What Every Seller Should Know About Home Prices

If you’re trying to decide whether or not to sell your house, recent headlines about home prices may be top of mind. And if those stories have you wondering what that means for your home’s value, here’s what you need to know.

What’s Happening with Home Prices?

You may have seen news stories mentioning a drop in home values or home price depreciation, but it’s important to remember those headlines are designed to make a big impression in just a few words. But what headlines aren’t always great at is painting the full picture.

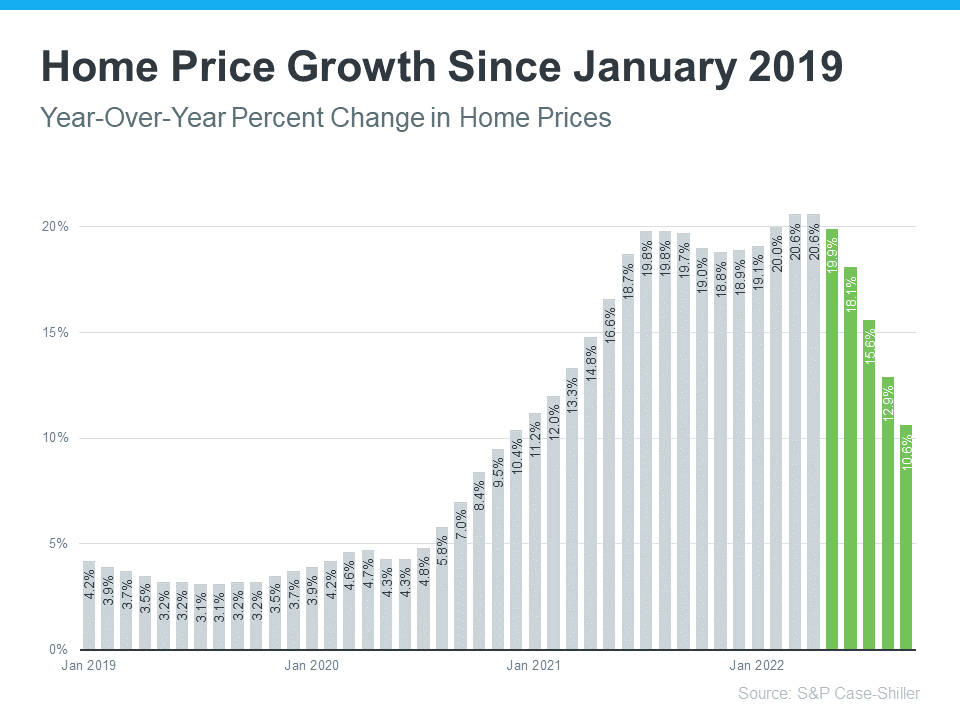

While home prices are down slightly month-over-month in some markets, it’s also true that home values are up nationally on a year-over-year basis. The graph below uses the latest data from S&P Case-Shiller to help tell the story of what’s happening in the housing market today:

As the graph shows, home price growth has moderated in recent months (shown in green) as buyer demand has pulled back in response to higher mortgage rates. This is what the headlines are drawing attention to today.

But what’s important to notice is the bigger, longer-term picture. While home price growth is moderating month-over-month, the percent of appreciation year-over-year is still well above the home price change we saw during more normal years in the market.

The bars for January 2019 through mid-2020 show that home price appreciation of around 3-4% a year was more typical (see bars for January 2019 through mid-2020). But even the latest data for this year shows prices have still climbed by roughly 10% over last year. Last week’s RI Market Report for single-family homes shows an increase of 9.7% in the median sale price for November 2022 compared to one year prior.

What Does This Mean for Your Home’s Equity?

While you may not be able to capitalize on the 20% appreciation we saw in early 2022, in most markets, your home’s value, on average, is up 10% over last year – and a 10% gain is still dramatic compared to a more normal level of appreciation (3-4%).

The big takeaway? Don’t let the headlines hinder your plans to sell. Over the past two years alone, you’ve likely gained a substantial amount of equity in your home as home prices climbed. Even though home price moderation will vary by market moving forward, you can still use the boost your equity got to help power your move.

