A closer look at VA Loans in honor of Veteran’s Day

Making a Home for the Brave Possible [INFOGRAPHIC]

![Making a Home for the Brave Possible [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/11/05133615/20201106-MEM-1046x1717.png)

Some Highlights

- VA Home Loans provide unique opportunities for Veterans, active-duty personnel, and their families in recognition of their service to our Nation.

- For eligible individuals, options associated with VA Loans can help make the dream of homeownership a reality.

- If you or someone you know may benefit from a VA Loan, reach out to me so that I can answer your questions about VA loans here in RI , today!

Getting help with the financial side of making a home purchase

How Down Payment Assistance Opens the Door to Homeownership

Many people are eager to buy a home right now while affordability continues to be a highlight of the current housing market. However, a recent survey by Sparks Research shows that 20% of first-time homebuyers cite a lack of financial education as a barrier to homeownership. This is definitely understandable. If you don’t feel comfortable with the financial process of buying a home, it’s hard to make a confident decision. In fact, four in five homebuyers say they need help to understand what they can even afford in the first place. This is why finding the right professionals to help you through the process is so important.

On top of that, the same survey reports over two-thirds of prospective homebuyers believe they’ll need assistance to save enough for a down payment. What they may not realize is that there are a lot of down payment assistance programs at the state and regional levels, and many of them have funds available for potential buyers. Down Payment Resources recently released its Q3 2020 Homeownership Program Index, which explains:

“The number of total programs is 2,340, and over 81 percent (81.1%) of programs currently have funds available for eligible homebuyers.”

Down Payment Assistance Programs Are Not Only for First-Time Homebuyers

Keep in mind, these programs aren’t just for first-time homebuyers, so it’s worth exploring your options no matter where you are in your homeownership journey. For example, if you’re working from home now, you may be thinking of relocating to a more affordable area where you can stretch your dollar further and have more space, inside and out. Lawrence Yun, Chief Economist for the National Association of Realtors (NAR), explains:

“Rural areas have mortgages (USDA loans) that don’t require down payments; and some workers who can work from home may want to consider outer suburbs or small towns where USDA home loans are available and where homes are very affordable.”

If affordability is on your mind and you’re expecting to be working from home long-term, the right home may be in an area you haven’t considered yet. In addition, the assistance program you need might be within reach too.

If you’re interested in learning more about down payment assistance programs, additional information is available through Down Payment Resource. Your real estate advisor can help you decide which option is best for you personally.

Bottom Line

Thanks to a range of down payment assistance programs, affordable options are out there for today’s hopeful homebuyers. It’s important to get the financial education you need to understand the homebuying process and accomplish your real estate goals.Many buyers have questions right now. How much to put down?…How can I get help to put money down?….How much for earnest deposit?…. What IS earnest deposit? The teacher in me loves to guide and inform my clients and the athlete in me always seeks to get them the maximum return for their investment. While I inform and educate my buyers about best practices I am fortunate to further the support via an array of incredible loan officers who can further drill down on the down payment/loan option side with each client. Providing information, guidance and direction truly defines the role of a Realtor and this agent does so with a very thorough and earnest approach! Let’s connect today to get you started on the path to your dream home.

Home values expected to continue to rise

Home Values Projected to Keep Rising

As we enter the final months of 2020 and continue to work through the challenges this year has brought, some of us wonder what impact continued economic uncertainty could have on home prices. Looking at the big picture, the rules of supply and demand will give us the clearest idea of what is to come.

Due to the undersupply of homes on the market today, there’s upward pressure on prices. Consider simple economics: when there is high demand for an item and a low supply of it, consumers are willing to pay more for that item. That’s what’s happening in today’s real estate market. The housing supply shortage is also resulting in bidding wars, which will also drive price points higher in the home sale process.

