The Holidays are not slowing down buyers….That is for sure!

The Holidays Aren’t Stopping Homebuyers This Year

Black Friday and Cyber Monday are behind us, yet finding the perfect holiday gifts for friends and family is certainly still top of mind for many right now. This year, there’s another type of buyer that’s very active this holiday season – the homebuyer.

Each month, ShowingTime releases their Showing Index which tracks the average number of appointments received on active U.S. house listings. The most recent index notes:

“The Showing Index reported a 60.9 percent jump in nationwide showing traffic year over year in October, the sixth consecutive month to see an increase over last year.”

Here’s the breakdown of the latest activity by region of the country compared to this time last year:

- The Northeast increased by 65.5%

- The West increased by 64.7%

- The Midwest increased by 55.7%

- The South increased by 54.7%

Why is the traffic so active?

The health crisis definitely put homebuying plans on pause for many earlier this year. Buyers, however, are in the market and making moves well past the typical busy homebuying seasons of spring and summer.

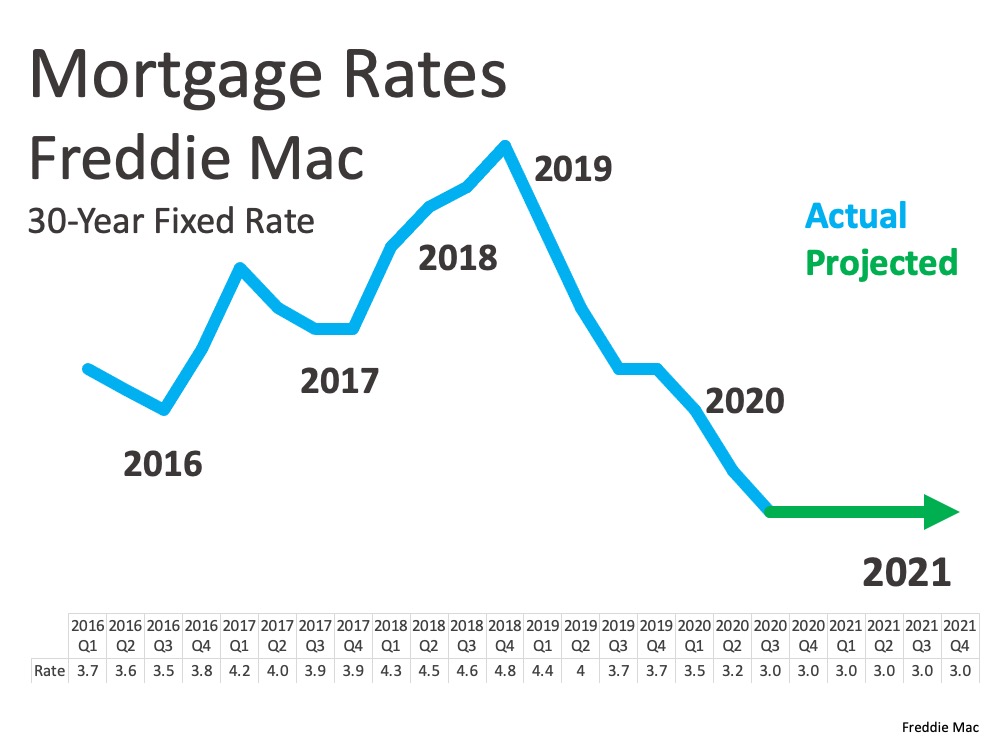

One of the main reasons buyer traffic has continued to soar in the second half of 2020 is how dramatically mortgage rates have fallen. According to Freddie Mac, the average mortgage rate last December was 3.72%. Today, the rate is a full percentage point lower.

Bottom Line

There are first-time, move-up, and move-down buyers actively looking for the home of their dreams this winter. If you’re thinking of selling your house in 2021, you don’t need to wait until the spring to do it. Your potential buyer is very likely searching for a home in your neighborhood right now.

