Where Are Mortgage Rates Headed?

A headline that hints at a favorite Dave Matthews Band song of mine ” Where are we going.”

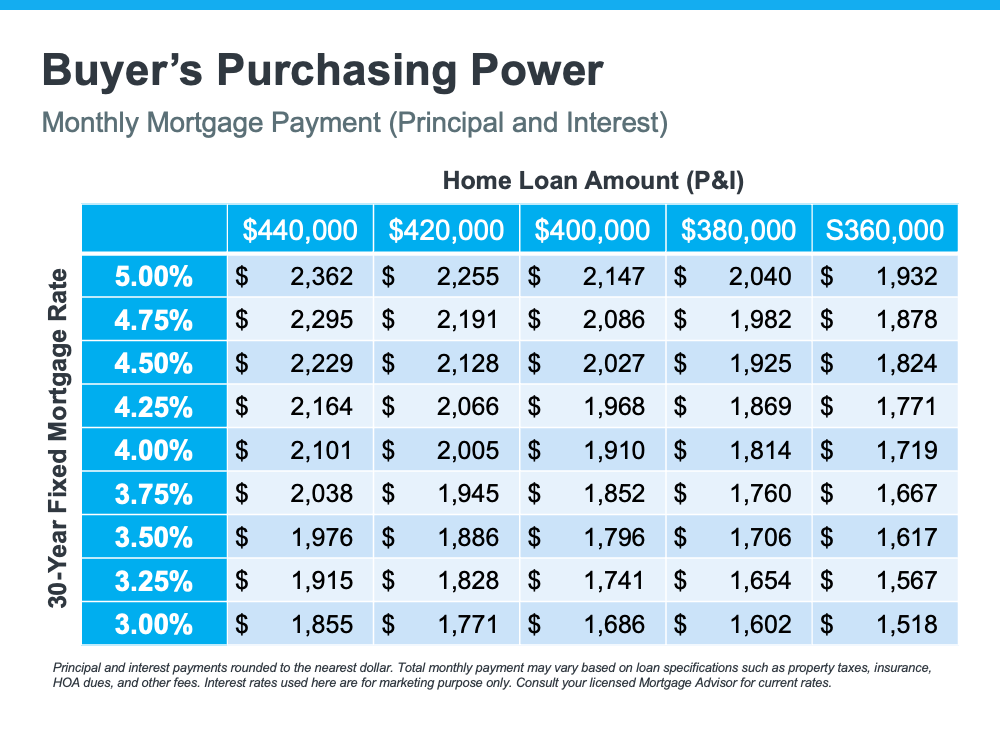

Interest rates and the rising of them, are a hot topic amongst my buyers AND sellers these days. How will they impact affordability? Will they have an effect on the incredible home price appreciation we have been experiencing in RI? I always go back to the notion of affordability as it relates to my client’s monthly mortgage payments. That is the number we need to be cognizant of especially with home prices sky high and mortgages rates increasing. What is your debt to income ratio in light of the rate you will lock into AND that purchase price? THAT is where the focus needs to be aimed; now more than ever.