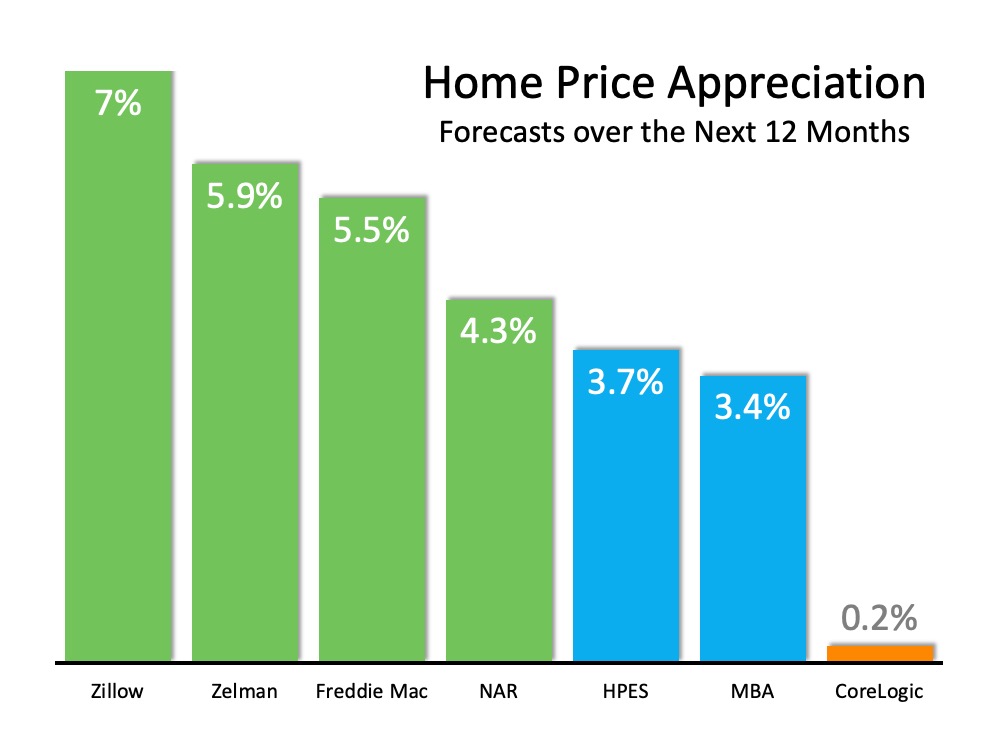

There’s no evidence that buyer demand will wane. As a result, experts project price appreciation will continue over the next twelve months. Here’s a graph of the major forecasts released in the last 60 days:

I hear many foreclosures might be coming to the market soon. Won’t that drive prices down?

Some are concerned that homeowners who entered a mortgage forbearance plan might face foreclosure once their plan ends. However, when you analyze the data on those in forbearance, it’s clear the actual level of risk is quite low.

Ivy Zelman, CEO of Zelman & Associates and a highly-regarded expert in housing and housing-related industries, was very firm in a podcast last week:

“The likelihood of us having a foreclosure crisis again is about zero percent.”

With demand high, supply low, and little risk of a foreclosure crisis, home prices will continue to appreciate.

Bottom Line

Originally, many thought home prices would depreciate in 2020 due to the economic slowdown from the coronavirus. Instead, prices appreciated substantially. Over the next year, we will likely see home values rise even higher given the continued lack of inventory of homes for sale.

Real estate continues to be a source of strength

Real Estate Continues to Show Unprecedented Strength This Year

The 2020 housing market has surpassed all expectations and continues to drive the nation’s economic recovery. The question is, will this positive trend continue throughout the rest of the year, especially given the uncertainty around the current health crisis, the upcoming election, and more?

Here’s a look at what several industry-leading experts have to say.

Lawrence Yun, Chief Economist, National Association of Realtors

“Home sales continue to amaze, and there are plenty of buyers in the pipeline ready to enter the market…Further gains in sales are likely for the remainder of the year, with mortgage rates hovering around 3% and with continued job recovery.”

Frank Martell, President and CEO, CoreLogic

“Homeowners’ balance sheets continue to be bolstered by home price appreciation, which in turn mitigated foreclosure pressures…Although the exact contours of the economic recovery remain uncertain, we expect current equity gains, fueled by strong demand for available homes, will continue to support homeowners in the near term.”

“Zillow’s predictions for seasonally adjusted home prices and pending sales are more optimistic than previous forecasts because sales and prices have stayed strong through the summer months amid increasingly short inventory and high demand.