3 Reasons to be Optimistic about 2021!!!

3 Reasons to Be Optimistic about Real Estate in 2021

This year will be remembered for many reasons, and optimism is one thing that’s been in short supply since the spring. We’re experiencing a global pandemic, social unrest, an economic downturn, and natural disasters, just to name a few. The challenges brought on by the health crisis have also forced many homeowners to reevaluate their space and what they need in a home going into 2021. So, experts are forecasting that next year is one in which we can be optimistic about real estate for three key reasons.

1. The Economy Is Expected to Continue Improving

Tim Duy from the University of Oregon puts it this way:

“There is nothing fundamentally ‘broken’ in the economy that needs to heal…there was no obvious financial bubble driving excessive activity in any one economic sector when the pandemic hit…With Covid-19 cases surging again, it is understandably hard to look optimistically to the other side of this winter…Don’t let the near-term challenges distract from the economic stage being set for next four years.”

2. Interest Rates Are Projected to Stay Low

In the latest projections from Freddie Mac, interest rates for a 30-year fixed-rate mortgage are expected to remain at or near 3% next year. These low rates will continue to make homes more affordable, driving demand for housing in 2021.

3. Future Home Sales Are Forecasted to Grow

While the economy improves and interest rates remain low, homes are also expected to continue appreciating as more people buy in the coming year. Danielle Hale, Chief Economist at realtor.com, says:

“We expect home sales in 2021 to come in 7.0% above 2020 levels, following a more normal seasonal trend and building momentum through the spring and sustaining the pace in the second half of the year.”

Bottom Line

Experts forecast that buyers and sellers are going to be active in 2021. If you’ve thought about buying or selling your home this year but have held off, now may be the time to take advantage of this market. Last month’s numbers in RI real estate are just in and they are strong. Median sale prices are up 11.4% compared to this time last year and for buyers interest rates remain incredibly low. Let’s connect to take the first step toward your new home today.

5 Tips for Homebuyers on How to Submit a Competitive Offer!

5 Tips for Homebuyers Who Want to Make a Competitive Offer

Today’s real estate market has high buyer interest and low housing inventory. With so many buyers competing for a limited number of homes, it’s more important than ever to know the ins and outs of making a confident and competitive offer. Here are five keys to success for this important stage in the homebuying process.

1. Listen to Your Real Estate Agent

A recent article from Freddie Mac offers guidance on making an offer on a home in today’s market. Right off the bat, it points out how emotional this can be for buyers and why trusted professionals can help you stay focused on the most important things:

“Remember to let your homebuying team guide you on your journey, not your emotions. Their support and expertise will keep you from compromising on your must-haves and future financial stability.”

Your real estate professional should be your primary source for answers to the questions you have when you’re ready to make an offer.

2. Understand Your Finances

Having a complete understanding of your budget and how much house you can afford is essential. The best way to know this is to reach out to your lender to get pre-approved for a loan early in the homebuying process. Only 44% of today’s prospective homebuyers are planning to apply for pre-approval, so be sure to take this step so you stand out from the crowd. It shows sellers you’re a serious, qualified buyer and can give you a competitive edge if you enter a bidding war.

3. Be Ready to Move Quickly

According to the Realtors Confidence Index, published monthly by the National Association of Realtors (NAR), the average property being sold today is receiving more than three offers and is only on the market for a few weeks. These are both results of today’s competitive market, showing how important it is to stay agile and vigilant in your search. As soon as you find the right home for your needs, be prepared to work with your agent to submit an offer as quickly as possible.

4. Make a Fair Offer

It’s only natural to want the best deal you can get on a home. However, Freddie Mac also warns that submitting an offer that’s too low can lead sellers to doubt how serious you are as a buyer. Don’t submit an offer that will be tossed out as soon as it’s received. The expertise your agent brings to this part of the process will help you stay competitive:

“Your agent will work with you to make an informed offer based on the market value of the home, the condition of the home and recent home sale prices in the area.”

