemic. Commenting on the labor report, Robert Dietz, Chief Economist for the National Association of Home Builders (NAHB), tweeted:

“Housing continues to rebound in another positive labor market report. Home builder and remodeler job gains of 24K for July. Residential construction employment down just 56.4K compared to a year ago. Total residential construction employment at 2.85 million.”

Bottom Line

We should remain cautious in our optimism, as the recovery is ultimately tied to our future success in mitigating the ongoing health crisis. However, as Mike Fratantoni, Chief Economist for the Mortgage Bankers Association, reminds us: “The pace of job growth slowed in July, but the gains over the past three months represent an impressive rebound during the ongoing economic challenges brought forth by the pandemic.”

Seeking the suburbs…..

Will We See a Surge of Homebuyers Moving to the Suburbs?

Surban living……Seeking the amenities/perks of urban living yet in a suburban setting. It’s a big movement right now and I am seeing it daily in RI. Five new buyer clients last week alone looking to leave the city and hit the ‘burbs. It’s a nationwide trend. fueled by the pandemic and one we are seeing locally here in RI.

As remote work continues on for many businesses and Americans weigh the risks of being in densely populated areas, will more people start to move out of bigger cities? Spending extra time at home and dreaming of more indoor and outdoor space is certainly sparking some interest among homebuyers. Early data shows an initial trend in this direction of moving from urban to suburban communities, but the question is: will the trend continue?