As Mark Fleming, Chief Economist at First American, says:

“Potential home sellers gained significant amounts of equity over the pandemic, so even as affordability-constrained buyer demand spurs price declines in some markets, potential sellers are unlikely to lose all that they have gained.”

Bottom Line

If you have questions about home prices or how much equity you have in your current Rhode Island or Massachusetts home, let’s connect so you have an expert’s advice. I am here to help!

Top Questions About Selling Your Home This Winter

There’s no denying the housing market is undergoing a shift this season, which may leave you with questions about whether it still makes sense to sell your house. Here are three of the top questions you may be asking – and the data that helps answer them – so you can make a confident decision.

1. Should I Wait To Sell?

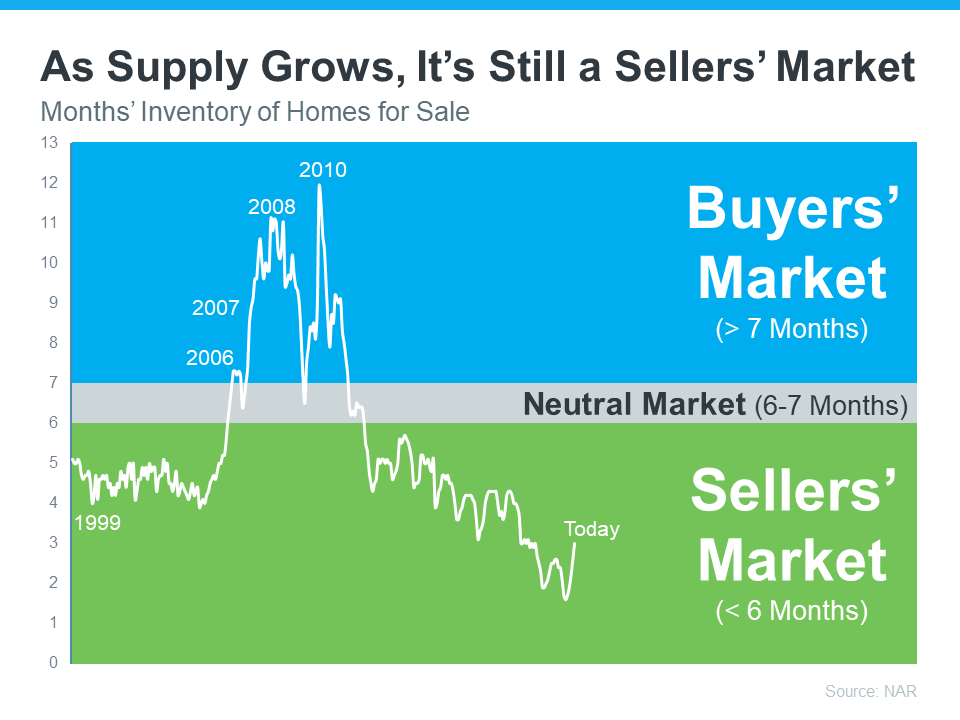

Even though the supply of homes for sale has increased in 2022, inventory is still low overall. That means it’s still a sellers’ market. The graph below helps put the inventory growth into perspective. Using data from the National Association of Realtors (NAR), it shows just how far off we are from flipping to a buyers’ market:

While buyers have regained some negotiation power as inventory has grown, you haven’t missed your window to sell. Your house could still stand out since inventory is low, especially if you list now while other sellers hold off until after the holiday rush and the start of the new year. Home prices were up 8.8% year-over-year in October here in RI. The median sale price in RI stands strong at $46,500, and the number of homes for sale in RI is down a whopping 23.8%.

2. Are Buyers Still Out There?

If you’re thinking of selling your house but are hesitant because you’re worried buyer demand has disappeared in the face of higher mortgage rates, know that isn’t the case for everyone. While demand has eased this year, millennials are still looking for homes. As an article in Forbes explains:

“At about 80 million strong, millennials currently make up the largest share of homebuyers (43%) in the U.S., according to a recent National Association of Realtors (NAR) report. Simply due to their numbers and eagerness to become homeowners, this cohort is quite literally shaping the next frontier of the homebuying process. Once known as the ‘rent generation,’ millennials have proven to be savvy buyers who are quite nimble in their quest to own real estate. In fact, I don’t think it’s a stretch to say they are the key to the overall health and stability of the current housing industry.”