The pandemic also pushed the buying season further back in the year, adding to recent sales. Future sources of uncertainty including lapsed fiscal relief, the long-term fate of policies supporting the rental and mortgage market, and virus-specific factors, were incorporated into this outlook.”

Bottom Line

Many economists are in unison, indicating the housing market will continue to fuel the economy through the end of the year, maintaining this unprecedented strength.

Why use a Realtor ?

There are many benefits to working with a real estate professional when selling your house. If you’re considering selling on your own, known in the industry as a For Sale by Owner (FSBO), it’s critical to consider the following:

1 – Your safety is a priority

real estate professional will have the proper protocols in place to protect not only your belongings, but your family’s health and well-being too.

2 – A powerful online strategy is a must to attract a buyer

Recent studies from NAR have shown that, even before COVID-19, the first step 44% of all buyers took when looking for a home was to search online. Throughout the process, that number jumps to 93%.

3 – There are too many negotiations

As part of their training, agents are taught how to negotiate every aspect of the real estate transaction and how to mediate the emotions felt by buyers looking to make what is probably the largest purchase of their lives.

4 – You won’t know if your purchaser is qualified for a mortgage

Having a buyer who wants to purchase your house is the first step. Making sure they can afford to buy it is just as important. As a FSBO, it’s almost impossible to be involved in the mortgage process of your buyer.

5 – FSBOing has become more difficult from a legal standpoint

In an increasingly litigious society, the agent acts as a third-party to help the seller avoid legal jeopardy.

6 – You net more money when using an agent

A study by Collateral Analytics revealed that FSBOs don’t actually save anything by forgoing the help of an agent. In some cases, the seller may even net less money from the sale. The study found the difference in price between a FSBO and an agent-listed home was an average of 6%.

Managing an entire transaction on your own is difficult. Agents like this one make your success their number one priority and use their expertise , market reach experience and keen market insight to maximize the selling opportunities on your behalf. And this agent will do it with drive , determination and pure Huard Hustle !

#sellingyourhome #homeforsale #rhodeisland

Should you buy a retirement home sooner rather than later?

Should You Buy a Retirement Home Sooner Rather than Later?

Every day in the U.S., roughly 10,000 people turn 65. Prior to the health crisis that swept the nation in 2020, most people had to wait until they retired to make a move to the beach, the golf course, or the senior living community they were looking to settle into for their later years in life. This year, however, the game changed.

Many of today’s workers who are nearing the end of their professional careers, but maybe aren’t quite ready to retire, have a new choice to make: should I move before I retire? If the sand and sun are calling your name and you have the opportunity to work remotely for the foreseeable future, now may be a great time to purchase that beach bungalow you’ve always dreamed of or the single-story home in the sprawling countryside that might be a little further out of town. Whether it’s a second home or a future retirement home, spending the next few years in a place that truly makes you smile every day might be the best way to round out a long and meaningful career.

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“The pandemic was unexpected, working from home was unexpected, but nonetheless many companies realized that workers can be just as productive working from home…We may begin to see a boost in people buying retirement homes before their retirement.”

According to the 20th Annual Transamerica Retirement Survey, 3 out of 4 retirees (75%) own their homes, and only 23% have mortgage debt (including any equity loans or lines of credit). Since entering retirement, almost 4 in 10 retirees (38%) have moved into a new home. They’re making a profit by selling their current homes in today’s low inventory market and using their equity to purchase their future retirement homes. It’s a win-win.