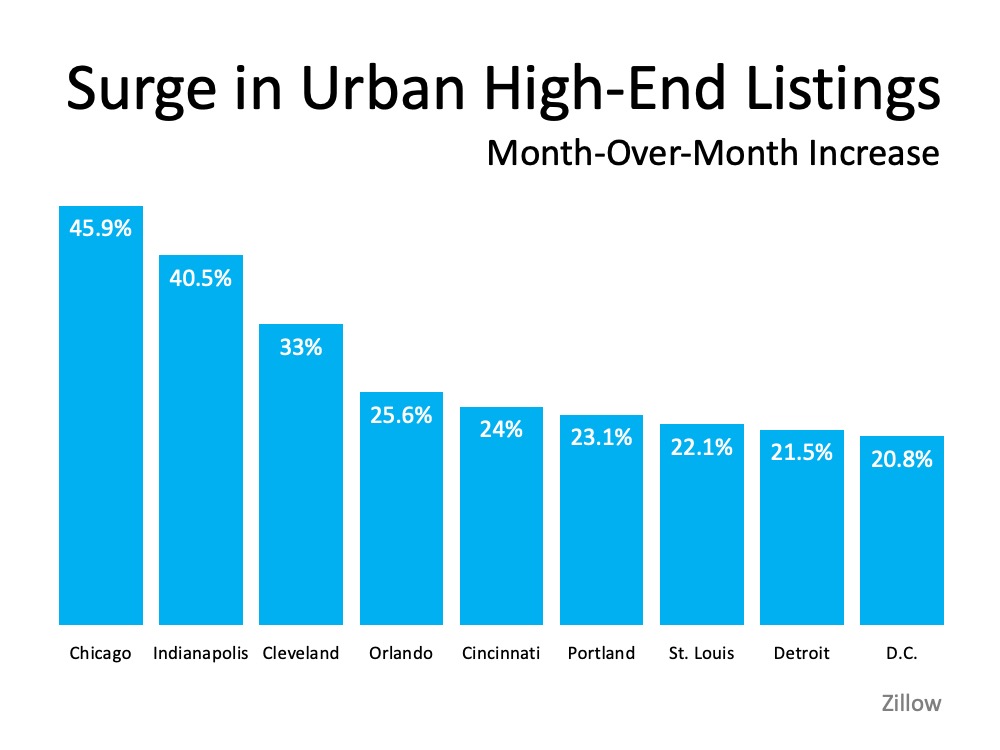

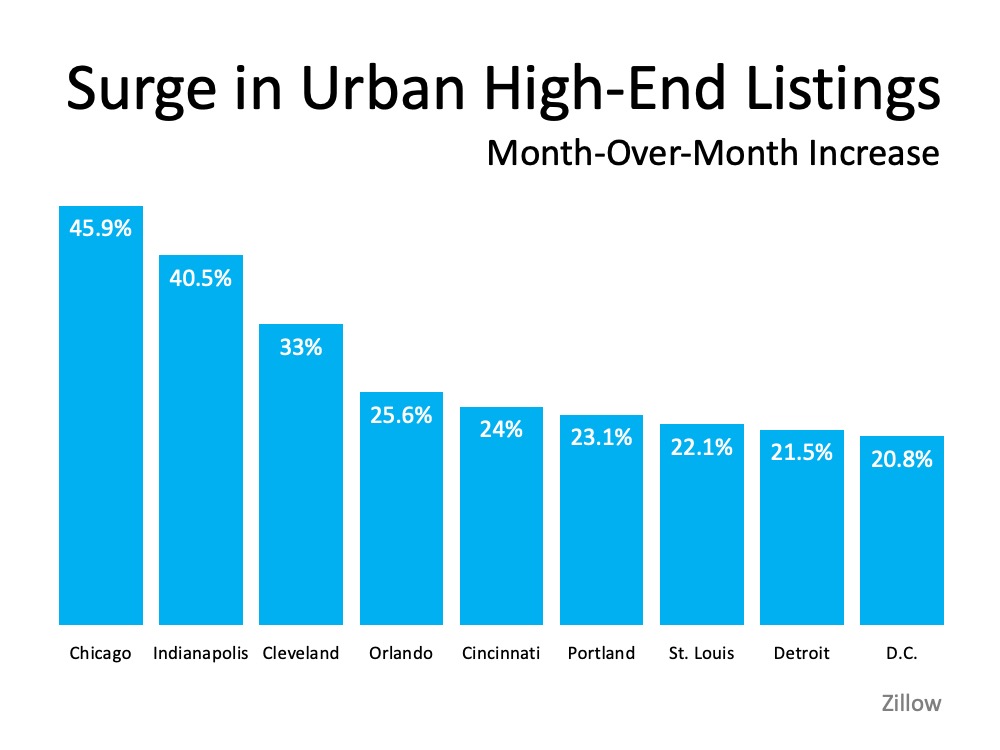

According to recent data from Zillow, there is a current surge in urban high-end listings in some larger metro areas. The month-over-month increase in these homes going on the market indicates more urban homeowners may be ready to make a move out of the city, particularly at the upper end of the market (See graph below):

Why are people starting to move out of larger cities?

With the ongoing health crisis, it’s no surprise that many people are starting to consider this shift. A July survey from HomeLight notes the top reasons people are actually moving today:

- More interior space

- Desire to own

- Move from city to suburbs

- More outdoor space

More space, proximity to fewer people, and a desire to own at a more affordable price point are highly desirable features in this new era, so the list makes sense.

John Burns Consulting notes:

“The trend is accelerating faster than anyone could have predicted. The need for more space is driving suburban migration.”

In addition, Sheryl Palmer, CEO of Taylor Morrison, a home building company, indicates:

“Most recently, we’re really seeing a pickup in folks saying they want more rural or suburban locations. Initially, there was a lot of talk about that, but it’s really coming through our buyers today.”

The National Association of Home Builders (NAHB) also shares:

“New home demand is improving in lower density markets, including small metro areas, rural markets and large metro exurbs, as people seek out larger homes and anticipate more flexibility for telework in the years ahead. Flight to the suburbs is real.”

Will the shift pick up speed and continue on?

The question remains, will this interest in suburban and rural living continue? Some, like Lawrence Yun, Chief Economist at the National Association of Realtors (NAR) think the possibility is there, but it is still quite early to tell for sure. Yun notes:

“Homebuyers considering a move to the suburbs is a growing possibility after a decade of urban downtown revival…Greater work-from-home options and flexibility will likely remain beyond the virus and any forthcoming vaccine.”

While much of the energy behind this trend has largely been accelerated by the current health crisis, monitoring the momentum over time is critically important. Businesses are discovering new and innovative ways to function in remote environments, so the shift has the potential to stick. Much like the economic recovery, however, the long-term impact may hinge largely on the health situation throughout this country.

Bottom Line

Early data is showing a shift from urban to suburban markets, but keeping an eye on this trend will help us understand how it will ultimately play out.

Will We See a Surge of Homebuyers Moving to the Suburbs?

As remote work continues on for many businesses and Americans weigh the risks of being in densely populated areas, will more people start to move out of bigger cities? Spending extra time at home and dreaming of more indoor and outdoor space is certainly sparking some interest among homebuyers. Early data shows an initial trend in this direction of moving from urban to suburban communities, but the question is: will the trend continue?