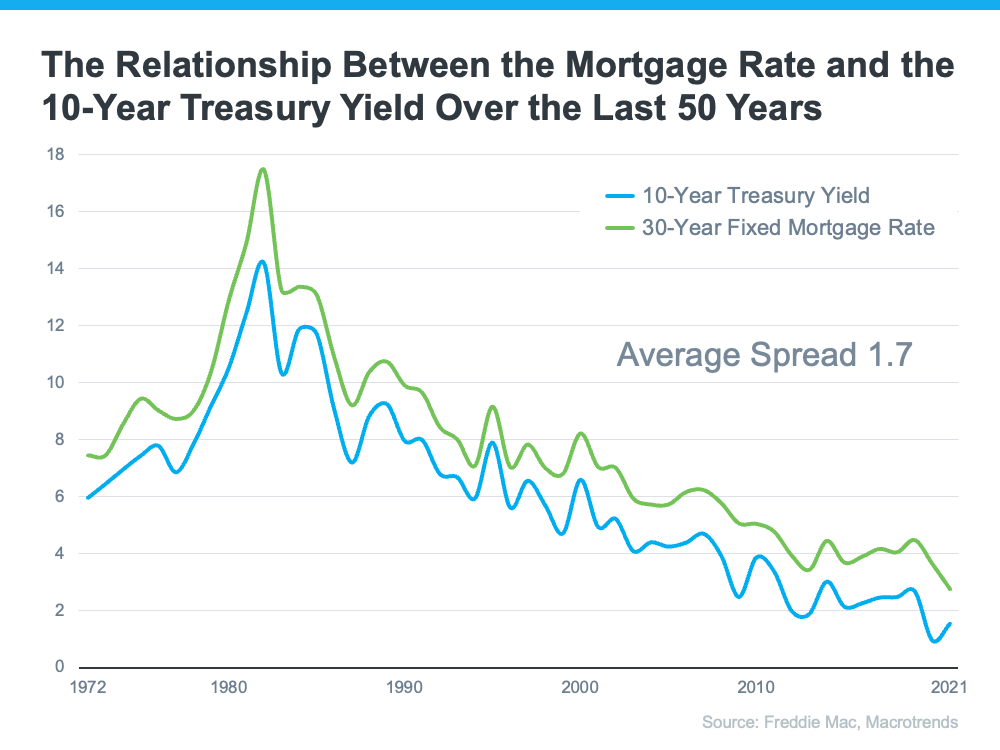

Let’s drill down on mortgage rates and where they are heading.

There’s never been a truer statement regarding forecasting mortgage rates than the one offered last year by Mark Fleming, Chief Economist at First American:

“You know, the fallacy of economic forecasting is: Don’t ever try and forecast interest rates and or, more specifically, if you’re a real estate economist mortgage rates, because you will always invariably be wrong.”

Coming into this year, most experts projected mortgage rates would gradually increase and end 2022 in the high three-percent range. It’s only April, and rates have already blown past those numbers. Freddie Mac announced last week that the 30-year fixed-rate mortgage is already at 4.72%.

Danielle Hale, Chief Economist at realtor.com, tweeted on March 31:

“Continuing on the recent trajectory, would have mortgage rates hitting 5% within a matter of weeks. . . .”

Just five days later, on April 5, the Mortgage News Daily quoted a rate of 5.02%.

No one knows how swiftly mortgage rates will rise moving forward. However, at least to this point, they haven’t significantly impacted purchaser demand. Ali Wolf, Chief Economist at Zonda, explains:

“Mortgage rates jumped much quicker and much higher than even the most aggressive forecasts called for at the end of last year, and yet housing demand appears to be holding steady.”

Through February, home prices, the number of showings, and the number of homes receiving multiple offers all saw a substantial increase. However, much of the spike in mortgage rates occurred in March. We will not know the true impact of the increase in mortgage rates until the March housing numbers become available in early May.

Rick Sharga, EVP of Market Intelligence at ATTOM Data, recently put rising rates into context:

“Historically low mortgage rates and higher wages helped offset rising home prices over the past few years, but as home prices continue to soar and interest rates approach five percent on a 30-year fixed rate loan, more consumers are going to struggle to find a property they can comfortably afford.”

While no one knows exactly where rates are headed, experts do think they’ll continue to rise in the months ahead. In the meantime, if you’re looking to buy a home, know that rising rates do have an impact. As rates rise, it’ll cost you more when you purchase a house. If you’re ready to buy, it may make sense to do so sooner rather than later.

Bottom Line

Mark Fleming got it right. Forecasting mortgage rates is an impossible task. However, it’s probably safe to assume the days of attaining a 3% mortgage rate are over. The question is whether that will soon be true for 4% rates as well. Care to drill down on what buying and selling look like for you in this ever-changing RI real estate market? Reach on out. I am here to help!

One of the four market forces we are dealing with in RI real estate ….

One topic I touched upon during a recent real estate panel detailed the market forces of 2021 which led to the extremely high price growth which are still in effect today.

The four forces are limited supply, elevated demand , demographics and low mortgage rates. Here is a national look at the supply / demand imbalance we are currently dealing with

![Supply and Demand in Today’s Market [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/03/03164955/20220304-MEM-1046x2586.png)

Some Highlights

- Today’s housing market is the direct result of low supply and high buyer demand. Here’s what that means for you and your plans to buy or sell.