5. Be a Flexible Negotiator

After submitting an offer, the seller may accept it, reject it, or counter it with their own changes. In a competitive market, it’s important to stay nimble throughout the negotiation process. Your position can be strengthened with an offer that includes flexible move-in dates, a higher price, or minimal contingencies (conditions you set that the seller must meet for the purchase to be finalized). There are, however, certain contingencies you don’t want to forego. Freddie Mac explains:

“Resist the temptation to waive the inspection contingency, especially in a hot market or if the home is being sold ‘as-is’, which means the seller won’t pay for repairs. Without an inspection contingency, you could be stuck with a contract on a house you can’t afford to fix.”

Bottom Line

Align yourself with an exceptional agent; an agent with a solid hand on the local market, the grit to dig deeply too help you craft your most compelling offer and the drive to bring it ” home” for you!

Today’s competitive market makes it more important than ever to make a strong offer on a home, and having a trusted real estate expert guiding you can help you rise to the top along the way.

A New Way to Shop for Homes in a Virtual World

A New Way to Shop for Homes in a Virtual World

In a year when we’re learning to do so much remotely, homebuying is no exception. From going to work to attending school, grocery shopping, and even seeing our doctors online, digital practices have changed the way we live.

This year, rather than delaying their home purchases, buyers – alongside their trusted real estate professionals – turned to the Internet to do more than just a typical home search. In some cases, they bought homes without even stepping foot inside. Jessica Lautz, Vice President of Demographics and Behavioral Insights at the National Association of Realtors (NAR), says:

“People really didn’t buy houses sight-unseen, traditionally. It’s still not a huge number, but it has gone up, and we have definitely seen that trend accelerate.”

According to NAR, throughout the coronavirus pandemic, one in every 20 homebuyers purchased a house sight-unseen.