According to recent data from Zillow, there is a current surge in urban high-end listings in some larger metro areas. The month-over-month increase in these homes going on the market indicates more urban homeowners may be ready to make a move out of the city, particularly at the upper end of the market (See graph below):

Why are people starting to move out of larger cities?

With the ongoing health crisis, it’s no surprise that many people are starting to consider this shift. A July survey from HomeLight notes the top reasons people are actually moving today:

- More interior space

- Desire to own

- Move from city to suburbs

- More outdoor space

More space, proximity to fewer people, and a desire to own at a more affordable price point are highly desirable features in this new era, so the list makes sense.

John Burns Consulting notes:

“The trend is accelerating faster than anyone could have predicted. The need for more space is driving suburban migration.”

In addition, Sheryl Palmer, CEO of Taylor Morrison, a home building company, indicates:

“Most recently, we’re really seeing a pickup in folks saying they want more rural or suburban locations. Initially, there was a lot of talk about that, but it’s really coming through our buyers today.”

The National Association of Home Builders (NAHB) also shares:

“New home demand is improving in lower density markets, including small metro areas, rural markets and large metro exurbs, as people seek out larger homes and anticipate more flexibility for telework in the years ahead. Flight to the suburbs is real.”

Will the shift pick up speed and continue on?

The question remains, will this interest in suburban and rural living continue? Some, like Lawrence Yun, Chief Economist at the National Association of Realtors (NAR) think the possibility is there, but it is still quite early to tell for sure. Yun notes:

“Homebuyers considering a move to the suburbs is a growing possibility after a decade of urban downtown revival…Greater work-from-home options and flexibility will likely remain beyond the virus and any forthcoming vaccine.”

While much of the energy behind this trend has largely been accelerated by the current health crisis, monitoring the momentum over time is critically important. Businesses are discovering new and innovative ways to function in remote environments, so the shift has the potential to stick. Much like the economic recovery, however, the long-term impact may hinge largely on the health situation throughout this country.

Bottom Line

Early data is showing a shift from urban to suburban markets, but keeping an eye on this trend will help us understand how it will ultimately play out. It may just be a temporary swing in a new direction until Americans once again feel a sense of comfort in the cities they’ve grown to love .

Thinking of selling your home ? Now may be the right time!

Thinking of Selling Your House? Now May be the Right Time

Inventory is arguably the biggest challenge for buyers in today’s housing market. There are simply more buyers actively looking for homes to purchase than there are sellers selling them, so the scale is tipped in favor of the sellers.

According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), total housing inventory is down 18.8% from one year ago. Inventory is well below what was available last year, and the houses that do come to the market are selling very quickly.

Sam Khater, Chief Economist at Freddie Mac notes:

“Simply put, new housing supply is not keeping up with rising demand. We estimate that the housing market is undersupplied by 3.3 million units, and the shortage is rising by about 300,000 units a year. More than half of all states have a housing shortage.”

Why is inventory so low?