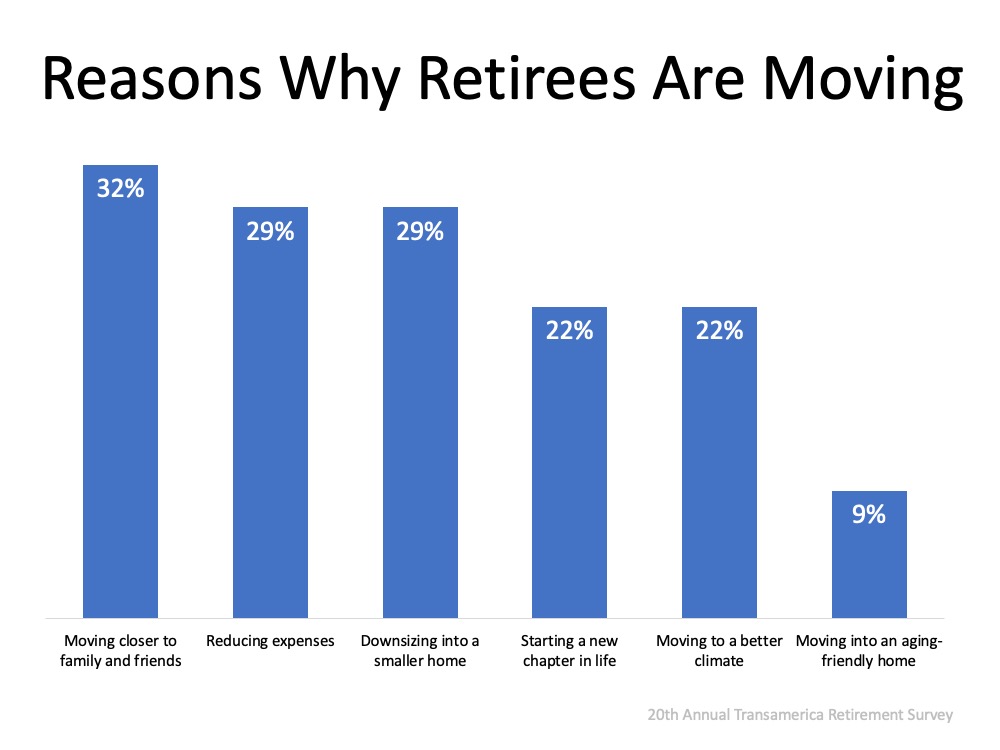

Why These Homeowners Are Making Moves Now

The health crisis this year made us all more aware of the importance of our family and friends, and many of us have not seen our extended families since the pandemic started. It’s no surprise, therefore, to see in the same report that 32% of those surveyed cited the top reason they’re making a move is that they want to be closer to family and friends (See graph below): The survey also revealed that 73% percent of retirees currently live in single-family homes. With the overall number of homes for sale today hitting a historic low, and with the buyer demand for single-family homes skyrocketing, there’s never been a more ideal time to sell a single-family home and make a move toward retirement. Today’s market has the perfect combination of driving forces to make selling optimal, especially while buyers are looking to take advantage of low interest rates.

The survey also revealed that 73% percent of retirees currently live in single-family homes. With the overall number of homes for sale today hitting a historic low, and with the buyer demand for single-family homes skyrocketing, there’s never been a more ideal time to sell a single-family home and make a move toward retirement. Today’s market has the perfect combination of driving forces to make selling optimal, especially while buyers are looking to take advantage of low interest rates.

If you’re one of the 73% of retirees with a single-family home and want to move closer to your family, now is the time to put your house on the market. With the pace homes are selling today, you could essentially wrap up your move – start to finish – before the holidays.

Bottom Line

Whether you’re looking to fully retire or to buy a second home with the intent to use it as your retirement home in the future, the 2020 fall housing market may very well work in your favor. Let’s connect today to discuss your options in our local Rhode Island market.

