Do you think the Housing Market is about to crash?

Lately, it feels like a lot of people have been asking the same question: “Is the housing market about to crash?”

If you’ve been scrolling through social media or watching the news, you might have seen some pretty scary headlines yourself. That’s why it’s no surprise that, according to data from Clever Real Estate, 70% of Americans are worried about a housing crash in 2025.

But before you hit pause on your plans to buy or sell a home, take a deep breath. The truth is: the housing market isn’t about to crash – it’s just shifting. And that shift actually works in your favor.

Today’s Inventory Keeps the Housing Market from Crashing

Mark Fleming, Chief Economist at First American, says:

“There’s just generally not enough supply. There are more people than housing inventory. It’s Econ 101.”

Think about it. If there’s a shortage of something – like tickets to a popular concert – prices go up. That’s what’s been happening with homes. We still have a shortage of supply. Too many buyers and not enough homes push prices higher.

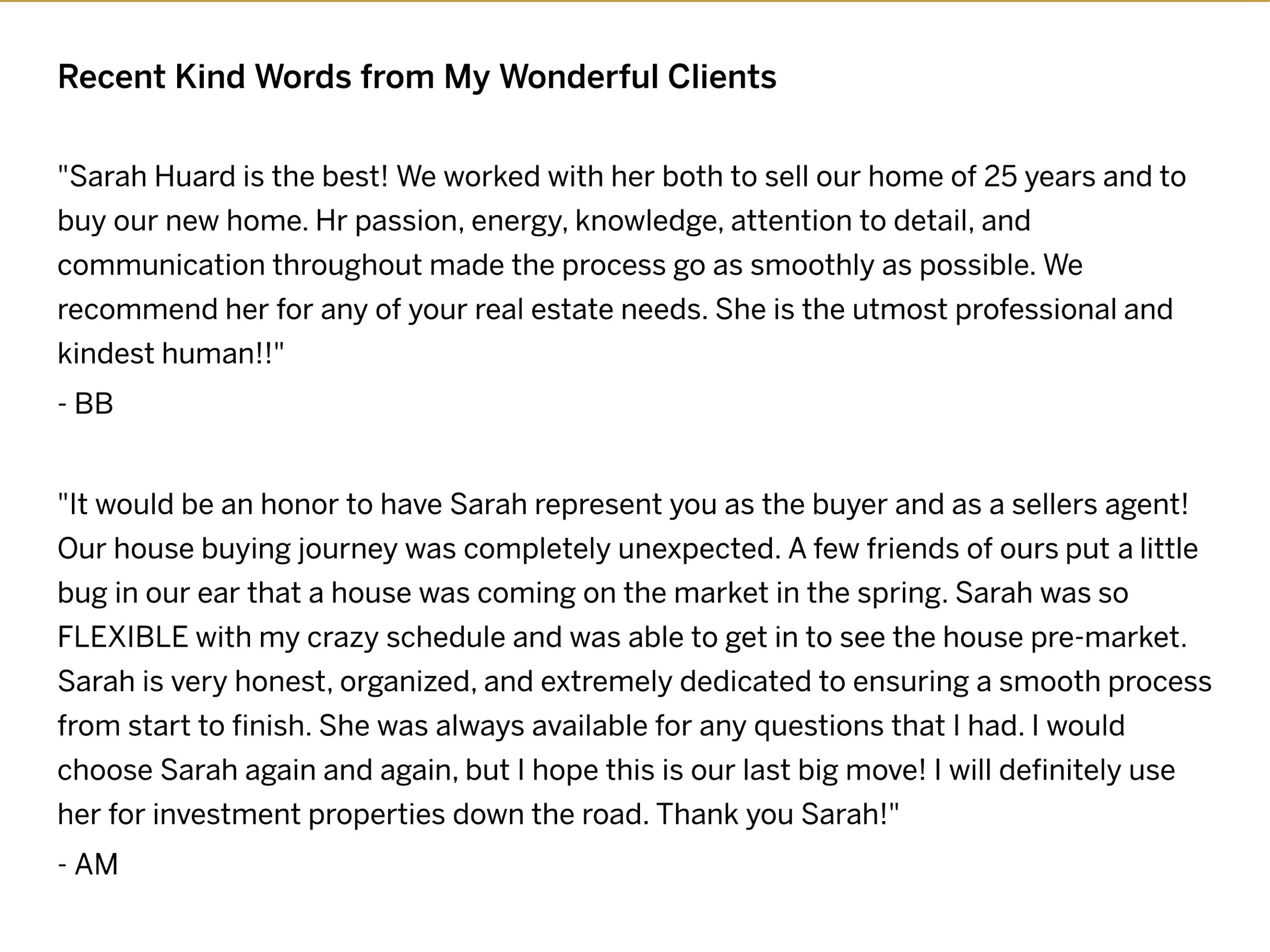

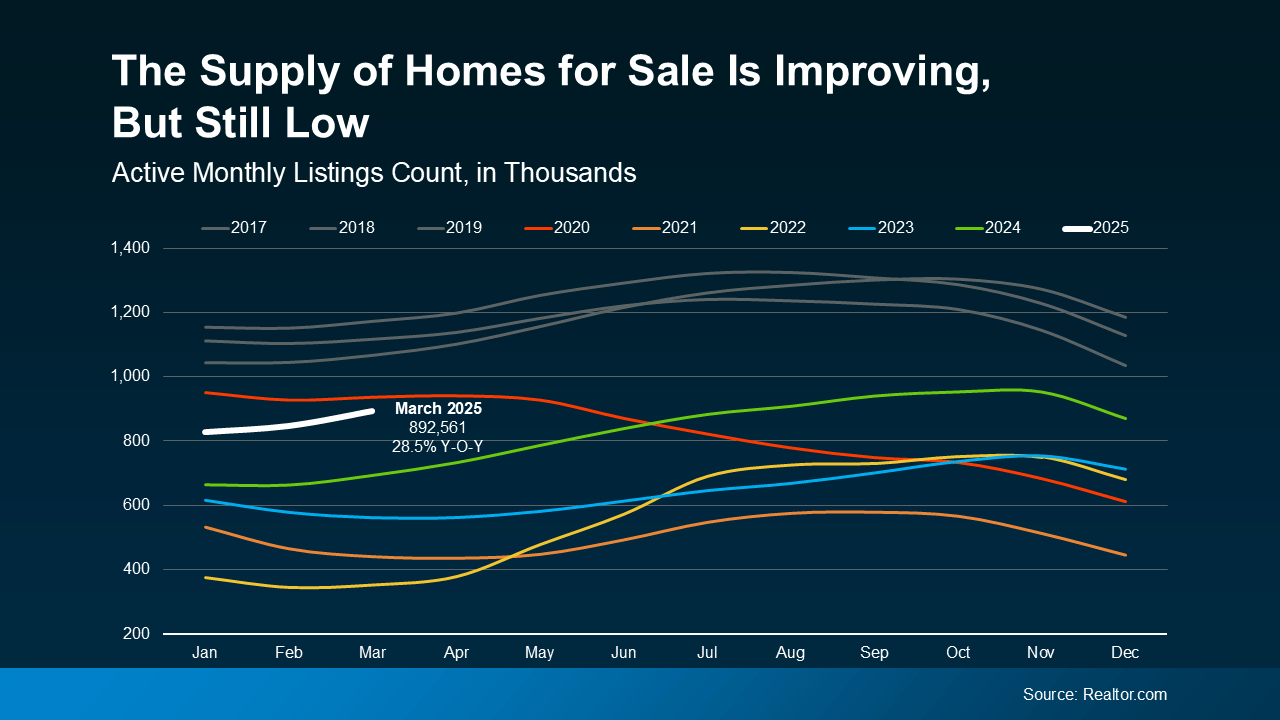

Check out the white line for 2025 in the graph below. Even though the number of homes for sale is climbing, data from Realtor.com shows we’re still well below normal levels (shown in gray):

That ongoing low supply is what’s stopping home prices from dropping at the national level. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

That ongoing low supply is what’s stopping home prices from dropping at the national level. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“… if there’s a shortage, prices simply cannot crash.”

More Homes for Sale Means Price Growth Is Easing

And, as more homes become available, that takes some of the intense upward pressure off home price growth – leading to healthier price appreciation.

