How much leverage do today’s sellers have?

How Much Leverage Do Today’s House Sellers Have?

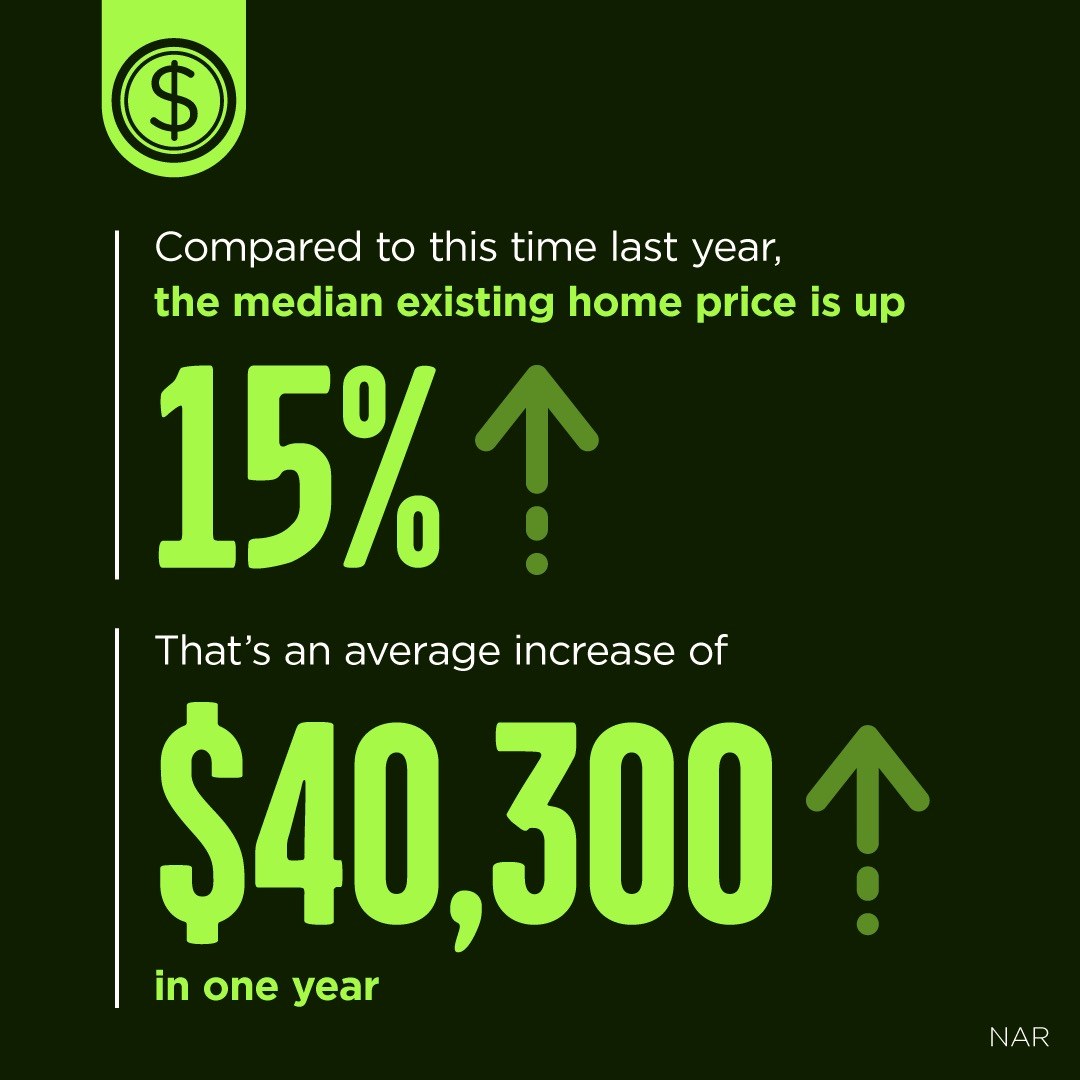

The housing market has been scorching hot over the last twelve months. Buyers and their high demand have far outnumbered sellers and a short supply of houses. According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), sales are up 23.7% from the same time last year while the inventory of homes available for sale is down 25.7%. There are 360,000 fewer single-family homes for sale today than there were at this time last year. This increase in demand coupled with such limited supply is leading to more bidding wars throughout the country.