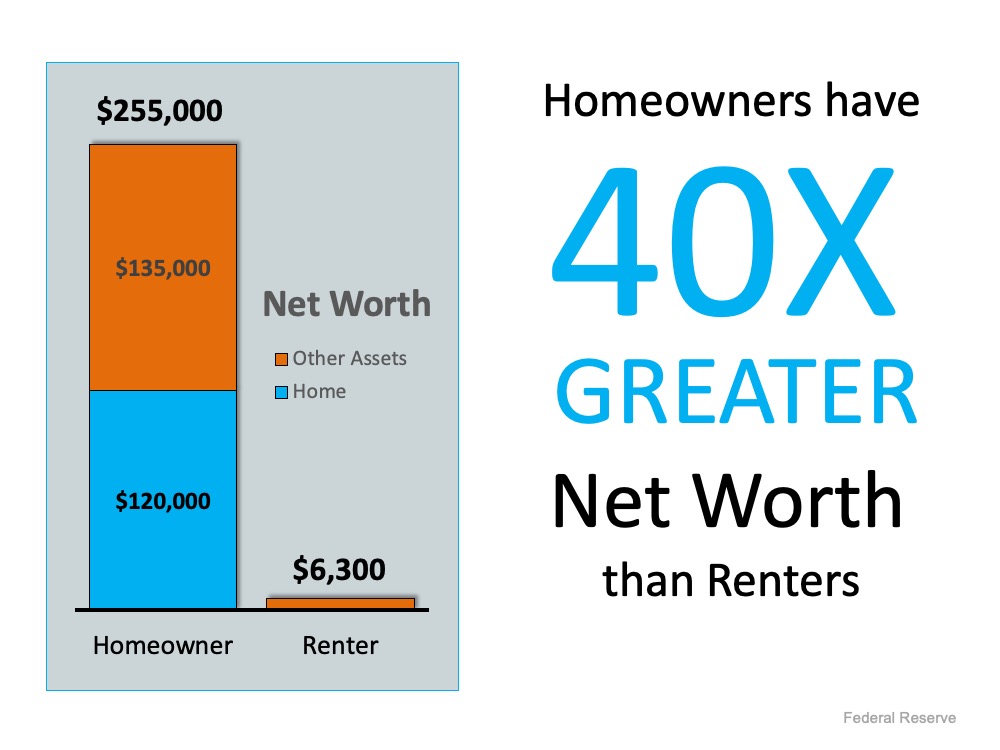

A Homeowner’s Net Worth is 40X Greater than a Renter’s

A Homeowner’s Net Worth Is 40x Greater Than a Renter’s

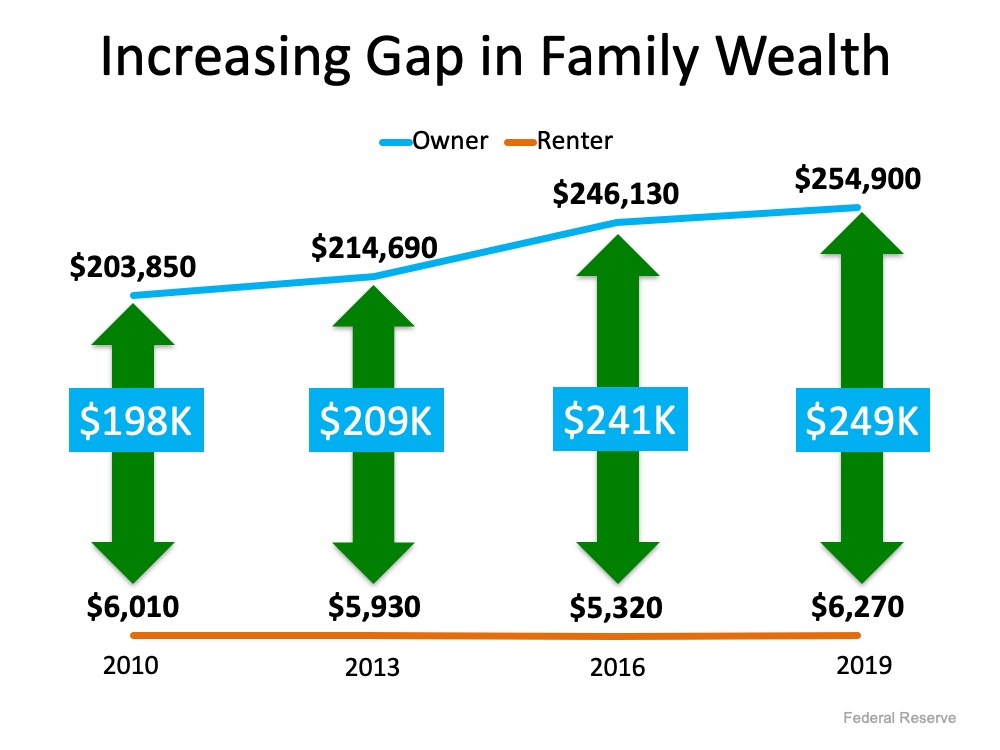

One of the best ways to build your family’s financial future is through homeownership. Recent data from the Federal Reserve indicates the net worth of a homeowner is actually over 40 times greater than that of a renter. Maybe it’s time to start thinking about buying a home, especially when they’re so affordable in today’s market.