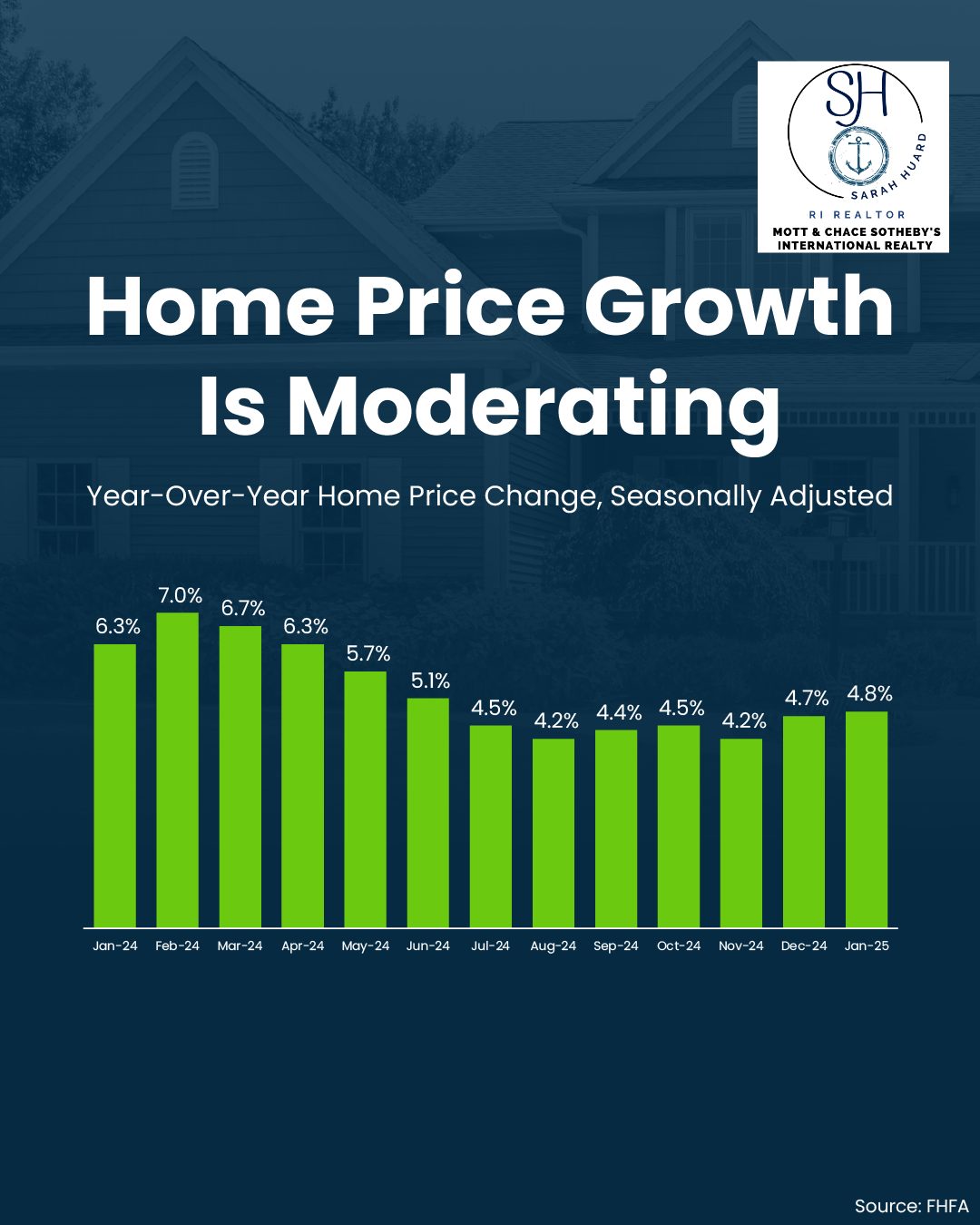

So, while prices aren’t falling nationally, growing inventory means they also aren’t rising as fast as they were. What we’re seeing is price moderation (see graph below):

And according to Freddie Mac, that moderation should continue through the rest of this year:

And according to Freddie Mac, that moderation should continue through the rest of this year:

“In 2025, we expect the pace of house price appreciation to moderate from the levels seen in 2024, while still maintaining a positive trajectory.”

Put simply, that means prices will continue going up in most areas, just not as quickly. That’s good news for anyone who’s been having trouble finding a home and feeling sticker shock from the rapid price appreciation of the past few years.