While the millennial generation has been dubbed the renter generation, that namesake may not be appropriate anymore. Millennials, the largest generation, are actually a significant driving force for buyer demand in the housing market today. If you’re wondering if buyers are still out there, know that there are still people who are searching for a home to buy today. And your house may be exactly what they’re looking for.

3. Can I Afford To Buy My Next Home?

If current market conditions have you worried about how you’ll afford your next move, consider this: you may have more equity in your current home than you realize.

Homeowners have gained significant equity over the past few years, and that equity can make a big difference in the affordability equation, especially with higher mortgage rates than last year. According to Mark Fleming, Chief Economist at First American:

“. . . homeowners, in aggregate, have historically high levels of home equity. For some of those equity-rich homeowners, that means moving and taking on a higher mortgage rate isn’t a huge deal—especially if they are moving to a more affordable city.”

Bottom Line

If you’re considering selling your house in Rhode Island this season, let’s connect, so you have the expert insights you need to make the best possible move today. With five listings hitting in the next two months, I can attest to the market’s vitality!

Home Price Deceleration Doesn’t Mean Home Price Depreciation

Experts in the real estate industry use a number of terms when they talk about what’s happening with home prices. And some of those words sound a bit similar but mean very different things. To help clarify what’s happening with home pricesand where experts say they’re going, here’s a look at a few terms you may hear:

- Appreciation is when home prices increase.

- Depreciation is when home prices decrease.

- Deceleration is when home prices continue to appreciate, but at a slower pace.

Where Home Prices Have Been in Recent Years

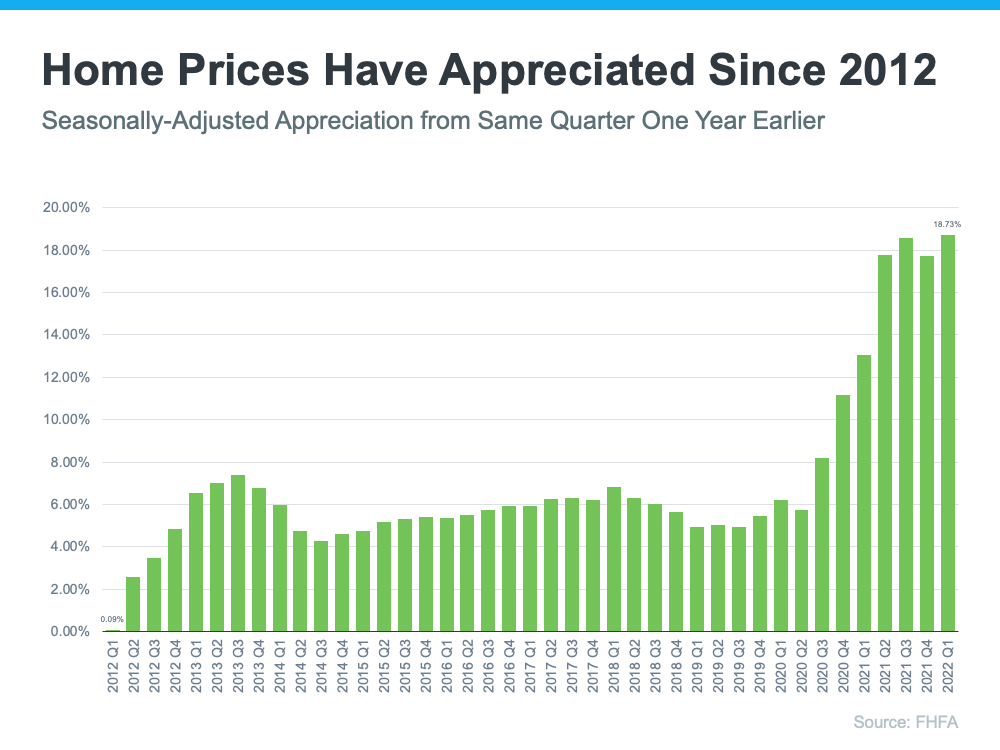

For starters, you’ve probably heard home prices have skyrocketed over the past two years, but homes were actually appreciating long before that. You might be surprised to learn that home prices have climbed for 122 consecutive months (see graph below):

As the graph shows, houses have gained value consistently over the past 10 consecutive years. But since 2020, the increase has been more dramatic as home price growth accelerated.