- For buyers, expect competition, be ready to move fast, and be prepared to submit your strongest offer. For sellers, know your house will be the center of attention and that it’ll likely sell quickly and get multiple offers.

- If you’re ready to move, let’s connect to talk about our local area and how you can take advantage of today’s unprecedented housing market.

There are Almost No Houses For Sale in Rhode Island

https://www.golocalprov.com/business/there-are-almost-no-houses-to-buy-in-ri

Great new spot in Little Rhody that YOU need to check out!

When Covid hit I brainstormed ( teacher-speak) on how I could help support my neighbors. I pondered about what I could do to show my support of small businesses and their surrounding communities in some tangible way. I was living in NH at the time, commuting back and forth to “Do” real estate in RI while residing in NH so that my son could play prep school hockey, and each day I awoke fixated on how I could help. I had heard about Parkbench for a few years and was drawn to their mission at my first introduction on LinkedIn. A group whose mission is to support communities, by highlighting small businesses and providing value via “local leaders” who lived to unite, strengthen and help others was completely right up my proverbial ally. It was expensive to do however and I simply couldn’t “afford” to do it…Or so I thought..

That notion quickly turned into how I couldn’t afford NOT to do it as I watched local businesses spin in place as our world tilted more and unraveled more and more each day. One month before my 50th birthday I called Parkbench and said ” I want to do it.” The cost became a minor detail and as the CAUSE became my purpose.

25 businesses supported later, I have never looked back.

Meeting with small business owners in my home state of RI in communities I have grown up populating and creating memories in is truly the answer to my “Why I’m here” part….. A “part” that has been called into question a bit the last few months and by golly, I swear it’s my need to help others that fuels me to emerge triumphant over seemingly insurmountable odds.

Helping others IS my why and Parkbench Barrington & Beyond and my role as a RI Realtor are the Ultimate conduit cocktail for it!!!

So please continue to support local. Shop local. Gift local. Eat local. Unite local. We all need each other more than we realize. Small businesses constitute the unique heartbeats of each and every little Rhody town. Let’s continue to fuel their fires via our support, shall we?

Check out my latest video highlighting a new addition to Bristol that is as Off the Charts high as its beautiful smoke stack….Pivotal Brewing !

https://parkbench.com/blog/pivotal-brewing-company-bars-pubs-bristol-todd-ernst

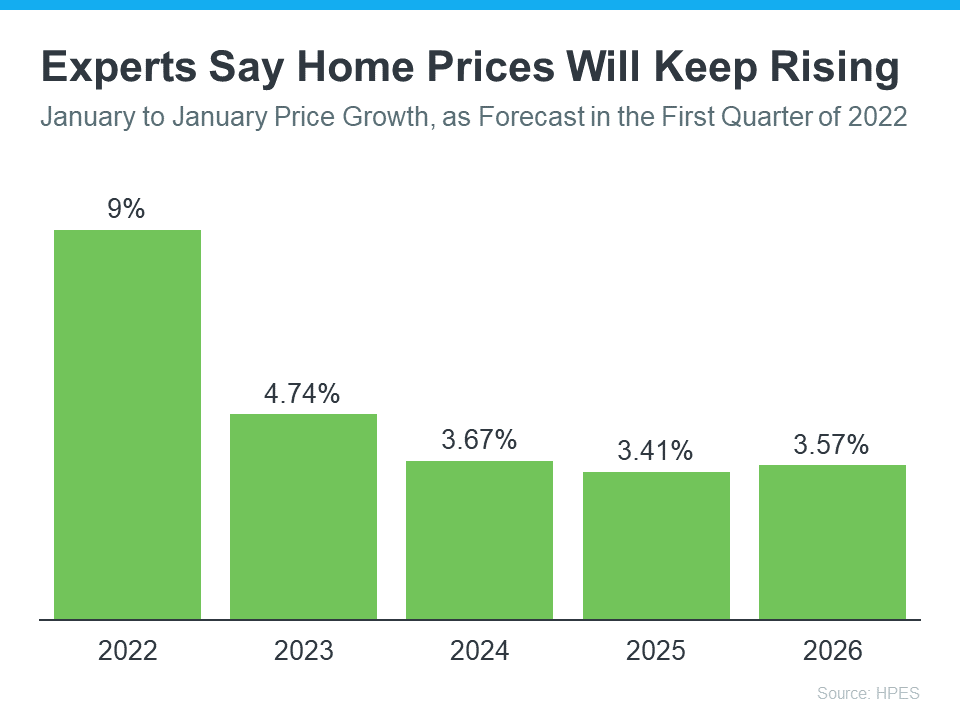

What’s Going To Happen with Home Prices This Year?