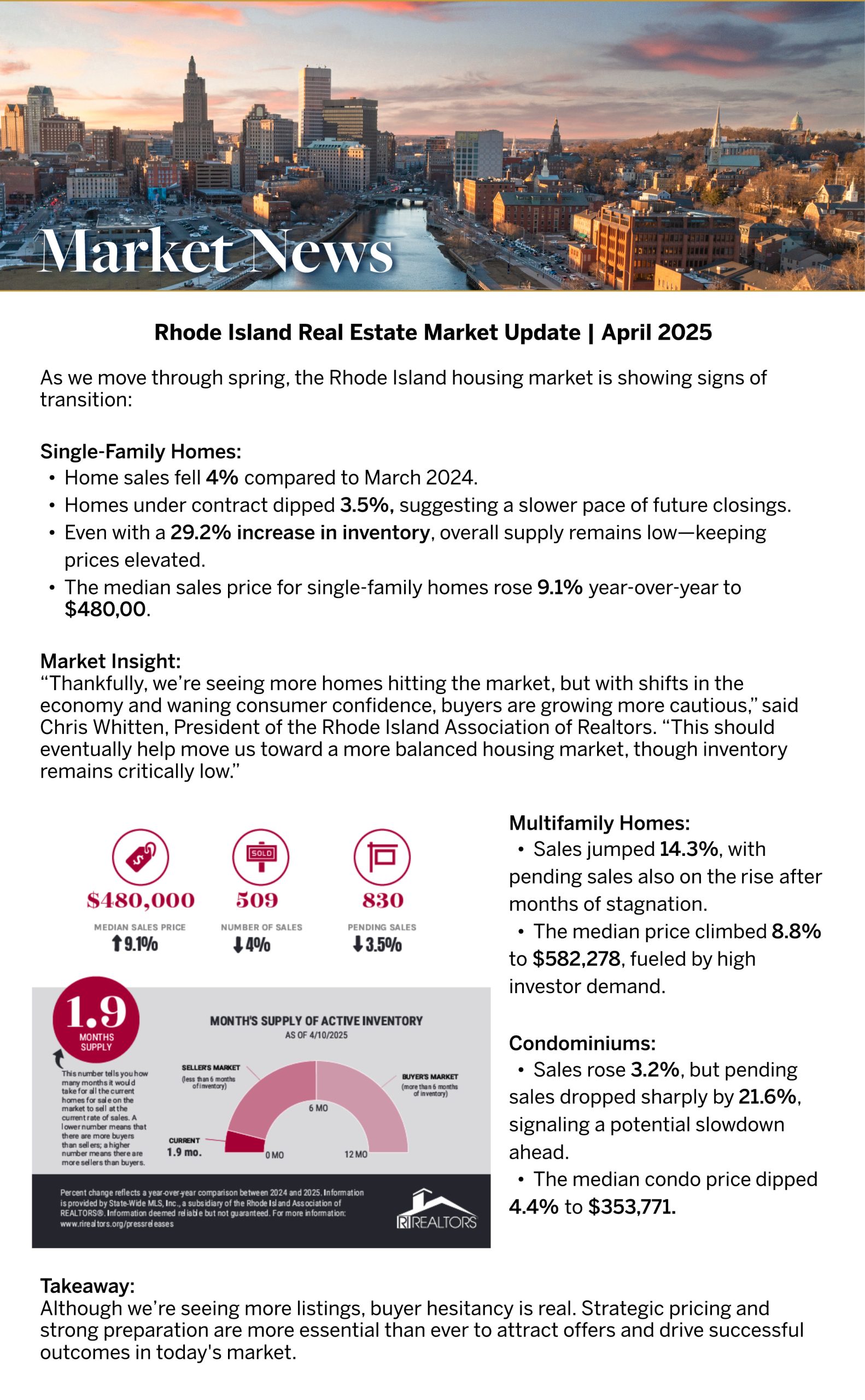

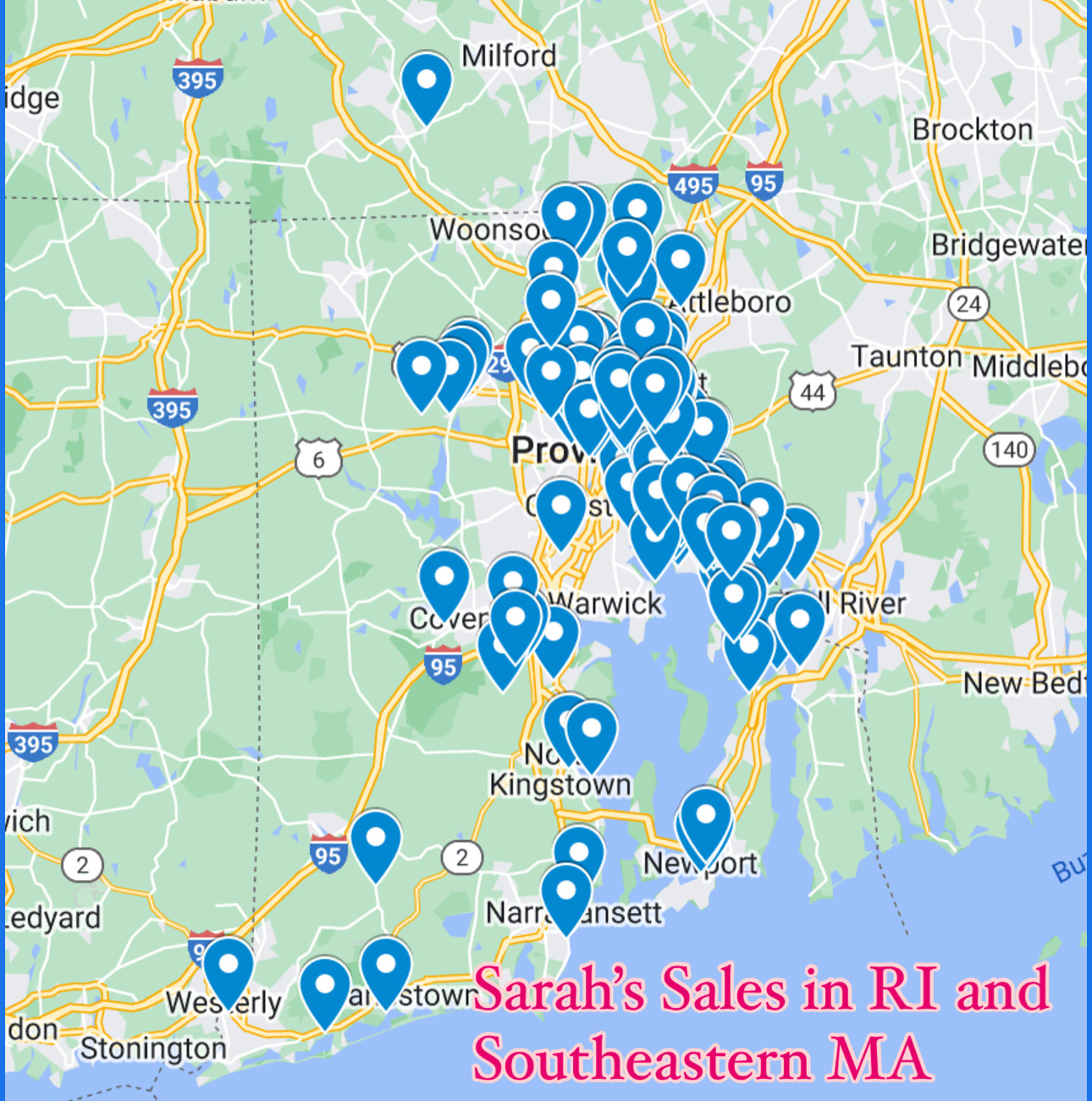

But of course, what’s happening with prices and inventory is going to vary by local market. So, here’s the scoop on what is happening in RI!

In Rhode Island, March’s median sold price reached $480,000, with inventory still tight at just 1.7 months—a far cry from the 6 months that signals a balanced market. Translation? Buyer demand remains high, and values are holding strong.

More listings mean more choice for buyers, which slows down how quickly prices rise—but prices are still rising. It’s not decline—it’s healthy growth. 💪🏼

So… how does this shift affect your game plan?

Let’s strategize your next move—whether buying or selling, I’ve got you.

Bottom Line

So… how does this shift affect your game plan?