Rose Quint, Assistant Vice President for Survey Research with the National Association of Home Builders (NAHB), recently reported:

“The number one reason long-time searchers haven’t made a home purchase is not because of their inability to find an affordably-priced home, but because they continue to get outbid by other offers.”

A survey in the NAHB report showed that 40% of buyers have been outbid for a home they wanted to purchase. This is more than twice the percentage in 2019, which was 19%.

What does this mean for sellers today?

It means sellers have tremendous leverage when negotiating with buyers.

In negotiations, leverage is the power that one side may have to influence the other side while moving closer to their negotiating position. A party’s leverage is based on its ability to award benefits or eliminate costs on the other side.

In today’s market, a buyer wants three things:

- To buy a home

- To buy now before prices continue to appreciate

- To buy now and take advantage of historically low mortgage rates while they last

These three buyer needs give the homeowner tremendous leverage when selling their house. Most realize this leverage enables the seller to sell at a good price. However, there may be another need the seller has that can be satisfied by using this leverage.

Here’s an example:

Odeta Kushi, Deputy Chief Economist at First American, recently identified a situation in which many sellers are finding themselves today:

“As mortgage rates are expected to remain near 3%, millennials continue to form households and more existing homeowners tap their equity for the purchase of a better home…Many homeowners may want to upgrade, but do not for fear that they will be unable to find a home to buy.”

She then offers a possible solution:

“While the fear of not being able to find something to buy will not disappear in a limited supply environment, new housing supply can incentivize existing homeowners to move.”

There’s no doubt many sellers would love to build a new home to perfectly fit their changing wants and needs. However, most builders require that they sell their house first. If the seller sells their home, where would they live while their new home is being constructed?

Going back to the concept of leverage:

As mentioned, buyers have compelling reasons to purchase a home now, and many homeowners have challenges to address if they want to sell. Perhaps they can make a deal to satisfy each party’s needs. But how?

The seller may decide to sell their home to the buyer at today’s price, which will enable the purchaser to take advantage of current mortgage rates. In return, the buyer might lease the house back to the seller for a pre-determined length of time while the seller’s new home is being built. A true win-win negotiation.

Not every buyer will agree to such a deal – but you only need one.

That’s just one example of how a seller might be able to overcome a challenge because of the leverage they have in today’s market. Maybe you feel a need to make certain repairs before selling. Perhaps you need time to get permits or approvals for certain upgrades you made to the house. Whatever the challenge, you may be able to work it out.

Bottom Line

If you’re considering selling your house in RI now but worry a huge obstacle stands in your way, let’s connect. Maybe with the leverage you currently have, you can negotiate a deal that will allow you to make the move of your dreams. I would love to be of help!

The incentive to buy in RI is as clear as a “3 bridge day” in the Ocean State!

Home Mortgage Rates by Decade [INFOGRAPHIC]

![Home Mortgage Rates by Decade [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/02/18124453/20210219-MEM-1046x1207.png)

Some Highlights

- Mortgage interest rates have dropped considerably over the past year, and compared to what we’ve seen in recent decades, it’s a great time to buy a home.

- Locking in a low rate today could save you thousands of dollars over the lifetime of your home loan, but these low rates may not last forever.

- If you’re in a position to buy a home in Rhode Island let’s connect to determine your best move in today’s housing market while interest rates are still in your favor.

Real estate market realities for buyers and sellers

There is no doubt the real estate market is booming. No longer tethered to a workplace, many are choosing to leave the cities and head to the burbs. This has put an incredibly high demand on the pre-existing low-inventory of homes nationwide in our surban and suburban areas.

Per the supply and demand principle, prices of homes have escalated tremendously. It’s made for a very competitive market for buyers where multiple offers are the norm. Many issues surface in such a robust and “inflamed” market and ones that I like to keep all my buyers and sellers cognizant of. Here are a few to keep in your buying/selling headspace.