So why did home prices climb so much? It’s because there were more buyers than there were homes for sale. That imbalance put upward pressure on home prices because demand was high and supply was low.

Where Experts Say Home Prices Are Going

While this is helpful context, if you’re a buyer or seller in today’s market, you probably want to know what’s going to happen with home prices moving forward. Will they continue that same growth path or will home prices fall?

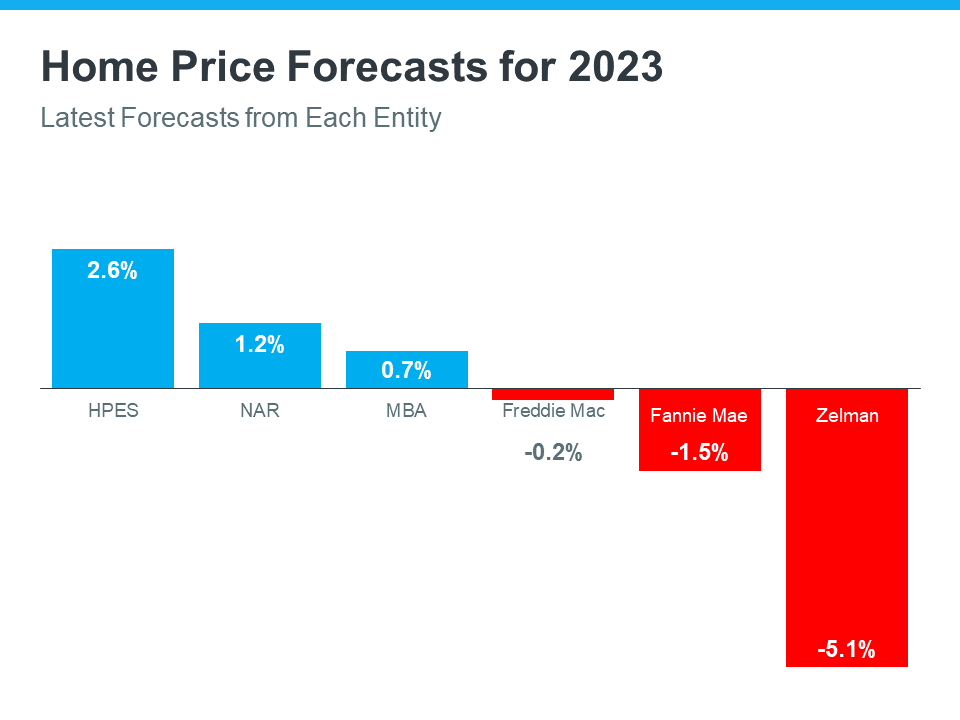

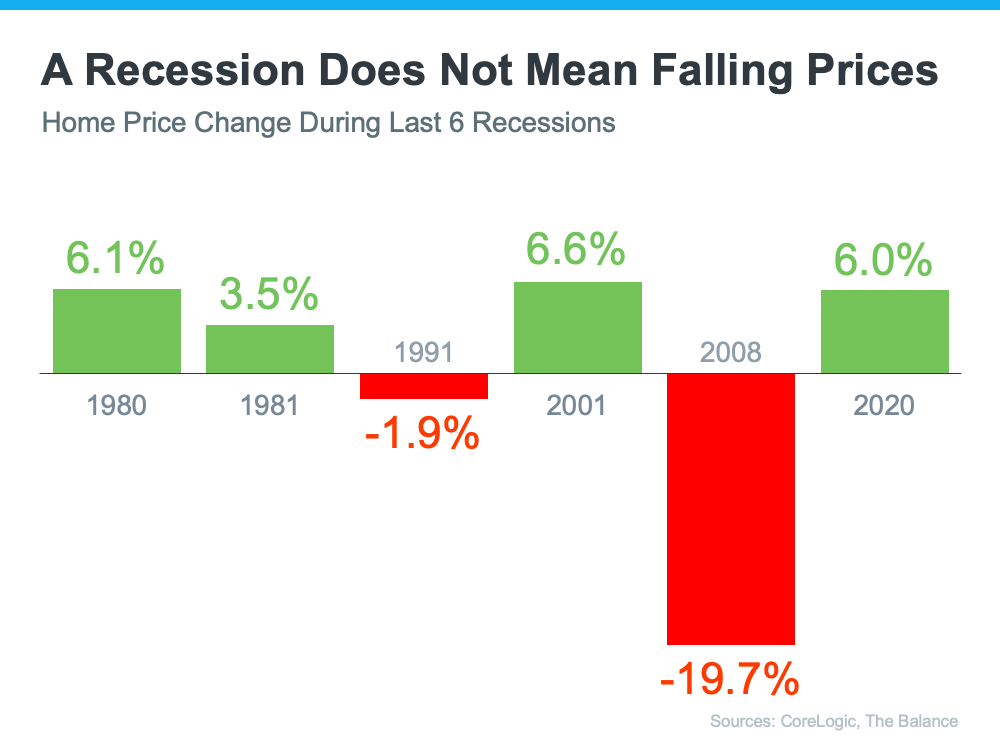

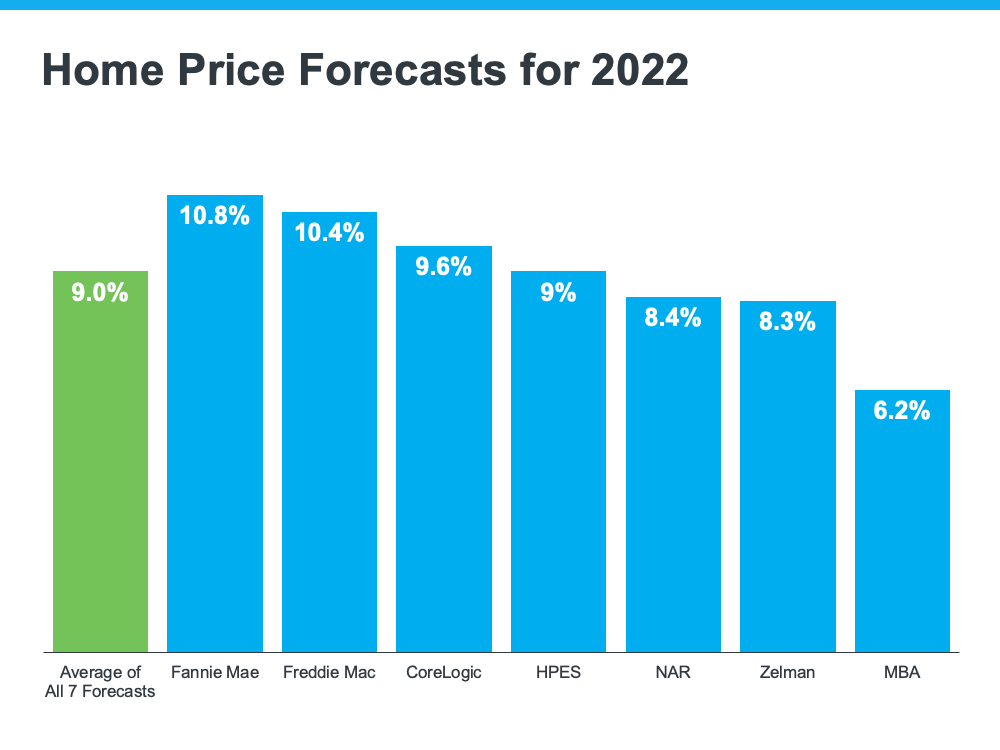

Experts are forecasting ongoing appreciation, just at a decelerated pace. In other words, prices will keep climbing, just not as fast as they have been. The graph below shows home price forecasts from seven industry leaders. None are calling for prices to fall (see graph below):

Mark Fleming, Chief Economist at First American, identifies a key reason why home prices won’t depreciate or drop:

“In today’s housing market, demand for homes continues to outpace supply, which is keeping the pressure on house prices, so don’t expect house prices to decline.”

And although housing supply is starting to tick up, it’s not enough to make home prices decline because there’s still a gap between the number of homes available for sale and the volume of buyers looking to make a purchase.