Let’s strategize your next move—whether buying or selling, I’ve got you.

Don’t let the talk scare you. Experts agree that a housing market crash is unlikely in 2025. As Business Insider reports:

“. . . economists who study housing market conditions generally do not expect a crash in 2025 or beyondunless the economic outlook changes.”

Instead, we’re heading into a housing market that’s healthier and more balanced, with slower price growth and more opportunity.

Let’s chat about what’s happening in our local market and how you can make the most of it.

I sell throughout the state of Rhode Island and cover Southern Massachusetts!

If your House’s Price isn’t Compelling, it’s not Selling

One big mistake you must avoid when selling your house this year is setting your price too high. It might seem like overpricing gives you room to negotiate or could really boost your profit, but the reality is that it usually backfires.

Realtor.com says almost 20% of sellers — that’s one in five — have to reduce their price to get their house sold. And you don’t want to be one of them. Here’s why starting too high can lead to trouble and how to avoid it.

Overpricing Pushes Buyers Away

With mortgage rates and home prices where they are right now, buyers are already stretching their budgets to make a move. So, when they see a house priced too high, they do not think, “I can negotiate.” They’re more likely to think “next” and skip over your house entirely. An article from the National Association of Realtors (NAR) explains:

“Some sellers are pricing their homes higher than ever just because they can, but this may drive away serious buyers . . .”

And if they skip over your listing, you’ll miss out on getting them through the door. That’s the last thing you want because fewer showings mean fewer chances to receive an offer.

The Longer Your House Sits, the More Skeptical Buyers Will Get

Here’s the other issue. An overpriced house tends to sit on the market longer. And the longer a house lingers, the more buyers wonder what’s wrong with it. Is there a problem with the house itself? Are you difficult to work with? Even if the only issue is the price, that extra time creates doubt. As U.S. News says:

“. . . setting an unrealistically high price with the idea that you can come down later doesn’t work in real estate . . . A home that’s overpriced in the beginning tends to stay on the market longer, even after the price is cut, because buyers think there must be something wrong with it.”

At that point, you’ll have no choice but to lower your price to drum up interest. However, that price reduction has its own downside: buyers may see it as another red flag: an issue with the house.

The Key To Finding the Right Price for Your House

So, what’s the secret to avoiding all these headaches? It’s simple. Work with a local real estate agent who knows the market and will be honest with you about how you should price your house.

You don’t want to partner with someone who agrees to whatever number you throw out there. That’s not an expert who will get you the best results.

You want an agent who recommends a price based on their expertise. The right agent will use real-time data from your local market to help you land a price that makes sense — one that grabs attention, attracts buyers, and still enables you to walk away with a great return. Someone who has been there and done that – and done it well. That’s the agent you want to work with.

Bottom Line

Remember, if the price isn’t compelling, it’s not selling. Instead of shooting too high and scaring off buyers, work with a local agent who can price it right.

Let’s team up and make sure your house hits the market with the right price, gets noticed, and gets sold. I pride myself on delivering an unmatched work ethic, tireless grit, fierce client loyalty, and a results-driven, hands-on agency to each client I “get” to represent!

Will your home be 1 of the 11,000 homes that sell today?

Should you buy now or wait to buy later?

Click on the link below for the downlow on why buying now may be the way to go!

August Market News & Message

|

Thinking of buying a home? Here are some of Sarah’s Tips to Guide You!

Hi there, future homeowner! If you’re reading this, you’re probably toying with the idea of buying your first home. It’s exciting, nerve-wracking, and a bit overwhelming. But don’t worry, I’ve got you covered. Think of this as your trusty guide to navigating the wild world of real estate in Rhode Island.

By the end of this post, you’ll be well on your way to making that dream home a reality. Plus, I’ve got something special for you – a free home buyer guide that’ll be your game-day playing card throughout this journey. Ready? Let’s dive in!

1. Understanding Your Budget: More Than Just a Number Before you start touring homes or even scrolling through listings, it’s crucial to understand your budget. This isn’t just about knowing how much you can spend; it’s about knowing what you can comfortably afford.

Here’s how to get started:

Assess Your Finances: Look at your income, savings, and current expenses. What’s your monthly net income after taxes? How much are you saving, and what can you afford to put toward a mortgage each month?