1. Low inventory/Multiple offers–

A seller’s market is likely to continue for the foreseeable future especially in the suburbs and in states featuring coastline or mountains. Areas that boast outdoor amenities are now on many- a-buyer “hot list.” I heard on a recent podcast that the “flyover states” have now become the “fly- to states.” What this all means is that when a house hits, you as a buyer need to be ready to pounce. Multiple offers are the new normal and learning how to create competitive offers via escalator addendums and waiving some contingencies are areas buyers must be educated in.

2 . The market will NOT pay top dollar for overpriced or dated homes.

Despite the seller’s market one can not throw a listing up there like spaghetti to a wall, with little market prep and/or a high price tag. It simply won’t sell. Buyers are NOT jumping on these homes no matter how “desperate” they are for inventory. If it’s priced too high or the condition is perceived as poor (ie dated and or cluttered) it simply will not sell. There are simply too many properties that HAVE been updated and that have been prepped impeccably, staged well etc for buyers to choose from. The real estate market is like a beauty pageant where pretty really does sell and it sells well.

3. Transactions will become more accelerated.

Loans and closings took much longer during the beginning of the pandemic. Addendums were developed for unforeseen delays yet somehow along the way everyone found out how to make the process faster and more efficient. What that means for a buyer is that the ability to go out and look at 15 plus homes has waned. There are simply too many buyers out there surfing online for weeks prior who are ready to see a home and then make an offer. This is now a market where willing and able buyers are out making offers daily.

4. Leaseback options

The more flexible a buyer is, the stronger an offer appears. So many times it’s not the offer price that wins the multiple offer contest but it’s the one with the fewest contingencies and the most flexibility with closing dates and occupancy. Buyers who can offer sellers the ability to stay in their homes after closing for a specified period of time may have an advantage over a buyer who needs to move in right after closing.

5. Appraised values may become increasingly challenged.

Median sale prices are up 8- 41% in towns across Rhode Island versus where they were a year ago. With that comes the risk that an appraisal comes in below the contract sales price, especially where properties are going well over asking prices. As an agent, I always give my sellers and buyers a big ‘Appraisal 101″ where I inform them that an appraisal is simply one person’s opinion of value and it may not be the market value and/or the price that the buyer and seller agreed to. If an appraisal contingency is waived by the buyer to add great strength to the offer, then the buyer will be forced to put down more money to make up for the difference. Tactics can be taken on behalf of the buyer to provide an element of compromise, where the buyer will agree to come up with x amount of the asking price, or something to that effect but “what if” plans need to be discussed early on in the offer process. Some buyers may not be able to come up with the out of pocket money needed to pay the difference and that needs to be discussed with their realtor before an offer is made. Likewise, sellers need to be advised on what the repercussions are when an appraisal comes in under the sales contract price.

Bottom line is that the market is hot and buyers and sellers need to be well informed, educated and prepared for anything and everything that MAY come their way. As a former teacher, I pride myself on my value proposition which rests heavily on knowledge and guidance every step of the way.

Owning a home is more affordable than renting one!

Owning a Home Is Still More Affordable Than Renting One

If spending more time at home over the past year is making you really think hard about buying a home instead of renting one, you’re not alone. You may be wondering, however, if the dollars and cents add up in your favor as home prices continue to rise. According to the experts, in many cases, it’s still more affordable to buy a home than rent one. Here’s why.

ATTOM Data Solutions recently released the 2021 Rental Affordability Report, which states:

“Owning a median-priced three-bedroom home is more affordable than renting a three-bedroom property in 572, or 63 percent of the 915 U.S. counties analyzed for the report.

That has happened even though median home prices have increased more than average rents over the past year in 83 percent of those counties and have risen more than wages in almost two-thirds of the nation.”

How is this possible?

The answer: historically low mortgage interest rates. Todd Teta, Chief Product Officer with ATTOM Data Solutions, explains:

“Home-prices are rising faster than rents and wages in a majority of the country. Yet, home ownership is still more affordable, as amazingly low mortgage rates that dropped below 3 percent are helping to keep the cost of rising home prices in check.”