How Your Real Estate Agent Will Pave the Way

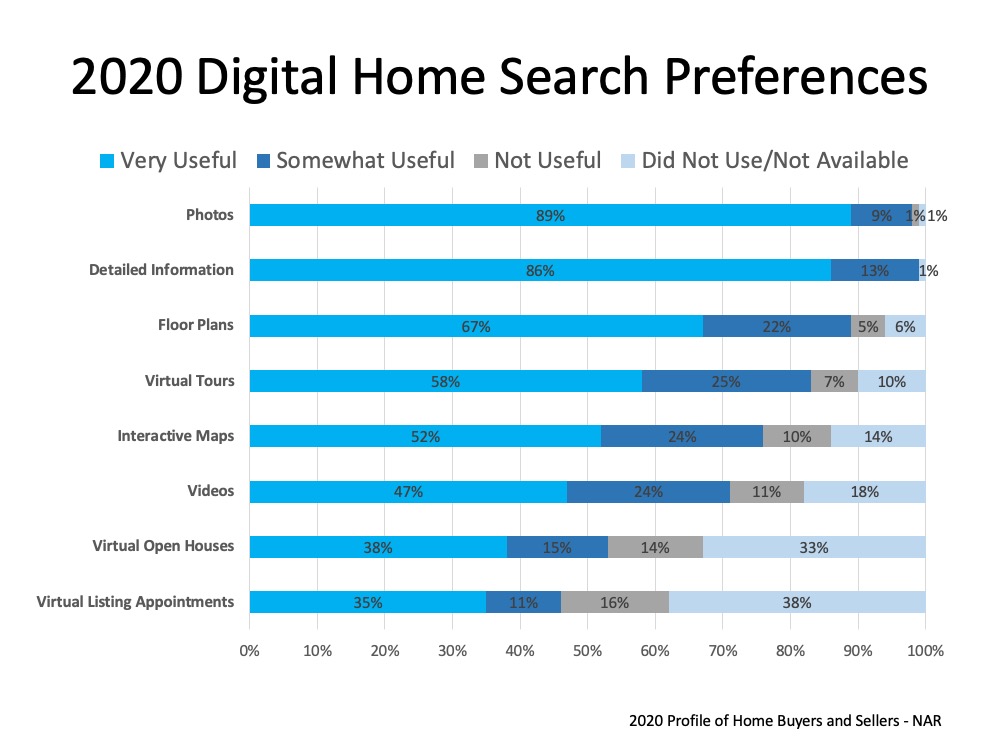

Today, real estate professionals are using digital practices to help homebuyers and sellers walk through many steps in the process virtually. While following the regulations set forth by the CDC and all local guidelines, this year, agents quickly empowered buyers and sellers with virtual tours, 3D floor plans, high-quality photos, videos, online open houses, and more. For those who had homebuying and selling needs in 2020, trusted advisors made it possible in many markets.

Here’s a graph showing some of the digital options buyers found most helpful in their searches this year, as noted by NAR in the 2020 Profile of Home Buyers and Sellers: The report also mentions that buyers this year generally searched for eight weeks. Throughout that search, they viewed a median of 9 homes, but not all of them were seen in-person. Yahoo Finance notes:

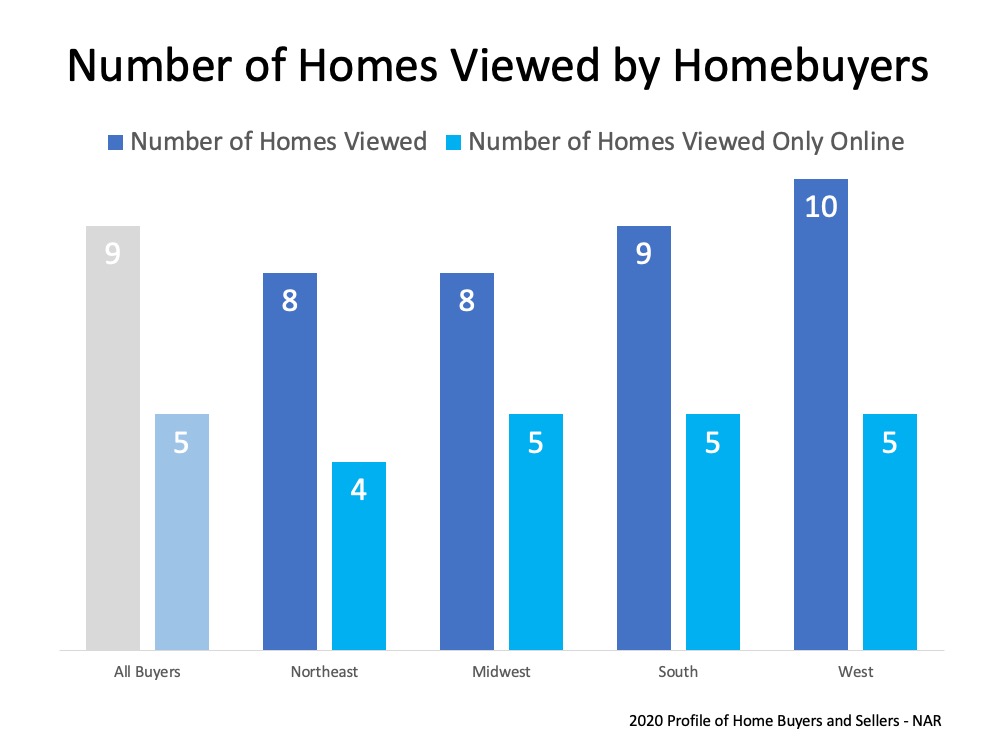

The report also mentions that buyers this year generally searched for eight weeks. Throughout that search, they viewed a median of 9 homes, but not all of them were seen in-person. Yahoo Finance notes:

“Buyers viewed five homes online and four homes in-person during the pandemic, compared to nine homes in-person in 2019, according to NAR. This was the first year NAR asked buyers to specify the number of homes toured virtually.”