Every three years the Survey of Consumer Finances shows the breakdown of how owning a home helps build financial security. In the graph below, we see that the average net worth of homeowners continues to grow, while the net worth of renters tends to hold fairly steady and be significantly lower than that of homeowners. The gap between owning and renting just keeps getting wider over time, making homeownership more and more desirable for those who are ready.

Owning a home is a great way to build family wealth.

For many families, homeownership serves as a form of ‘forced savings.’ Every time you pay your mortgage, you’re contributing to your net worth by increasing the equity you have in your home (See chart below): The impact of home equity is part of why Gallup reports that Americans picked real estate as the best long-term investment for the seventh year in a row. According to this year’s survey, 35% of Americans chose real estate over stocks, savings accounts, gold, and bonds.

The impact of home equity is part of why Gallup reports that Americans picked real estate as the best long-term investment for the seventh year in a row. According to this year’s survey, 35% of Americans chose real estate over stocks, savings accounts, gold, and bonds.

Today, there are great opportunities available for those planning to buy a home. The housing market has made a full recovery, and all-time low interest rates are giving homebuyers a big boost in purchasing power. If you’re ready, buying a home this fall can set you up to increase your net worth and create a safety net for your family’s future.

Bottom Line

To learn how you can use your monthly housing cost to build your family’s net worth, let’s connect . I would be happy to advise you on how to get started on the homebuying process here in RI !

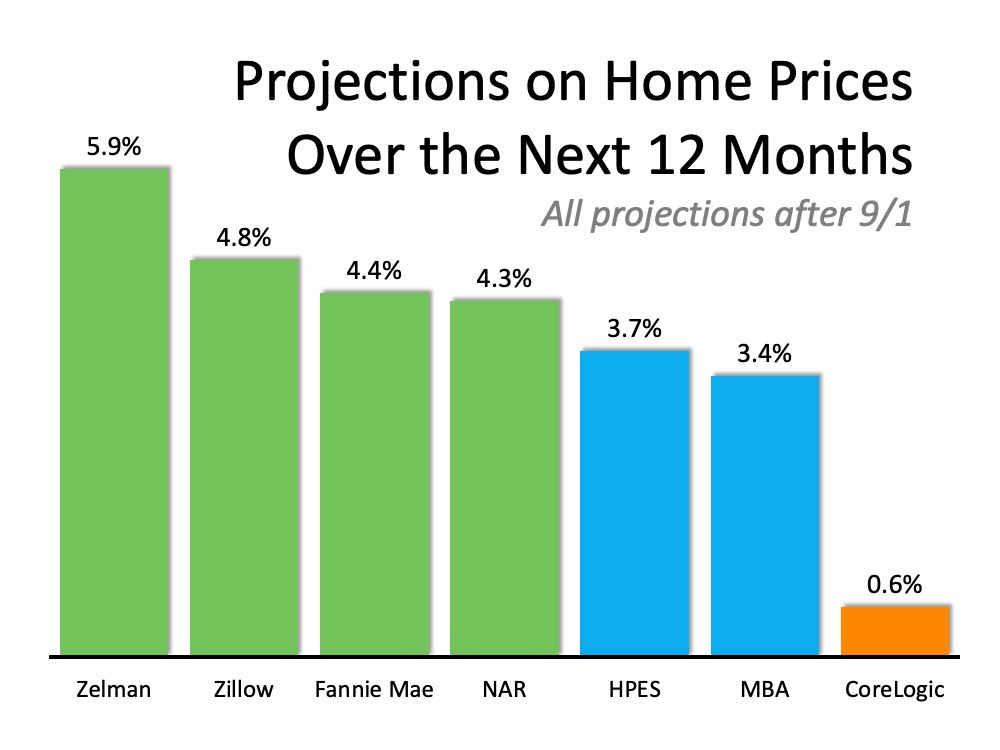

Where are Home Values heading in the next 12 months?