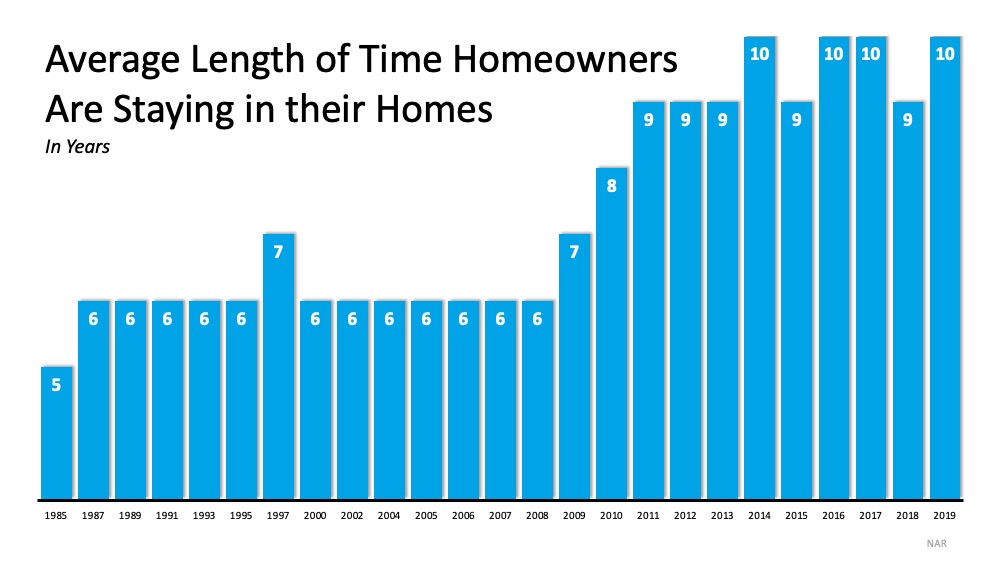

There are many reasons why it’s hard to find a home to buy today, stemming from an undersupply of newly constructed homes to sellers pressing pause on their moving plans due to the current health pandemic. One of the key factors making it even more challenging, however, is the amount of time current homeowners are staying in their homes. There has truly been a fundamental shift in the market that started about 10 years ago: people are staying put longer, and it’s contributing to the shortage of houses for sale.

In the 2019 Profile of Home Buyers and Sellers, NAR explained:

“In 2019, the median tenure for sellers was 10 years…After 2008, the median tenure in the home began to increase by one year each year. By 2011, the median tenure reached nine years, where it remained for three consecutive years, and jumped up again in 2014 to 10 years.”

As shown in the graph below, historical data indicates that staying in a home for 5-7 years used to be the norm, until the housing bubble burst. Since 2010, that length of time has trended upward, toward 9-10 years, largely due to homeowners aiming to recoup their equity: Thankfully, with the strength the market has gained over the last 10 years, today’s homeowners are in a much better equity position. Now is a fantastic time for homeowners who are ready to make a move to break the 10-year trend and sell their houses, especially while buyer demand is so high and inventory is so low. It’s a prime time to sell.

Thankfully, with the strength the market has gained over the last 10 years, today’s homeowners are in a much better equity position. Now is a fantastic time for homeowners who are ready to make a move to break the 10-year trend and sell their houses, especially while buyer demand is so high and inventory is so low. It’s a prime time to sell.

In addition, with today’s historically low interest rates, there’s an opportunity for sellers to maintain a low monthly payment while getting more house for their money. Think: move-up opportunity, more square footage, or finding the features they’re really looking for rather than doing costly renovations. With more new homes poised to enter the market this year, homeowners ready to make a move may have a golden opportunity to do so right now.

Bottom Line

There are simply not enough houses for sale today. We currently have 1.1 months supply of inventory here in RI. A balanced market has SIX months of inventory. Asking prices are up 6% and Sales prices are up 3.3 %. If you’re ready to leverage your equity and sell your Rhode Island house, let’s connect today. It’s a great time to move while demand for homes to buy is extremely high.

How is the Economy Affecting the Real Estate Market?

Watch the video for July numbers and trends

A Remarkable Recovery for the Housing Market

A Remarkable Recovery for the Housing Market

For months now the vast majority of Americans have been asking the same question: When will the economy turn around? Many experts have been saying the housing market will lead the way to a recovery, and today we’re seeing signs of that coming to light. With record-low mortgage rates driving high demand from potential buyers, homes are being purchased at an accelerating pace, and it’s keeping the housing market and the economy moving.

Here’s a look at what a few of the experts have to say about today’s astonishing recovery. In more than one instance, it’s being noted as truly remarkable.

Ali Wolf, Chief Economist, Meyers Research

“The housing recovery has been nothing short of remarkable…The expectation was that housing would be crushed. It was—for about two months—and then it came roaring back.”

“Recent home purchase measures have continued to show remarkable strength, leading us to revise upward our home sales forecast, particularly over the third quarter. Similarly, we bumped up our expectations for home price growth and purchase mortgage originations.”

Javier Vivas, Director of Economic Research for realtor.com

“All-time low mortgage rates and easing job losses have boosted buyer confidence back to pre-pandemic levels.”

James Knightley, Chief International Economist, ING

“At face value this is remarkable given the scale of joblessness in the economy and the ongoing uncertainty relating to the path of Covid-19…The outlook for housing transactions, construction activity and employment in the sector is looking much better than what looked possible just a couple of months ago.”

Bottom Line

The strength of the housing market is a bright spark in the economy and leading the way to what is truly being called a remarkable recovery throughout this country. If you’re thinking of buying or selling a home in R.I. maybe this is your year to make a move after all.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link