In true 2020 fashion, virtual practices helped buyers safely narrow down their top choices, so they didn’t have to unnecessarily walk into more homes than they needed to see throughout the process. Here’s the breakdown by region: At a time when health and safety are top priorities, current technology is making it possible for buyers and sellers to move their real estate plans forward at their own comfort levels, even through a worldwide pandemic. For many, this means buyers no longer have to physically tour every home they want to see, and sellers don’t need to open their doors over and over again throughout the process. Safety can come first, and trusted real estate professionals are here to help.

At a time when health and safety are top priorities, current technology is making it possible for buyers and sellers to move their real estate plans forward at their own comfort levels, even through a worldwide pandemic. For many, this means buyers no longer have to physically tour every home they want to see, and sellers don’t need to open their doors over and over again throughout the process. Safety can come first, and trusted real estate professionals are here to help.

Bottom Line

If you’re ready to make a move, you may not have to press pause on your plans this season. With 17 sales during Covid19 , I am well prepared to lead you safely through the buying and selling process. Let’s connect to determine the safe and effective options to buy or sell a home in RI. I am here to help!

Knowledge is power especially in the home buying process. As a former teacher I am here to provide you WITH that real estate knowledge!

Knowledge Is Power on the Path to Homeownership

Homeownership is on the goal list for many young adults, but sometimes it’s hard to know exactly how to get there. From understanding the homebuying process to pre-approval and down payment assistance options, uncertainty along the way can ultimately hold some buyers back.

Today, there are over 75 million Millennials and 67 million Gen Z’ers in the U.S., making up a significant number of both current and soon-to-be homebuyers. According to a recent Fannie Mae survey of more than 2,000 of these individuals:

“88% said they are confident they will achieve homeownership someday.”

In addition, the survey also reveals that for younger generations, the motivation to own a home may be more emotional than financial compared to previous generations:

- <50% say they want to use their home as an asset

- 78% believe it’s the best way to live the way they want, without restrictions

- 80% believe homeownership is the best way to make it on their own

Whether homeownership goals come from the heart or are driven by financial aspirations (or maybe both), the obstacles standing in the way don’t have to bring these dreams to a screeching halt. The same survey also reveals two key roadblocks for potential buyers. Thankfully, they’re both easily overcome with the power of knowledge and trusted advisors leading the way. Here’s a look at these two challenges potential homebuyers face today:

1. 73% of future homebuyers are unaware of low-down-payment mortgage options

For those who want to purchase a home, low-down-payment options are instrumental to affording one sooner rather than later, especially given the amount of debt many younger adults have accumulated. Fannie Mae also notes:

“Among the challenges they face is an unprecedented amount of debt, along with a lack of understanding of the mortgage process and their own purchasing power. Debt, in particular, creates many obstacles such as a limited ability to save and the fear of taking on more debt.”

Today, there are more than 2,340 down payment assistance programs available nationwide to help relieve this pressure. Understanding what’s out there and the options available may help many buyers become homeowners faster than they thought possible. In a year like this, with record-low mortgage rates making their mark in the history books, being able to take advantage of the opportunity buyers have right now is essential to long-term affordability.

2. 64% of buyers expect lenders and other real estate professionals to educate them about the mortgage process

While many people love to do a quick search online to find instant answers to their questions, it isn’t the only way younger generations want to consume information or build their knowledge base. As the survey mentions, having trusted professionals help them learn what it takes to achieve their dreams is definitely on their wish list too.

Bottom Line

If you’re aiming for homeownership someday, it may be in closer reach than you think. Let’s connect so I can help bridge that gap between what you know and what you need to know . I am here to guide you every step of the way. Reach out today so you can learn about the process and get the guidance you need to make it happen.

Knowledge and understanding is key ….

Key Terms to Know in the Homebuying Process [INFOGRAPHIC]

![Key Terms to Know in the Homebuying Process [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/11/19135542/20201127-MEM-1046x2889.png)

Some Highlights

- Buying a home can be intimidating if you’re not familiar with the terms used throughout the process.