Where Are Home Values Headed Over the Next 12 Months?

As shelter-in-place orders were implemented earlier this year, many questioned what the shutdown would mean to the real estate market. Specifically, there was concern about home values. After years of rising home prices, would 2020 be the year this appreciation trend would come to a screeching halt? Even worse, would home values begin to depreciate?

Original forecasts modeled this uncertainty, and they ranged anywhere from home values gaining 3% (Zelman & Associates) to home values depreciating by more than 6% (CoreLogic).

However, as the year unfolded, it became clear that there would be little negative impact on the housing market. As Mark Fleming, Chief Economist at First American, recently revealed:

“The only major industry to display immunity to the economic impacts of the coronavirus is the housing market.”

Have prices continued to appreciate so far this year?

Last week, the Federal Housing Finance Agency (FHFA) released its latest Home Price Index. The report showed home prices actually rose 6.5% from the same time last year. FHFA also noted that price appreciation accelerated to record levels over the summer months:

“Between May & July 2020, national prices increased by over 2%, which represents the largest two-month price increase observed since the start of the index in 1991.”

What are the experts forecasting for home prices going forward?

Below is a graph of home price projections for the next year. Since the market has changed dramatically over the last few months, this graph shows forecasts that have been published since September 1st.

Bottom Line

The numbers show that home values have weathered the storm of the pandemic.Home values in RI are up over 5% statewide. Let’s connect if you want to know what your home is currently worth and how that may enable you to make a move this year.

Rhode Island Real Estate Market Report – August 2020

Click the link below for the latest and greatest numbers and analysis for our local RI real estate market for August 2020!