Terry Loebs, Founder of the research firm Pulsenomics, notes that most real estate experts and economists anticipate home prices will continue rising. As he puts it:

“With home values at record-high levels and a vast majority of experts projecting additional price increases this year and beyond, home prices and expectations remain buoyant.”

Bottom Line

Experts forecast price deceleration, not depreciation. That means home prices will continue to rise, just at a slower pace. Let’s connect so you can get the full picture of what’s happening with home prices in our local market and to discuss your buying and selling goals.

Will Home Prices Fall This Year? Here’s What Experts Say.

Many people are wondering: will home prices fall this year? Whether you’re a potential homebuyer, seller, or both, the answer to this question matters for you. Let’s break down what’s happening with home prices, where experts say they’re headed, and how this impacts your homeownership goals.

What’s Happening with Home Prices?

Home prices have seen 121 consecutive months of year-over-year increases. CoreLogic says:

“Price appreciation averaged 15% for the full year of 2021, up from the 2020 full year average of 6%.”

So why are prices climbing so much? It’s because there are more buyers than there are homes for sale. This imbalance is expected to maintain that upward pressure on home prices because homes for sale are a hot commodity in today’s low-inventory housing market.

Where Do Experts Say Prices Will Go from Here?

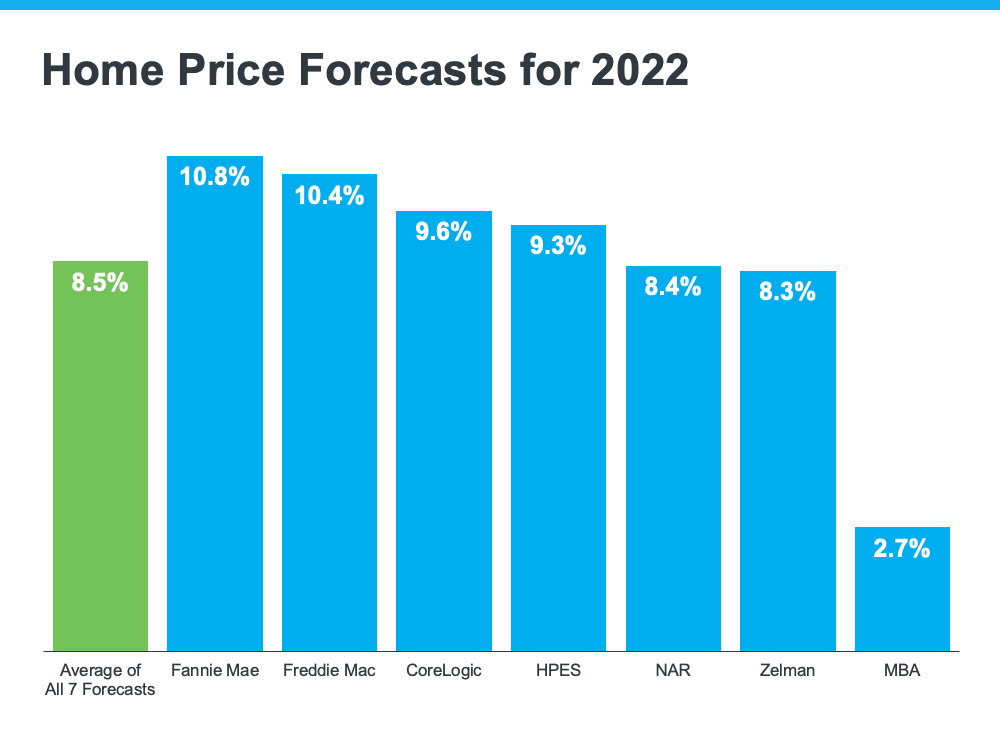

Experts say the housing market isn’t set up for a price decline due to that ongoing imbalance between supply and demand. In the latest home price forecasts for 2022, they’re calling for ongoing appreciation throughout the year (see graph below):

While the experts are forecasting more moderate price appreciation, the 2022 projections show price gains will remain strong throughout this year. First American explains it like this:

“While house price growth is expected to moderate from the rapid pace of 2021, strong home buyer demand against a backdrop of historically tight inventory of homes for sale will likely keep appreciation positive in the coming year.”