- To point you in the right direction, here’s a list of some of the most common language you’ll hear along the way.

- The best way to ensure your homebuying process is a positive one is to find a real estate professional who will guide you through every aspect of the transaction with ‘the heart of a teacher’ by putting your needs first.

Homes for sale are quickly disappearing

Homes for Sale Are Rapidly Disappearing

Through all the challenges of 2020, the real estate market has done very well, and purchasers are continuing to take advantage of historically low mortgage rates. Realtor Magazinejust explained:

“While winter may be typically a slow season in real estate, economists predict it isn’t likely to happen this year…Low inventories combined with high demand due to record-low mortgage rates is sending buyers to the market in a flurry.”

However, one challenge for the housing industry heading into this winter is the dwindling number of homes available for sale. Lawrence Yun, Chief Economist for the National Association of Realtors (NAR), recently said:

“There is no shortage of hopeful, potential buyers, but inventory is historically low.”

In addition, Danielle Hale, Chief Economist for realtor.com, notes:

“Fewer new sellers coming to market while a greater than usual number of buyers continue to search for a home causes inventory to continue to evaporate.”

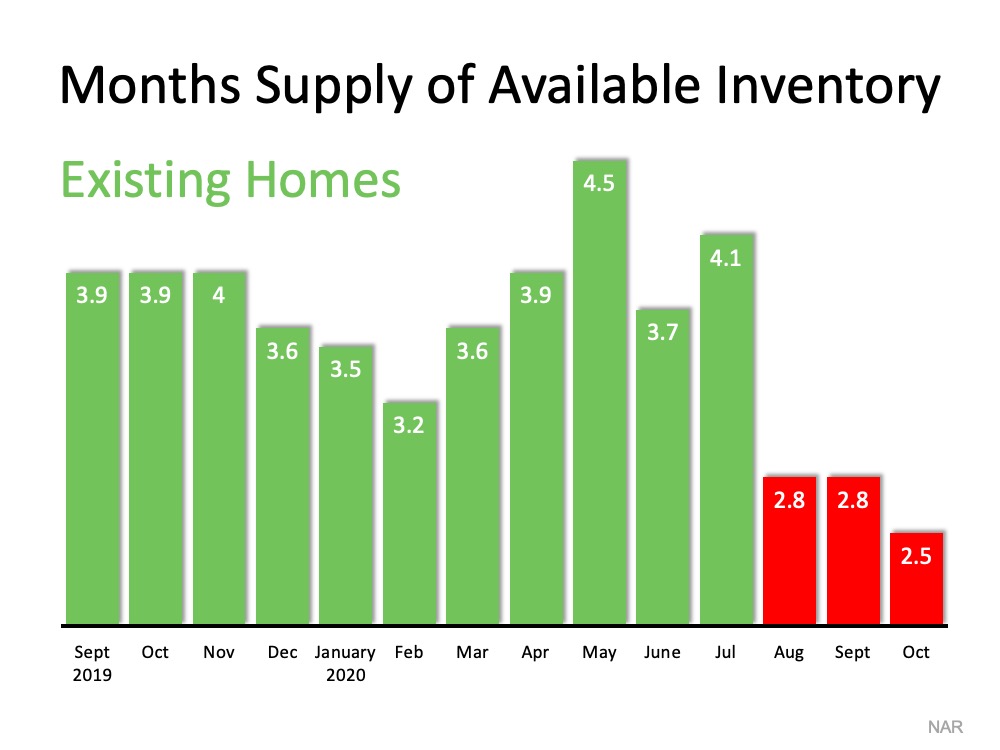

One major indicator the industry uses to measure housing supply is the months’ supply of inventory. According to NAR:

“Months’ supply refers to the number of months it would take for the current inventory of homes on the market to sell given the current sales pace.”

Historically, six months of supply is considered a normal real estate market. Going into the pandemic, inventory was already well below this mark. As the year progressed, the supply has was reduced even further. Here is a graph showing this measurement over the last year:

What does this mean if you’re a buyer?