In 2020, mortgage rates reached all-time lows 16 times, and so far, they’re continuing to hover in low territory this year. These low rates are a big factor in driving affordability. Teta also notes:

“It’s startling to see that kind of trend. But it shows how both the cost of renting has been relatively high compared to the cost of ownership and how declining interest rates are having a notable impact on the housing market and home ownership. The coming year is totally uncertain, amid so many questions connected to the Coronavirus pandemic and the broader economy. But right now, owning a home still appears to be a financially-sound choice for those who can afford it.”

Bottom Line

If you’re considering buying a home in RI this year, let’s connect today to discuss the options that match your budget while affordability is in your favor. Inventory is low so preparing far in advance is pivotal so that we can “strike when the iron is hot” when a listing hits the market that meets your checklists! Pre-game prep is essential in buying a home and in selling a home. I can help you get game-day ready and truly love the process of doing it!

Six Things to Splurge on in the Bathroom!

Bathrooms have a major impact on home value. What improvements can you make in a bathroom that will add value? What should you avoid doing? Clients always ask me what to do and what to avoid doing in terms of home improvements; especially, if like many, they plan to sell shortly.

4 Reasons People are Buying Homes in 2021

4 Reasons People Are Buying Homes in 2021

According to many experts, the real estate market is expected to continue growing in 2021, and it’s largely driven by the lasting impact the pandemic is having on our lifestyles. As many of us spend extra time at home, we’re reevaluating what “home” means and what we may need in one going forward.

Here are 4 reasons people are reconsidering where they live and why they’re expecting to buy a home this year.

1. Record-Low Mortgage Interest Rates

In 2020, the average interest rate for a 30-year fixed mortgage hit a record low 16 times, continuing to fall further below 3%. According to Freddie Mac, the average 30-year fixed interest rate today is 2.65%. Many wonder how low these rates will go and how long they’ll last. Len Keifer, Deputy Chief Economist for Freddie Mac, advises:

“If you’ve found a home that fits your needs at a price you can afford, it might be better to act now rather than wait for future rate declines that may never come and a future that likely holds very tight inventory.”

This sense of urgency is driving many to buy this year.

2. Working from Home

Remote work is a new normal for many businesses, and it’s lasting longer than most expected. Many in the workforce today are discovering they don’t need to live close to the office anymore and they can get more for their money by moving a little further outside of the city limits. David Mele, President at Homes.com, says:

“The surge in the work-from-home population has rewritten the playbook for many homebuying and rental decisions, from when and where to relocate, to what people are looking for in their next residence.”

The reality is, for some people, working remotely in their current home is challenging, especially when there may be other options available.

3. More Outdoor Space

Another new priority for homeowners is having more usable outdoor space. Being at home is driving those in some areas to seek less densely populated neighborhoods so they have more room to stretch their legs. In addition, those living in apartments and townhomes are often looking for extra square footage, both inside and out.

According to the State of Home Spending report by HomeAdvisor, of the households surveyed, almost half reported spending 27% more on outdoor living over the past year. This is a trend that’s expected to grow in 2021 and beyond.

4. Avoiding Renovations

It’s recently come to light that many homeowners would also rather buy a new home than go through the process of fixing up the one they have. According to the 2020 Profile of Home Buyers and Sellers report from the National Association of Realtors (NAR), 44% of homebuyers purchased a new home to “avoid renovations or problems with the plumbing or electricity.”

Depending on what needs to be addressed, today’s high buyer demand may make it possible to skip some renovations before selling. Many of these homeowners have prioritized buying over renovating for convenience and potential cost savings.

Bottom Line

It’s clear that homeownership needs are changing. As a result, Americans are expected to move in record numbers this year. If you’re trying to decide if now is the right time to buy a home in Rhode Island, let’s connect to discuss your options. I would be happy to help!

What does 2021 Have in Store for Home Values?

What Does 2021 Have in Store for Home Values?