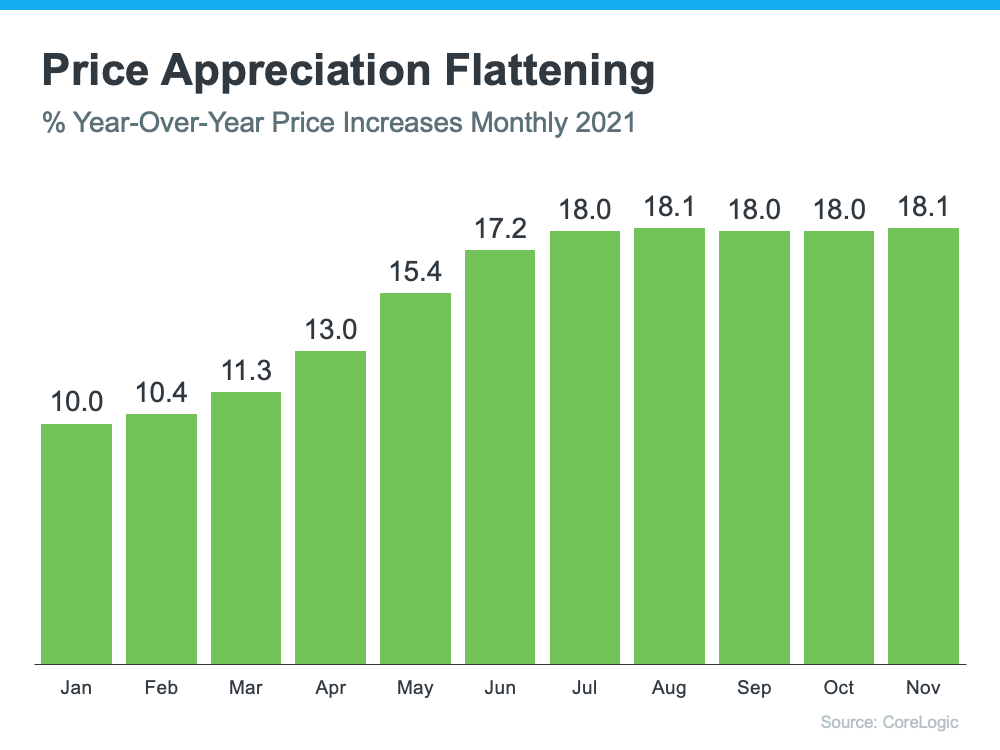

After almost two years of double-digit increases, many experts thought home price appreciation would decelerate or happen at a slower pace in the last quarter of 2021. However, the latest Home Price Insights Report from CoreLogic indicates while prices may have plateaued, appreciation has definitely not slowed. The following graph shows year-over-year appreciation throughout 2021. December data has not yet been released.

As the graph shows, appreciation has remained steady at around 18% over the last five months.

In addition, the latest S&P Case-Shiller Price Index and the FHFA Price Index show a slight deceleration from the same time last year – it’s just not at the level that was expected. However, they also both indicate there’s continued strong price growth throughout the country. FHFA reports all nine regions of the country still experienced double-digit appreciation. The Case-Shiller 20-City Index reveals all 20 metros had double-digit appreciation.

Why Haven’t We Seen the Deeper Deceleration Many Expected?