Be patient during your home search. It may take time to find a home you love. Once you do, be ready to move forward quickly. Get pre-approved for a mortgage, be prepared to make a competitive offer from the start, and understand how the shortage in inventory has led to more bidding wars. Calculate just how far you’re willing to go to secure a home if you truly love it.

What does this mean if you’re a seller?

Realize that, in some ways, you’re in the driver’s seat. When there’s a shortage of an item at the same time there’s a strong demand for it, the seller is in a good position to negotiate. Whether it’s the price, moving date, possible repairs, or anything else, you’ll be able to ask for more from a potential purchaser at a time like this – especially if you have multiple interested buyers. Do not be unreasonable, but understand you probably have the upper hand.

In Rhode Island the absorption rate plummeted 78.9% in October meaning the supply of inventory dropped significantly. The massive lack of inventory in RI is the reason behind the 16.8% increase in sales price compared to October of 2019.

Bottom Line

The housing market will remain strong throughout the winter and heading into the spring. Know what that means for you, whether you’re buying, selling, or doing both.

For love or money? How to get the best return on your home improvements!

Getting the best ROI on home improvements…It’s a conversation I have often with my investors, those thinking of selling and those just buying a home. Which projects will bring them the greatest return? At the end of the day we all want our investments to be made wisely and those that entail quite a bit of sweat equity behoove even greater forethought before diving in!

The ROI on home improvements isn’t always about money however. Often the joy you get when you wake up in a home you love more and more with each project you complete IS the greatest “return.” To me, loving the space you are in trumps any financial kickback you will benefit from upon selling. But since so many of us crave the “down low” on which projects bring the greatest ROI, let’s dive in and take a look! I’ve attached the ROI percentage as well as the estimated cost to complete each project. Which projects you then want to take on will be a personal choice and I support each and every one!

Here are some of the more popular home improvement projects and their associated ROI and cost.

1. Kitchen Remodel- ROI 63% Cost estimate- $65,,000

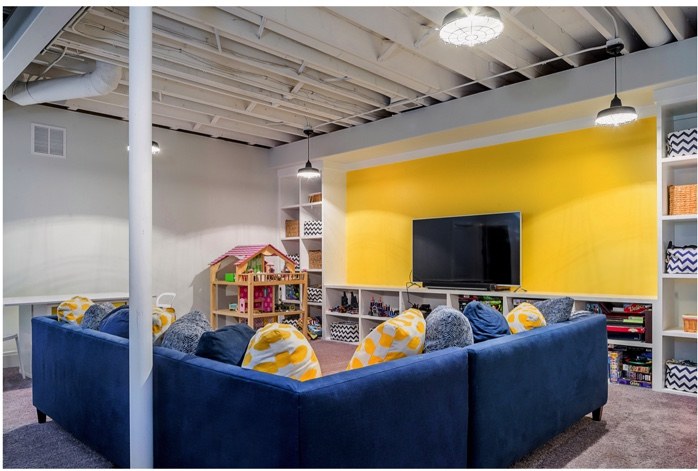

2. Basement Conversion- ROI 63% Cost-$40,000

3. New wood floors- ROI 91% Cost- $5500

4. Pool- ROI 43% Cost-$57,500

5. Bathroom Addition- ROI 50% Cost- $59,000

6. New Garage Door- ROI 87% Cost- $2300

7. Outdoor Kitchen – ROI 71% Cost -$14,000

8. Plant Trees- ROI 100% or more Cost- $50-$100 for 6.7 foot deciduous tree

9. New Roof – ROI 109% Cost- $7500

Whatever improvements you make, be sure YOU are the ones who want to make it because home improvements entail 100% commit!

Questions about which projects your specific home would benefit most from in today’s hot market? It can be a bit location specific so please reach out to me with any questions. I am happy to come take a look at your personal situation and give you some professional feedback. Helping people is my “why I’m here!”

Tips for selling your house right now !