According to the latest CoreLogic Home Price Insights Report, nationwide home values increased by 8.2% over the last twelve months. The dramatic rise was brought about as the inventory of homes for sale reached historic lows at the same time buyer demand was buoyed by record-low mortgage rates. As CoreLogic explained:

“Home price growth remained consistently elevated throughout 2020. Home sales for the year are expected to register above 2019 levels. Meanwhile, the availability of for-sale homes has dwindled as demand increased and coronavirus (COVID-19) outbreaks continued across the country, which delayed some sellers from putting their homes on the market.

While the pandemic left many in positions of financial insecurity, those who maintained employment and income stability are also incentivized to buy given the record-low mortgage rates available; this is increasing buyer demand while for-sale inventory is in short supply.”

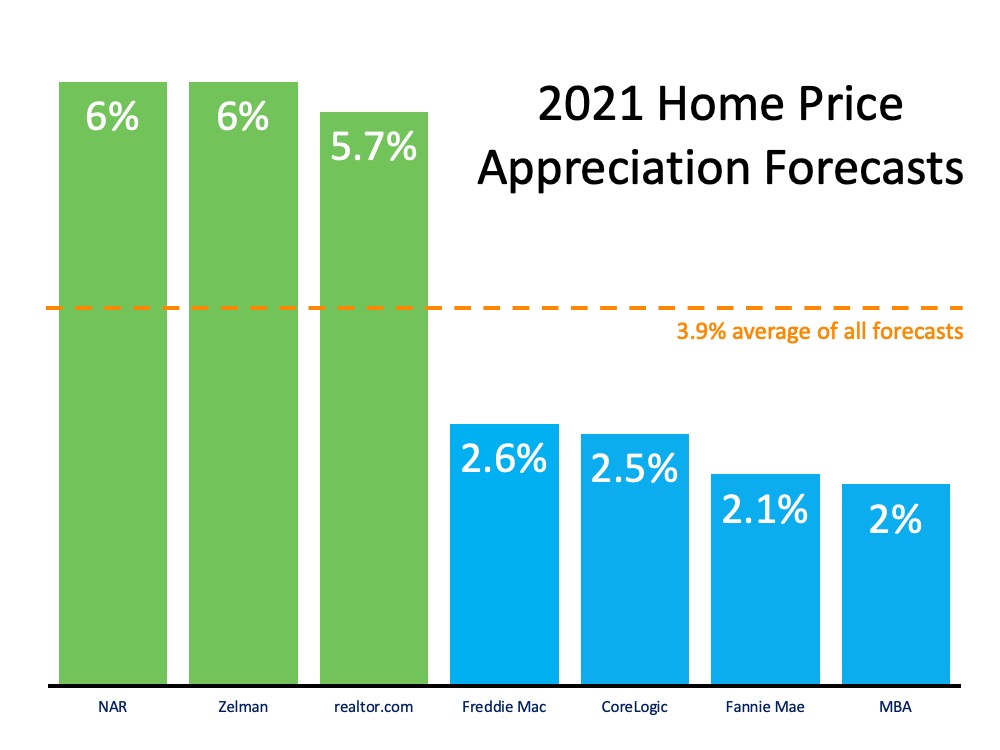

Where will home values go in 2021?

Home price appreciation in 2021 will continue to be determined by this imbalance of supply and demand. If supply remains low and demand is high, prices will continue to increase.

Housing Supply

According to the National Association of Realtors (NAR), the current number of single-family homes for sale is 1,080,000. At the same time last year, that number stood at 1,450,000. We are entering 2021 with approximately 370,000 fewer homes for sale than there were one year ago.

However, there is some speculation that the inventory crush will ease somewhat as we move through the new year for two reasons:

1. As the health crisis eases, more homeowners will be comfortable putting their houses on the market.

2. Some households impacted financially by the pandemic will be forced to sell.

Housing Demand

Low mortgage rates have driven buyer demand over the last twelve months. According to Freddie Mac, rates stood at 3.72% at the beginning of 2020. Today, we’re starting 2021 with rates one full percentage point lower than that. Low rates create a great opportunity for homebuyers, which is one reason why demand is expected to remain high throughout the new year.