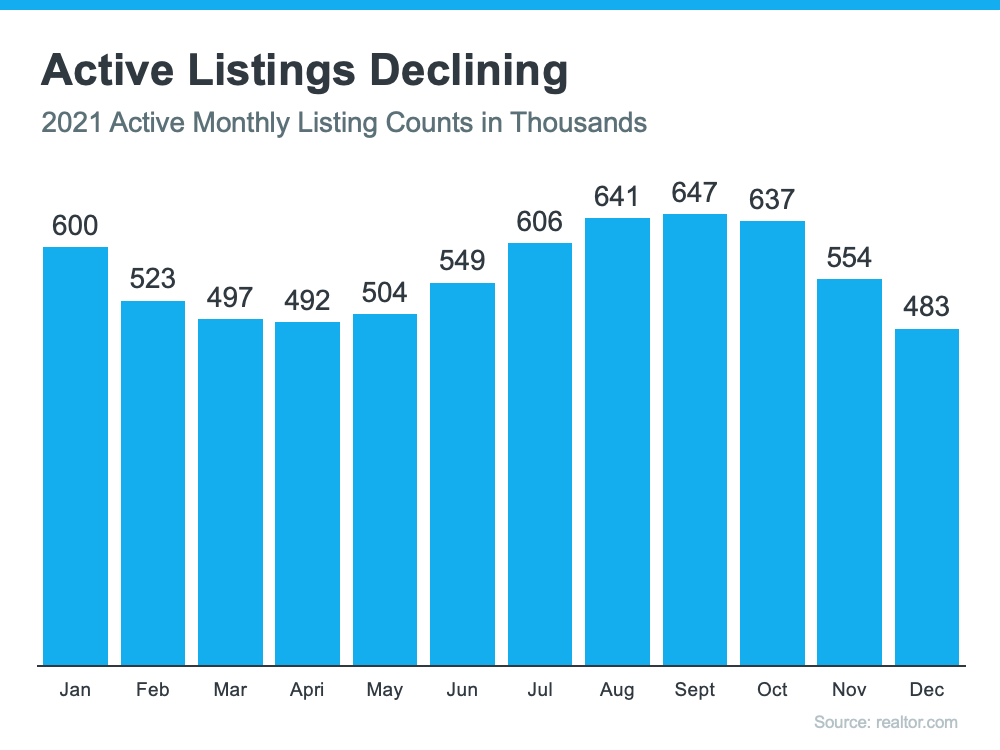

Experts had projected the supply of housing inventory would increase in the last half of 2021 and buyer demand would decrease, as it historically does later in the year. Since all pricing is subject to supply and demand, it seemed that appreciation would wane under those conditions.

Buyer demand, however, did not slow as much as expected, and the number of listings available for sale dropped instead of improved. The graph below uses data from realtor.com to show the number of available listings for sale each month, including the decline in listings at the end of the year.

Here are three reasons why the number of active listings didn’t increase as expected:

1. There hasn’t been a surge of foreclosures as the forbearance program comes to an end.

2. New construction slowed considerably because of supply chain challenges.

3. Many believed more sellers would put their houses on the market once the concerns about the pandemic began to ease. However, those concerns have not yet disappeared. A recent article published by com explains:

“Before the omicron variant of COVID-19 appeared on the scene, the 2021 housing market was rebounding healthily from previous waves of the pandemic and turned downright bullish as the end of the year approached. . . . And then the new omicron strain hit in November, followed by a December dip in new listings. Was this sudden drop due to omicron, or just the typical holiday season lull?”

No one knows for sure, but it does seem possible.

Bottom Line

Home price appreciation might slow (or decelerate) in 2022. However, based on supply and demand, you shouldn’t expect the deceleration to be swift or deep. It remains to be a very advantageous time to sell here in RI and neighboring Massachusetts. Many areas will continue to see strong combined growth in both sales volume AND sales prices. If you are contemplating a move, give me a call. I would love to come in and share my expertise and insight with you. We can formulate a winning game plan for 2022 with step-by-step guidance so that you know exactly what you need to do!