Tips to Sell Your House Safely Right Now [INFOGRAPHIC]

![Tips to Sell Your House Safely Right Now [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/11/12090934/20201113-MEM-1046x1641.png)

Some Highlights

- Your agent, this gal, has sold 17 homes during Covid with now over 6 months of experience selling houses during the pandemic and can make the process easier and safer for you today.

- COVID-19 protocols and technology usage recommendations from the National Association of Realtors (NAR) are making it possible to sell houses right now, while agents continue to abide first and foremost by state and local regulations.

- Let’s connect to discuss how to sell your house safely in today’s housing market.

Selling Safely during COVID-19

Is it Safe to Sell My House Right Now?

In today’s real estate market, the buzz is all about how it’s a great time to sell your house. Buyer demand is high, and there simply aren’t enough homes available to buy to meet that growing need. This means now is the time to make a move so you can close the deal on your ideal terms.

Even in today’s strong sellers’ market, there are homeowners who are choosing not to sell due to ongoing concerns around the health crisis, financial uncertainty, and life in general. According to Zillow, here are the top three reasons homeowners who are thinking of selling sometime in the next three years are not putting their houses on the market right now:

- 34% – Life is too uncertain right now

- 31% – Financial uncertainty

- 25% – COVID-19 health concerns

If you identify with any of these, you’re not alone. Whether it’s the future of your employment situation or simply being uncomfortable having guests in your home for showings, life feels a lot different than it did at this time last year. The good news is, real estate professionals have spent the majority of 2020 figuring out how to sell homes safely, and it’s paying off for those who are choosing to move this year.

Real estate agents are doing two things very well to make selling your house possible:

1. Agents Are Implementing Technology in the Process

While abiding by state and local regulations as a top priority, real estate agents are making sales happen safely and effectively by leveraging key pieces of technology. Agents know exactly what today’s buyers and sellers need and how to put the necessary digital steps in place. For example, agents have capitalized on the technology buyers find most helpful when deciding on a new home:

- Virtual tours

- Accurate and detailed listing information

- Detailed neighborhood information

- High-quality listing photos

- Agent-led video chats

They’re listening to their audience and leveraging the tools that help buyers get an initial look at a home without having to step inside. This helps reduce the number of people entering your home, so only those who are very seriously interested need to take the next step: in-person showings.

2. Agents Are Facilitating Safe and Effective In-Person Showings

After leveraging technology, if you have serious buyers who still want to see your house in person, agents are following the guidelines set by the National Association of Realtors (NAR) and utilizing safe ways to proceed. Here are a few of them, understanding again that the agent’s top priority is always to follow state and local restrictions first:

- Limiting in-person activity

- Requiring guests to wash their hands or use an alcohol-based sanitizer

- Removing shoes or covering them with booties

- Following CDC guidance on social distancing and wearing face coverings

Getting comfortable with your agent – a true trusted advisor – taking these steps under the modern-era safety standards might be your best plan. This is especially important if you’re in a position where you need to sell your house sooner rather than later.

As Jeff Tucker, Senior Economist for Zillow notes:

“Homeowners who feel life is uncertain right now may think they can still get a strong price if they delay selling until they have more clarity. The catch is that waiting to sell may raise the cost of a trade-up. This fall’s record low mortgage rates, which make a trade-up more affordable on a monthly basis, are not guaranteed to last.”

Bottom LineAs an agent, I quickly pivoted when the pandemic hit. As someone who has a suppressed auto- immune system i hold a personal and professional obligation to keep myself, my clients and my customers and colleagues safe. With a a personal motto of ” I am here to help, ” I most certainly do my all to do that in a completely safe fashion.

It simply is a uniquely amazing time to sell. Opening your doors up to new approaches could be game-changing when it comes to selling your house while the market is leaning in your favor. Looking for guidance and assistance in selling a home during a pandemic ? Please reach out. I am here as your trusted real estate professional to help you safely and effectively navigate all that’s new when it comes to making your next move.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link