Taking into consideration these projections on housing supply and demand, real estate analysts forecast homes will continue to appreciate in 2021, but that appreciation may be at a steadier pace than last year. Here are their forecasts:

Bottom Line

There’s still a very limited number of homes for sale for the great number of purchasers looking to buy them. As a result, the concept of “supply and demand” mandates that home values in the country will continue to appreciate.

Why you should reconsider selling a home on your own

Why Selling Your House on Your Own in 2021 Is a Mistake

There are many benefits to working with a real estate professional when selling your house. During challenging times, like what we face today, it becomes even more important to have an expert you trust to help guide you through the process. If you’re considering selling on your own, known in the industry as a For Sale By Owner (FSBO), it’s critical to consider the following items.

1. Your Safety Is a Priority

Your safety should always come first, and that’s more crucial than ever given the current health situation in our country. When you FSBO, it is incredibly difficult to control entry into your home. A real estate professional will have the proper protocols in place to protect not only your belongings but your health and well-being too. From regulating the number of people in your home at one time to ensuring proper sanitization during and after a showing, and even facilitating virtual tours, real estate professionals are equipped to follow the latest industry standards recommended by the National Association of Realtors (NAR) to help protect you and your potential buyers.

2. A Powerful Online Strategy Is a Must to Attract a Buyer

Recent studies from NAR have shown that, even before COVID-19, the first step 43% of all buyers took when looking for a home was to search online. Throughout the process, that number jumps to 97%. Today, those numbers have grown exponentially. Most real estate agents have developed a strong Internet and social media strategy to promote the sale of your house.

3. There Are Too Many Negotiations

Here are just a few of the people you’ll need to negotiate with if you decide to FSBO:

- The buyer, who wants the best deal possible

- The buyer’s agent, who solely represents the best interest of the buyer

- The inspection company, which works for the buyer and will almost always find challenges with the house

- The appraiser, if there is a question of value

As part of their training, agents are taught how to negotiate every aspect of the real estate transaction and how to mediate the emotions felt by buyers looking to make what is probably the largest purchase of their lives.

4. You Won’t Know if Your Purchaser Is Qualified for a Mortgage

Having a buyer who wants to purchase your house is the first step. Making sure they can afford to buy it is just as important. As a FSBO, it’s almost impossible to be involved in the mortgage process of your buyer. A real estate professional is trained to ask the appropriate questions and, in most cases, will be intimately aware of the progress being made toward a purchaser’s mortgage commitment. You need someone who’s working with lenders every day to guarantee your buyer makes it to the closing table.

5. FSBOing Is Becoming More Difficult from a Legal Standpoint

The documentation involved in the selling process is growing dramatically as more and more disclosures and regulations become mandatory. In an increasingly litigious society, the agent acts as a third-party to help the seller avoid legal jeopardy. This is one of the major reasons why the percentage of people FSBOing has dropped from 19% to 8% over the last 20+ years.

6. You Net More Money When Using an Agent

Many homeowners think they’ll save the real estate commission by selling on their own. Realize that the main reason buyers look at FSBOs is because they also believe they can save the real estate agent’s commission. The seller and buyer can’t both save on the commission.

A study by Collateral Analytics revealed that FSBOs don’t actually save anything by forgoing the help of an agent. In some cases, the seller may even net less money from the sale. The study found the difference in price between a FSBO and an agent-listed home was an average of 6%. One of the main reasons for the price difference is effective exposure:

“Properties listed with a broker that is a member of the local MLS will be listed online with all other participating broker websites, marketing the home to a much larger buyer population. And those MLS properties generally offer compensation to agents who represent buyers, incentivizing them to show and sell the property and again potentially enlarging the buyer pool.”

The more buyers that view a home, the greater the chance a bidding war will take place, potentially driving the price higher, too.

Bottom Line

Listing on your own leaves you to manage the entire transaction by yourself. Why do that when you can hire an agent and still net the same amount of money? Before you decide to take on the challenge of selling your house alone, let’s connect to discuss your options.

2021 Predictions for Real Estate

The housing market was a beacon of light in 2020 fueling the economic turnaround nationwide.

Will the vitality of the real estate market endure and continue throughout 2021?