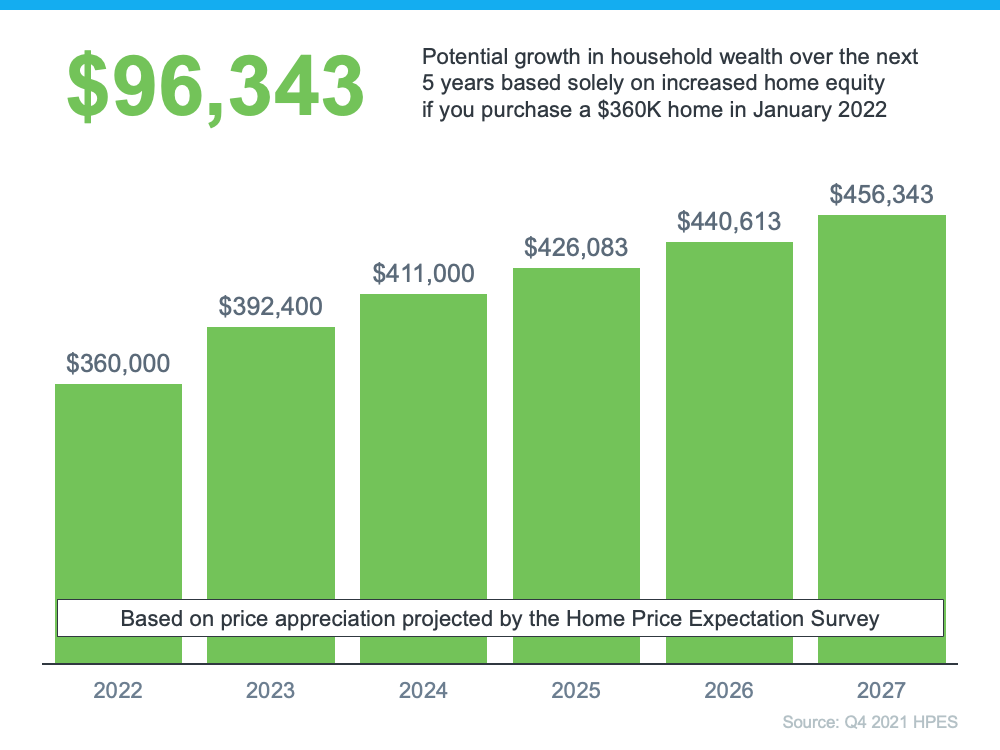

Why Inflation Shouldn’t Stop You from Buying a Home in 2022

If you’re following along with the news today, you’re probably hearing a lot about record-breaking home prices, rising consumer costs, supply chain constraints, and more. And if you’re thinking about purchasing a home this year, all of these inflationary concerns are likely making you wonder if you should wait to buy. Investopedia explains that during a period of high inflation, prices rise across the board. And while home prices aren’t immune from this increase, here’s why inflation shouldn’t stop you from buying a home in 2022.

Homeownership Offers Stability and Security

Home prices have been increasing for quite some time, and experts say they’re going to continue to climb throughout 2022. So, as a buyer, how can you protect yourself from rising costs for things like food, shelter, entertainment, and other goods and services? The answer lies in housing.

Buying a home allows you to lock in your monthly mortgage payment for the foreseeable future. That means as other prices rise, your monthly payment will be consistent thanks to your fixed-rate mortgage. This gives you the peace of mind that the bulk of your housing costs is shielded from inflation.

James Royal, Senior Wealth Management Reporter at Bankrate, says:

“A fixed-rate mortgage allows you to maintain the biggest portion of housing expenses at the same payment. Sure, property taxes will rise and other expenses may creep up, but your monthly housing payment remains the same.”

If you rent, you don’t have that same benefit and you won’t be protected from rising housing costs. As an added incentive to buy, consider that today’s mortgage interest rates are lower than they have been in decades. While inflation decreases what your dollars can buy, low mortgage rates help counteract it by boosting your purchasing power so you can get more home for your money. They also help keep your monthly payments down. This is especially important during an inflationary period because you’ll want to protect yourself from the impact of inflation as much as possible.

Ali Wolf, Chief Economist at Zonda, explains:

“If you have cash and are expecting inflation, you want to think through where you can put your money so it does not lose value. Housing is commonly looked at as a good inflation hedge, especially with interest rates so low.”

Bottom Line

The best hedge against inflation is a fixed housing cost. That’s why you shouldn’t let it stop you from buying a home this year. Not sure where to start? Let’s connect so you have expert advice and help throughout every step of the homebuying process. Reach out to me! I am here to help!

Will the Housing Market Stay Hot in 2022?

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link