Check Your Credit Score: Your credit score plays a big role in the mortgage rates you’ll be offered. The higher your score, the better the rates.

Get Pre-Approved: This gives you a clear picture of what you can afford and shows sellers you’re serious. Plus, it makes the whole process smoother and quicker. Pro Tip: Download our free home buyer guide for a detailed breakdown of budgeting tips and a handy checklist to keep you on track!

2. Finding the Right Neighborhood: Location, Location, Location Finding the perfect home isn’t just about the house itself – it’s also about the neighborhood. You should consider

Safety First: Check out crime rates and talk to locals about how safe they feel.

School Districts: Good schools can increase your home’s value even if you don’t have kids.

Amenities: What’s nearby? Grocery stores, parks, coffee shops? Make sure the neighborhood fits your lifestyle.

Commute: How long will it take you to get to work? Consider traffic patterns and public transportation options.

3. The House Hunt: What to Look For in a Home Now, the fun part – house hunting! Here’s how to make the most of it:

Make a Must-Have List: What are your non-negotiables? A big kitchen, a backyard, or maybe a home office?

Be Open-Minded: Finding a home that ticks every box is rare. Be prepared to compromise on some aspects.

Check the Bones: Pay attention to the structure and condition of the house. Look for signs of wear and tear, and don’t be afraid to ask about the age of the roof, plumbing, and electrical systems.

Consider Future Value: Consider how the home’s value might increase over time. Are there plans for new developments in the area? Is the neighborhood up-and-coming?

Freebie Alert: Our home buyer guide includes a comprehensive checklist to take with you on house tours, ensuring you don’t miss a thing!

4. Making an Offer: The Art of Negotiation You’ve found the one – now what? Making an offer can be nerve-wracking, but here’s how to navigate it:

Do your research: Know the market value of similar homes in the area. I will provide you with a solid understanding of the market values around the home you seek, giving you a solid foundation for your offer.

Be Prepared to Negotiate: Sellers often list their homes as being higher than what they expect to get. Don’t be afraid to make a counteroffer. Include Contingencies: Protect yourself with financing, inspections, and appraisal contingencies.

Stay Calm: It’s easy to get emotionally attached, but stay level-headed. If this one doesn’t work out, there’s always another home out there. Download Now: I have a “How to write a competitive offer” PDF I’d happily share once we find the house you want to compete for. It has detailed strategies for making offers and negotiating like a pro.

5. Closing the Deal: From Offer to Ownership Closing is the final step, and it involves paperwork.

Here’s what to expect:

Home Inspection: Ensure the home is in good condition. If issues are found, negotiate repairs or a price reduction.

Appraisal: The lender will require an appraisal to confirm the home’s value.

Final Walkthrough: Do one last check to ensure everything is in order. Closing Costs: Be prepared for additional costs, including lender fees, title insurance, and property taxes.

Signing the Papers: Finally, you’ll sign the documents, transfer the funds, and get the keys to your new home.

To Wrap Up, Buying your first home is a big step, but with the right preparation and guidance, you can navigate it confidently. Remember to stay flexible, keep an open mind, and don’t hesitate to ask for help. And speaking of help, don’t hesitate to contact me if you’d like my custom home buyer guide – it’s packed with all the tips, checklists, and advice you need to make your home-buying journey as smooth as possible. Happy house hunting, and welcome to the next exciting chapter of your life! I am here to help with Huard Heart + Hustle!

Thinking of buying a condo? Here are some key factors to consider

𝐍𝐚𝐯𝐢𝐠𝐚𝐭𝐢𝐧𝐠 𝐘𝐨𝐮𝐫 𝐅𝐢𝐫𝐬𝐭 𝐂𝐨𝐧𝐝𝐨 𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐞: 𝐊𝐞𝐲 𝐅𝐚𝐜𝐭𝐨𝐫𝐬 𝐭𝐨 𝐜𝐨𝐧𝐬𝐢𝐝𝐞𝐫

Owning a home is a significant milestone, and for many first-time buyers, condominiums present an appealing option. The allure of shared amenities, lower maintenance responsibilities, and potential cost savings can make condos an attractive choice. However, before diving into this exciting venture, it’s crucial to consider several factors to ensure a well-informed decision. I am active in the condo resale market in Rhode Island and am happy to offer some key points to consider when looking at buying a condo!