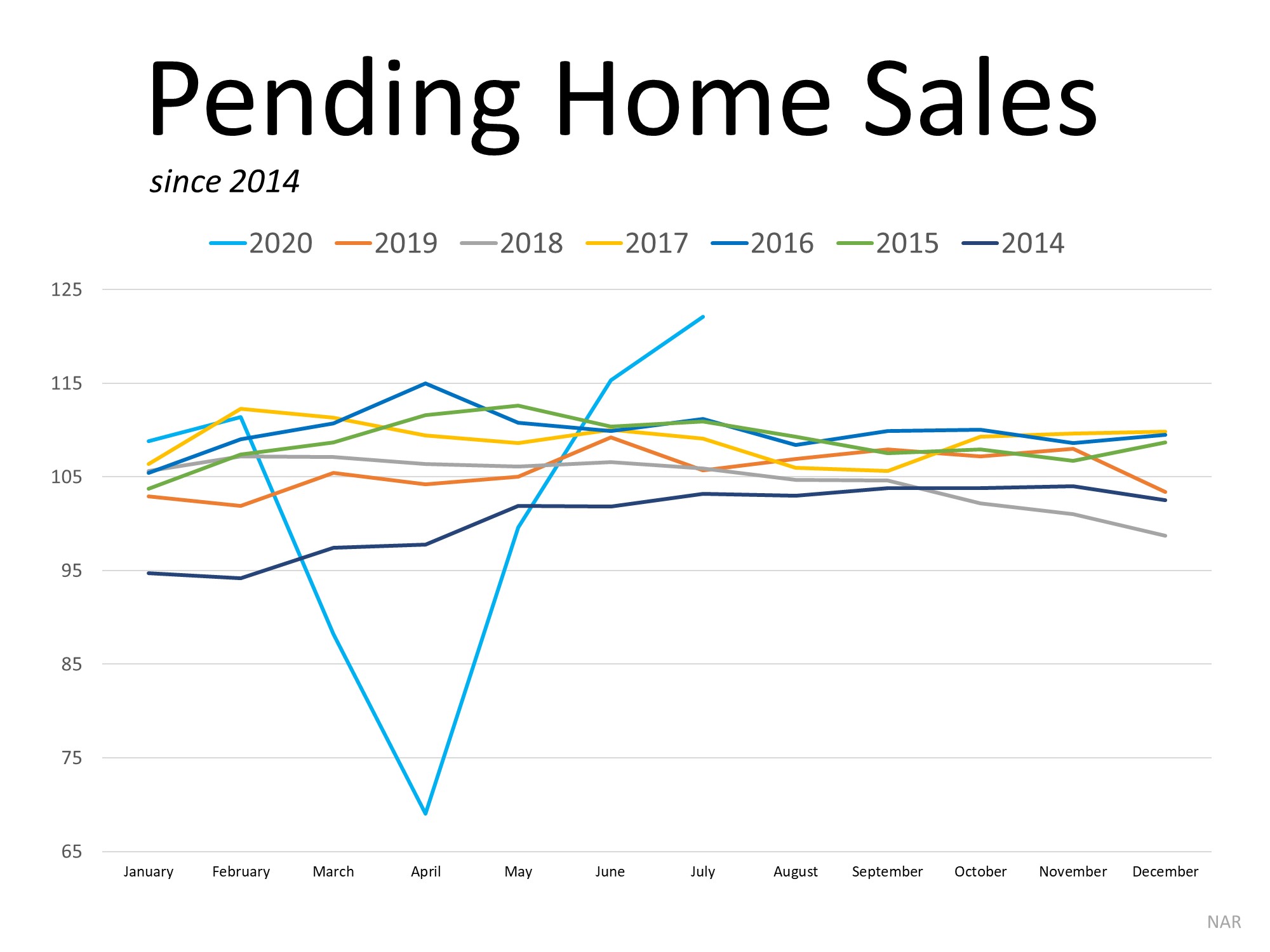

Homebuyer Demand is Far Above Last Year’s Pace

Homebuyer Demand Is Far Above Last Year’s Pace

Homebuying has been on the rise over the past few months, with record-breaking sales powering through the market in June and July. Buyers are actively purchasing homes, and the momentum is continuing into the fall. It is, however, becoming harder for buyers to find homes to purchase. If you’ve been thinking about selling your house, the coming weeks might just be the timing you’ve been waiting for.

According to the Pending Home Sales Report from the National Association of Realtors (NAR):

“Pending home sales in July achieved another month of positive contract activity, marking three consecutive months of growth.

The Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, rose 5.9% to 122.1 in July. Year-over-year, contract signings rose 15.5%. An index of 100 is equal to the level of contract activity in 2001.”

This means that for the past several months, buyers have signed an increasing number of contracts to purchase homes – well above where the market was at this time last year. Lawrence Yun, Chief Economist at NAR notes:

“We are witnessing a true V-shaped sales recovery as homebuyers continue their strong return to the housing market…Home sellers are seeing their homes go under contract in record time, with nine new contracts for every 10 new listings.”

Below is a graph that shows the impressive recovery of homes sales compared to previous years. The deep blue v marks the slowdown from this spring that turned into an exponential jump in sales that followed through the summer, skyrocketing above years past:

What Does This Mean for Sellers?

If you were thinking about putting your house on the market in the spring, but decided to wait due to the health crisis, it may be time to make your move. Buyers are in the market right now. With so few homes available to purchase, homeowners today are experiencing more bidding wars, creating an optimal time to sell.

Is This Trend Going to Continue?

As CNBC notes, there are no signs of slowing buyer demand this fall:

“The usual summer slowdown in the housing market is not happening this year. Buyers continue to show strong demand, spurred by the new stay-at-home world of the coronavirus and by record low mortgage rates.”

Danielle Hale, Chief Economist at realtor.com, concurred:

“In a typical year in the housing market, buyer interest begins to wane before seller interest causing the usual seasonal slowdown as we move into the fall. Due to a delayed spring season and low mortgage rates, we could see buyer interest extend longer than usual into the typically quieter fall. Whether this means more home sales will depend on whether sellers participate or decide to stay on the sidelines.”

As Hale mentioned, homeowners who are willing to sell their houses right now will play a big role in whether the trend continues. The market needs more homes to satisfy ongoing buyer demand. Maybe it’s time to leverage your equity and move up while eager home shoppers are ready to purchase a house just like yours.

Bottom Line

If your current home doesn’t meet your family’s changing needs here in RI, let’s connect to help you sell your house and make the move you’ve been waiting for all year.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link