What Does That Mean for You?

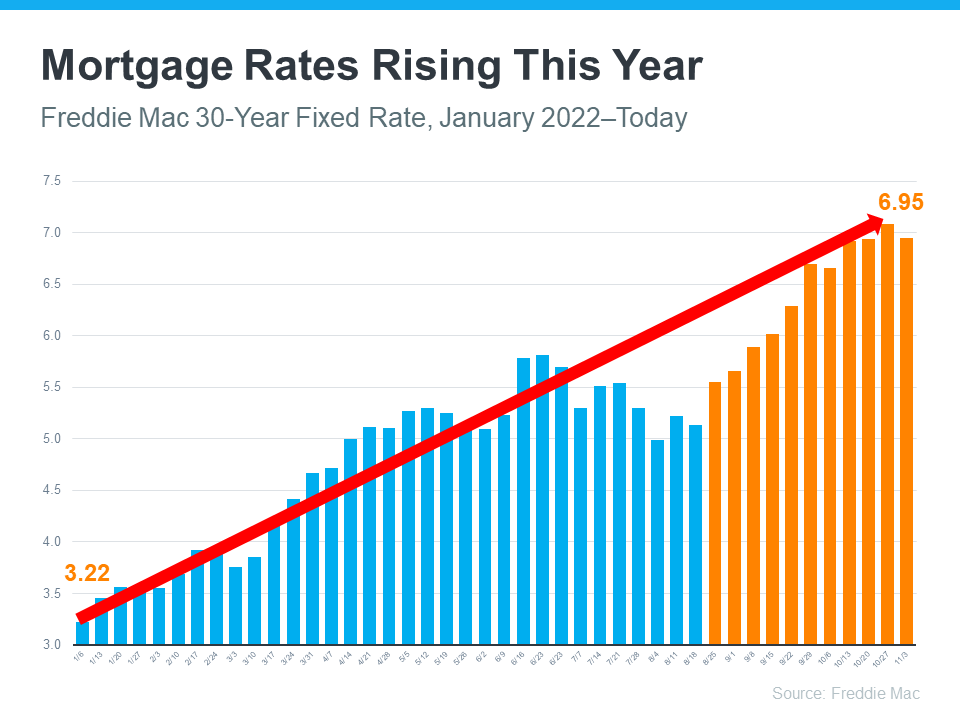

The biggest takeaway is that none of the experts are projecting depreciation. If you’re a homeowner thinking about selling, the higher price appreciation over the last two years has been great for your home’s value, but it’s also something you should factor in when planning your next steps. If you’ll also be buying a home after selling your current house, you shouldn’t wait for prices to fall. Waiting will only cost you more in the long run because climbing mortgage rates and rising home prices will have an impact on your next home purchase. Freddie Mac says:

“If you’re thinking about waiting until next year and that maybe rates are higher, but you’ll get a deal on prices – well that’s risky. It may be more advantageous to purchase this year relative to waiting until 2023 at this time.”

Bottom Line

If you’re thinking of selling to move up, you shouldn’t wait for prices to fall. Experts say prices will continue to appreciate this year. That means, if you’re ready, buying your next home before prices climb further may make the most financial sense. Demand continues to be incredibly high here in RI and until that lessens, prices will continue to escalate. Let’s connect to begin the process of selling your current home and looking for your next one before prices rise higher!

2022 Housing Market Forecast

While the Fed hopes to Calm Demand in order to Curb Inflation, the market will continue to be strong here in RI and elsewhere. I do believe the higher interest rates WILL in fact impact demand and home appreciation will lessen a bit. From all that I listen to, I believe prices will decrease @5-10% in our local RI market but not for quite some time. We simply still have incredible demand and very little supply of inventory.

![2022 Housing Market Forecast [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/05/05130426/20220506-MEM-1046x1885.png)

Some Highlights

- What does the rest of the year hold for the housing market? Here’s what experts have to say about what lies ahead.

- Home prices are projected to rise and so are mortgage rates. Experts are also forecasting another strong year for home sales as people move to meet their changing needs.

- Let’s connect so you can make your best move this year. I am here to help!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link