1. Location Matters:

Proximity to work, public transportation, shopping, and essential services should top your priority list. Assess the neighborhood’s safety, future development plans, and overall livability.

2. Condo Association Rules and Fees:

Understand the rules and regulations of the condominium association. Examine monthly fees, what they cover, and if there’s a reserve fund for major repairs. This will impact your budget and lifestyle.

3. Financial Readiness:

Evaluate your financial health and ensure you’re ready for homeownership. Consider your credit score, existing debts, and future earning potential—factor in the purchase price, closing costs, property taxes, and homeowner’s insurance.

4. Resale Value:

Investigate the resale value of similar units in the condo complex. A real estate investment should ideally appreciate over time, so understanding the market trends can help you make a more informed decision.

5. Amenities and Community Atmosphere:

Condos often have shared amenities like gyms, pools, or communal spaces. Assess whether these align with your lifestyle. Additionally, attend community events or meetings to gauge the atmosphere and sense of community within the condominium.

6. Building Maintenance and Condition:

Inspect the overall condition of the building, common areas, and individual units. Who manages the property? Are snow removal and ground maintenance covered? Understanding the maintenance schedule and any upcoming renovations is crucial for long-term satisfaction.

7. Reserve Fund:

A well-funded reserve is vital for covering unexpected repairs or improvements. Lack of financial planning in the condo association may result in special assessments for homeowners, potentially affecting your budget.

8. Rental Policies:

If there’s a possibility you might need to relocate in the future, familiarize yourself with the condo’s rental policies.

9. Future Development Plans:

Research any planned developments in the area that may impact your condo’s value or quality of life.

10. Legal Review:

Engage a real estate attorney to review the condo’s legal documents, including the association’s bylaws, covenants, conditions, and restrictions (CC&Rs).I have some great attorneys to recommend!

If you are considering buying a condo in RI or Southern MA and seeking guidance, reach out! I am here to help!

What Are Your Real Estate Goals This Year?

If buying or selling a home is part of your dreams for 2023, it’s essential for you to understand today’s housing market, define your goals, and work with industry experts to bring your homeownership vision for the new year into focus.

In the last year, high inflation greatly impacted the economy, the housing market, and your wallet. That’s why it’s critical to clearly understand not just the market today but also what you want out of it when you buy or sell a home. Danielle Hale, Chief Economist at realtor.com, explains:

“The key to making a good decision in this challenging housing market is to be laser focused on what you need now and in the years ahead, so that you can stay in your home long enough that buying is a sound financial decision.”

Here are a few questions you can start thinking through as you fine tune your goals for 2023.

1. What’s Motivating You?

You’re dreaming about making a move for a reason – what is it? No matter what’s happening in the market, there are many compelling reasons to buy a home today. Your needs may have changed in a way your current house can’t address, or you could be ready to step into homeownership for the first time and have a space that’s your own. Use what’s motivating you as a guidepost in partnership with an expert advisor to help make sure your move will give you a lasting sense of accomplishment.

2. What Does Your Next Home Look Like?

You know you want to move, but how would you describe your dream home? The available supply of homes for sale has grown, which could mean more options to choose from when you buy. Just be sure to keep your budget in mind and work with a trusted real estate professional to balance your wants and needs. The better you understand what’s essential and where you can be flexible, the easier it can be to find the right home for you.

3. How Ready Are You To Buy?

Getting clear on your budget and savings is essential before you get too far into the process. Working with a local agent and a lender early is the best way to ensure you’re in a good position to buy. This could include planning how much to save for a down payment, getting pre-approved for a home loan, and assessing your current home equity if your move involves selling your existing house.

A Professional Will Guide You Through Every Step of the Process

Buying or selling a home is a big process that takes expertise to navigate. If that feels a bit overwhelming, you aren’t alone. According to a recent Harris Poll survey, one in five respondents sees a lack of information or knowledge about the home-buying process as a barrier to owning a home. Don’t let uncertainty hold you back from your goals this year. A trusted expert can bridge that gap and give you the best advice and information about today’s market.

Bottom Line

If your 2023 plans entail buying or selling in MA or RI, let’s connect to plan how your dreams for 2023 can become a reality. Helping my clients is why I am here!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link