This year was a great year for…….Homeownership

The Difference a Year Makes for Homeownership

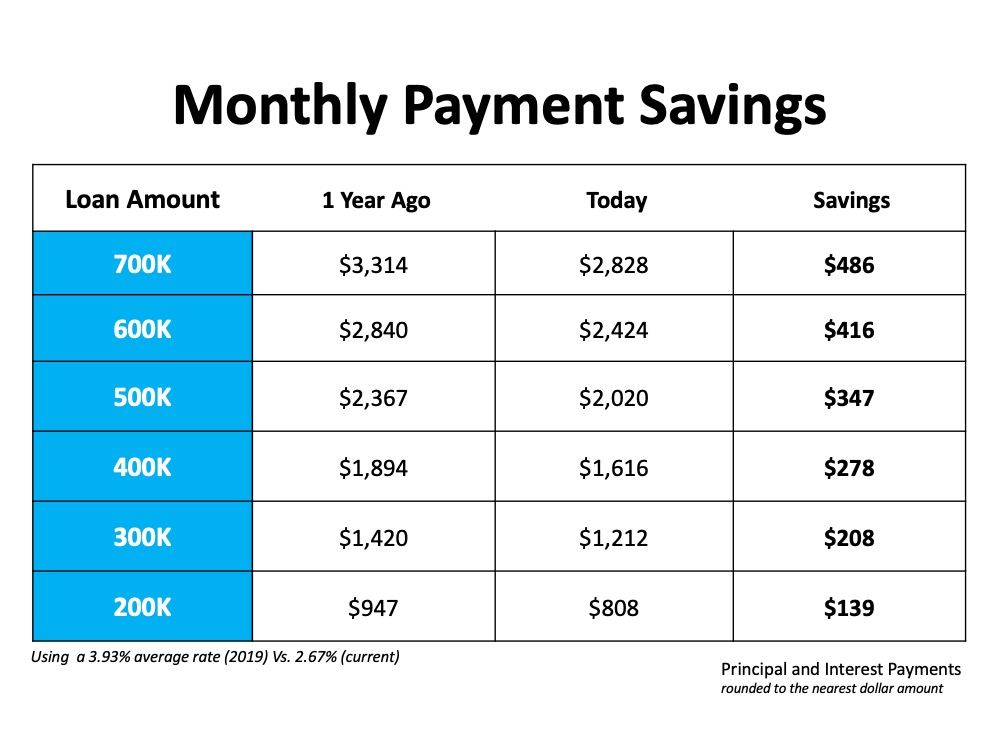

Over the past year, mortgage rates have fallen more than a full percentage point, hitting a new historic low 15 times. This is a great driver for homeownership, as today’s low rates provide consumers with some significant benefits. Here’s a look at three of them.

1. Move-up or Downsize: One option is to consider moving into a new home, putting the equity you’ve likely gained in your current house toward a down payment on a new one that better meets your needs – something that’s truly a perfect fit, especially if your lifestyle has changed this year.

2. Become a First-Time Homebuyer: There are many financial and non-financial benefits to owning a home, and the most important thing is to first decide when the time is right for you. You have to determine that on your own, but know that now is a great time to buy if you’re considering it. Just take a look at the cost of renting vs. buying.

3. Refinance: If you already own a home, you may decide you’re going to refinance. It’s one way to lock in a lower monthly payment and save more over time. However, it also means paying upfront closing costs, too. If you want to take this route, you have to answer the question: Should I refinance my home?

Why 2020 Was a Great Year for Homeownership

Last year, the average mortgage rate was 3.93% (substantially higher than it is today). If you waited for a better time to make a move, market conditions have improved significantly. Today’s low mortgage rates are a huge perk for buyers, so it’s a great time to get more for your money and consider a new home.

The chart below shows how much you would save per month based on today’s rates compared to what you would have paid if you purchased a home exactly one year ago, depending on how much you finance:

Bottom Line

If you’ve been waiting since last year to make your move into homeownership or to find a house that better meets your needs, today’s low mortgage rates may be just what you need to get the process going. Let’s connect today to discuss how you may benefit from the current rates.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link